Mergers and Big Decisions

The CVS-Aetna merger could be a transformative event for the pharmaceutical industry. Shrewd negotiating decisions, analytics and real world evidence have never been more important.

US antitrust officials recently approved the proposed $69 billion CVS-Aetna merger, subject to provisions requiring Aetna to sell off its Medicare Part D business (1). The merger combines the third largest health insurance company (Aetna) and its 22 million medical members, with a pharmacy business (CVS) and its reach of five million retail pharmacy customers per day, 9800 retail outlets, 1100 MinuteClinics, and its powerful pharmacy benefit manager (PBM) