An Economic Infection

The coronavirus is likely to have an economic impact on the pharma industry and highlights the need for analytics to help predict future “black swan” events and mitigate their effects

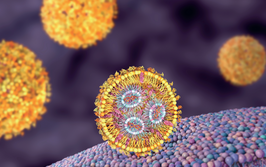

Events surrounding the coronavirus (officially named COVID-19) contagion, which started in China, are changing daily. No one really knows what the future holds or what the long-term global effects will be. A big question is, will the coronavirus become a pandemic? Recent events suggest we are on the brink of such a declaration at the time of writing. If so, this will dramatically affect the global economy in ways previous pandemics have not, due to numerous economic system structural changes, such as China’s emergence as a global economic superpower and the ease at which people can now travel around the world. Pandemics involving H1N1 (swine flu) from 2009-2010 are estimated to have caused global deaths between 284,500 and 575,400 people, based on statistical models (1). The high degree of viral contagiousness of H1N1 and its dissemination facilitated by the ease of modern global travel, similar to what we see today with the coronavirus, were key factors in causing the pandemic.

However, attempts to use previous virus outbreaks as a model for how the coronavirus will impact the global community (for example, the severe acute respiratory syndrome (SARS) outbreak and recovery in the 2002–2003 period) are likely misguided given differences in the transmission and dynamics of SARS versus the coronavirus. There is much we still do not know about the coronavirus, but it is certainly spreading well beyond China. Here, I look at the outbreak’s possible economic effects on the global pharmaceutical industry – and why a sophisticated culture of “competing on analytics”, as identified by Davenport and Harris (2), could help mitigate the business impact when surprise events do occur.

In the news

The following list of news items (in chronological order) demonstrate the extent and speed at which this virus has already affected the global community:

- The Dow Jones Industrial Average (DJIA) fell 1,031.61 points (3.56 percent) on February 24, 2020 because of expanding coronavirus concerns affecting the global economy (3). While history shows markets generally rebound quickly from such significant one-day pullbacks, the dramatic drop illustrates current uncertainty and fear around the coronavirus.

- As of March 3, 2020, there were more than 95,500 confirmed cases, more than 2,900 deaths globally, and the countries hit by the virus had risen to 72, according to data from the WHO, with numbers rising daily (4). The virus has expanded to Iran, and there are concerns that the country does not have the facilities to properly contain the virus. It could easily spread to neighboring Pakistan, given the high volume of cross-border traffic, causing an ever-expanding outbreak. South Korea has become the hardest hit country outside of China. Meanwhile, Italy has seen the largest outbreak in Europe near Milan, the economic center of Italy. Lastly, the fluctuations of daily numbers from China have raised concerns about the accuracy and collecting methods of data coming from this country.

- The global economy shows signs of adverse effects from the expanding virus outbreak, with finance ministers and central bankers from the G-20 countries meeting in Riyadh, Saudi Arabia, on February 23, 2020 regarding the economic risks and what actions should be taken. The International Monetary Fund (IMF) has reduced China’s annual growth projection to 5.6 percent – below the crucial 6 percent target rate which is important to Chinese leaders. Major producers around the world are also feeling the impact of supply chain disruptions from China on their own operations (5).

- Travel bans instituted by other countries against the movement of people from China has affected commerce, culture, and Chinese students studying abroad.

- US stocks with high exposure to China have significantly underperformed relative to broader market indices, showing the spillover effects that China has on the global economy (6).

- Apple reported that the coronavirus will adversely affect the company meeting its revenue projections, illustrating the effect the virus has had on limiting production and demand in China (7).

- The virus is adversely affecting the economy in Japan through numerous channels (for example, tourism and production), along with the imposition of a sales tax increase, which now may put the world’s third largest economy into recession (8, 9).

- Volkswagen AG reported that some factories in China may remain closed due to the virus, illustrating the challenges companies are having in reopening operations (10). Some other factories are reopening, but under medical protocols that must be followed to limit the spread of the virus (11, 12).

- Concerns have been expressed about the outbreak reaching a “turning point” since health officials have been unable to contain the outbreak to China. Similar concerns have been expressed about what other countries, like the US, need to do to prevent the outbreak from hitting and spreading.

- The virus is expected to affect US growth, according to a survey of economists, though the impact is predicted to be small (13). Federal Reserve Chairman Jerome Powell has warned of coronavirus risk to the US economy (14).

- Kristalina Georgieva, Chief of the International Monetary Fund, spoke about the uncertain impact the virus would have on the global economy, which was sluggish (outside the US) even before the virus hit. She says the likely scenario is a V-shaped economic impact – a sharp decline followed by a rapid recovery (15). This prediction is based on the SARS impact, but ultimately, we don’t know what the full extent of coronavirus will be, nor its economic effects. The role China plays in the global economy today is very different compared to the SARS outbreak of 2003. China’s global GDP was 4 percent in 2003 and is 15 percent today (16).

- The global supply chain has been adversely affected by the virus, with key commodity prices, such as oil, also taking a hit from the outbreak (17).

- The virus has increased the price of many household goods in China, causing the inflation rate to be the highest in eight years (18). This trend in domestic prices can have spillover effects on the demand of other consumer goods, putting added downward pressure on global economic growth.

The effect on pharma

The coronavirus contagion classifies as a “black swan” surprise, high-impact economic event, similar to other 21st century events that preceded it (for example, 9/11, Ebola, SARS, Trump’s election, Brexit). The 2007-2009 recession and the 2009-2010 H1N1 pandemic could also likely classify as “black swan” events. Lastly, depending on China’s response to this latest virus and its future policies to learn from and clamp down on commercial practices that provide the breeding ground for such outbreaks, the coronavirus may also likely not be the last one to materialize from China (19). However, using analytics it should be possible to predict and mitigate some of the effects of a “black swan” event like the coronavirus outbreak.

Right now, the potential effects from this latest event on the global pharmaceutical industry can be broken down into two possible pathways: demand and supply.

Demand

In terms of demand, the coronavirus directly decreases Chinese drug spending because the virus has caused a spike in domestic inflation, which means the cost of consumer goods is rising, thus causing less demand for drug spending. China is the second largest drug market (behind the US) in the world, with 2018 spending at $137 billion (20). However, the vast majority of that spending affects domestic Chinese drug companies serving the China market. For branded, non-Chinese pharma companies, the share of global sales coming from China is still relatively small (21). The focus on and increase in specialty medicines (for example, in oncology) has been the driver of spending growth in developed markets. Specialty medicines now have an emerging market presence in China, although this too is still relatively small. Empirical analysis should be undertaken to understand how the decreases in China’s economic growth and domestic spending caused by the outbreak will affect Chinese drug spending.

Another suggested effect stems from the reduction of pharma sales rep activity (to reduce personal contact and risk of disease spread), which could, in turn, reduce sales. There is a long and well-established body of pharma promotion-response modeling literature that shows how changes in sales rep activity affect sales. We also know from historical empirical industry evidence that new drug sales uptake in the early months of a launch is a strong predictor of long-term sales. If the outbreak persists, there could be longer-term implications for some product sales.

It is also possible that the coronavirus will increase the likelihood of a global recession via an economic shock to the system (22). The coronavirus decreases China's economic growth, which increases the risk of a global recession, which, in turn, decreases global aggregate demand for drugs. Also seen with the 2007-2009 recession, as governments faced declining tax revenues, higher entitlement spending for health programs, higher stimulus spending to reduce recessionary effects, higher budget deficits caused cuts in healthcare spending and branded drug demand through substitution to generics, tighter restrictions on prescribing and funding the utilization of patented drugs, and institution of price controls. The relationship between a recession and effects on drug demand has been recently noted in detail in The Medicine Maker (23). Also, importantly, these relationships can be empirically predicted and measured, along with the effects from pharma company countermeasures to mitigate recessionary effects on drug demand and revenue forecasts.

Supply

In terms of effects on the supply of pharmaceuticals, the coronavirus is disrupting the global supply chain of APIs developed in China and sent to other drug companies. Indian generic manufacturers are particularly dependent on raw materials from China – about 70 percent, according to one reference (24). The global implications of the supply chain disruptions are still unknown – companies are likely to buffer any effects through stockpiling and finding alternative supplies (21). However, confidence could be weakened in the longer-term stability of the Chinese supply chain system and cause companies to seek out alternative and more reliable sources of APIs, thus creating longer-term adverse effects for China. However, this could mean opportunities for other countries to fill in the gaps, as companies look beyond China to a more reliable source of materials. This redundancy might bring about longer-term beneficial effects in terms of companies being less reliant on China for APIs.

Similarly, disruption caused by the coronavirus could also adversely affect the conduct of current clinical trials in China. A number of international pharmaceutical companies have heavily invested in China in the hopes of conducting less expensive clinical trials, obtaining access to large patient populations, and gaining access to an ever-growing Asian market. Again, companies may look to reduce future risks by geographically spreading the conduct of clinical trials so the system is less susceptible to a shock in any one country, like China. The length of the outbreak, how China responds to it, the degree to which China modernizes the drug and healthcare sector, and the confidence from investors that such shocks like the coronavirus will be minimized in the future, will determine the trajectory of future foreign drug company investments.

In addition, the testing of new experimental drugs, especially those developed from within the Chinese pharmaceutical industry, could be delayed, affecting China’s efforts to supply drugs for its own market and globally deliver against the competition (25). If the outbreak continues, there could be significant effects in the longer-term for China to develop its own pharmaceutical industry and compete against global companies. If the outbreak becomes a pandemic, it may also shift R&D priority efforts toward addressing future virus pandemics, such as finding vaccines to handle future epidemics, and thus “crowd-out” investments on developing drugs for other conditions needed by society. Similarly, a pandemic would exert significant pressure on global healthcare systems, affecting the supply of medical care for other conditions, that could result in negative spillover effects on the utilization of drugs via demand-side effects.

Applying analytics to the black swan event

The outbreak of the coronavirus illustrates the inherent risks and uncertainties that are prevalent in the operation of a complex and global business, like the pharmaceutical industry. By their very nature, “black swan” events cannot be easily anticipated by business. However, it does not mean a pharma company is powerless to mitigate effects from a surprise incident. This latest contagion strongly demonstrates the need for pharma companies to invest in analytics. For example:

- Engage in simulations and wargames to map out the possibility of surprise events and their potential effects. This means creating a culture of “blue-sky” or “possibility” thinking, with interdisciplinary teams and new processes to foster the creation of new ideas. A business should have the right incentives and culture for people to generate new ideas.

- Attach risk coefficients and characterize the nature of uncertainty to future events that could bring significant harm to the company. This means having a “risk register” of potential events, attribute a likelihood of occurrence, and attach a degree of company impact to each event. Future events can then be prioritized for continued monitoring and contingency plans developed for possible implementation.

- Create robust, empirical platforms to quickly detect and measure the existence and potential effects of unexpected events when they occur. Artificial intelligence and machine learning can be very useful here as identification and prediction mechanisms. Models can also look at the effect of mitigation efforts through business policies implemented if and when that future event does indeed occur. Creating a library of past empirical models applied and their usefulness can also be beneficial.

- Translate empirical insights on the nature and extent of effects into actions based on empirical-driven business decisions. This means having a strong operations orientation and trust to execute plans based on analytics.

- Develop a well-designed data architecture to supply your chosen analytical engines. This also means eliminating data silos commonly seen in pharma companies.

- Senior leadership should promote and advocate an organization-wide culture of using analytics for all decision-making.

In my view, having detection systems that can quickly identify a problem, predict and measure the depth of effects, and then estimate the impact of management control policies are crucial for the long-term success and stability of a pharma company. Putting proper empirical risk/uncertainty-mitigation controls in place, along with using analytics to gather insight on the effects of adverse global events, are essential to develop evidence-based countermeasures. And that’s the only way to minimize impacts on business operations and, crucially, limit disruption to patients and healthcare systems from future black swan events.

Update: As of March 2, 2020

Events have changed rapidly since we started production on this article, so we thought it would be a good idea to pause production and provide a brief update to see what predictions were correct (virtually all of them) and which ones were incorrect (only one noted that was partially true). The major source for the updated information came from various articles in The Wall Street Journal (WSJ) (March 2, 2020 issue) and the Internet:

- The coronavirus continues to expand rapidly around the world, now in over 60 countries. Over 90,000 cases worldwide have been reported with deaths now approaching 3,000. Cases in Italy are expanding (largest outbreak in Europe) with South Korea being the country with the largest number of cases outside China. The situation in Japan is improving due to precautionary and control measures put in place. Concerns about the spread of the virus in Iran and surrounding countries persist. Large populated events and gathering places (like major tourist sites in Europe) have been halted and closed, respectively. Business conferences have been postponed in affected countries where large outbreaks exist.

- Virus cases are growing in the US, with a deadly outbreak in the state of Washington. Expansion of the virus around the US is expected. Expanded travel bans have been instituted, with controls at the borders and checks at major airports for incoming passengers.

- A bipartisan spending bill from Congress, exceeding the President’s requested amount, will reach his desk for signature for the resources needed, at this time, to mitigate the spread of this outbreak. Vice President Pence was selected by President Trump to lead a governmental task force to control and limit the scope of the outbreak. Pharmaceutical company CEOs met with the President to discuss developments of a vaccine for the virus. The US is in a much better position than other countries in developing a breakthrough vaccine by having many of the world’s largest pharma companies based there, as noted by the Wall Street Journal, illustrating the power of the private sector to help solve this problem.

- Drug shortages are being seen in older generics produced in China, and with single-sourced generic drugs that are reliant on China for key ingredients. Our prediction downplayed the virus effect of drugs produced here because China is not seen as a key source for materials. Our prediction was largely true. The extent of this problem will be dependent on the length of the outbreak.

- The virus is taking an economic toll on companies, disrupting supply chains, canceling travel, delaying investment plans, and stopping hiring. The economic effects of the outbreak continue. The Dow Jones Industrials Average (DJIA) index fell by 14 percent the week of February 24-28 (a fall of 20 percent from the market high would be considered moving into “bear” market territory). The DJIA rebounded by rising over 5 percent on March 2, 2020, on the hope that the Federal Reserve may step in with a rate cut to prevent an economic contraction. The European central bank may consider a similar action. Economists are expecting a V-shaped pattern of effect and recovery, though this prediction relies on the coronavirus not turning into a longer-term event. A great deal of uncertainty still exists about this virus, with comparisons to previous outbreaks likely not valid. Therefore, predictions about the coronavirus not causing a recession are likely still premature at this time.

- Encyclopaedia Britannica, “Influenza pandemic (H1N1) of 2009,” (2009). Available at bit.ly/2TepzyY.

- T Davenport, J Harris, Competing on analytics: the new science of winning; Harvard Business School Press, Cambridge, MA, 2007.

- CNBC, “Dow plunges 1,000 points on coronavirus fears, 3.5% drop is worst in two years,” (2020). Available at cnb.cx/37X0UEB.

- WHO, “Coronavirus disease 2019 (COVID-19) Situation Report – 43,” (2020). Available at https://bit.ly/2xasBNs.

- The Wall Street Journal, “Global economy shows strain as virus starts to take a toll,” (February 24, A1, A6, 2020).

- The Wall Street Journal, “Many stocks with China exposure miss out on market rally,” (February 19, B13, 2020).

- The Wall Street Journal, “Apple warns coronavirus to hit sales,” (February 18, A1, A7, 2020.

- The Wall Street Journal, “Sales tax and virus hit Japan economy,” (February 18, A7, 2020).

- The New York Times, “Coronavirus threatens to tip Japan’s fragile economy into recession,” (February 18, B2, 2020).

- The Wall Street Journal, “Some VW factories stay closed,” (February 18, B6, 2020).

- The New York Times, “China’s factories, badly hurt by a virus, struggle to reopen,” (February 17, A1, A7, 2020).

- The Wall Street Journal, “Businesses in China struggle to reopen,” (February 11, A1, A7, 2020).

- Fox Business, “Coronavirus likely to trim US growth,” (2020). Available at fxn.ws/2Pqgu4V.

- The New York Times, “Powell, warning of a possible virus fallout, is slammed again by Trump,” (2020). Available at: nyti.ms/3a3jNaa.

- Fox Business, “Coronavirus impact on world economy uncertain amid ‘sluggish’ growth: IMF chief,” (2020). Available at https://fxn.ws/3a30g9Z.

- The Wall Street Journal, “China’s economic contagion,” (February 4, A16, 2020).

- The Wall Street Journal, “Virus shakes up global supply lines,” (February 12, B13, 2020).

- The Wall Street Journal, “Chinese inflation highest in eight years,” (February 11, A7, 2020).

- The Wall Street Journal, “China is the sick man of Asia,” (February 4, A15, 2020).

- IQVIA Institute for Human Data Science, “The global use of medicine in 2019 and outlook to 2023,” (2019). Available at bit.ly/2HVtEmt.

- FiercePharma, “How will coronavirus hit U.S. drugmakers? Depends what kind of drugmaker you are: Moody’s,” (2020). Available at bit.ly/3c90dez.

- Fox Business, “What triggers an economic recession?” (2020). Available at Fox Business, published online 16 February 2020, available at fxn.ws/2T24clq.

- G Chressanthis, “The Next Great Recession,” The Medicine Maker, 61, 18-27 (2020). Available at https://bit.ly/2VnxSez and bit.ly/392NKHg.

- CNN Business, “Drugmakers could be hit by the coronavirus. India is especially vulnerable,” (2020). Available at cnn.it/2vg2B2o.

- Reuters, “Coronavirus outbreak begins to disrupt booming China drug trials,” (2020). Available at reut.rs/2wbDwWr.

George A. Chressanthis is Principal Scientist at Axtria.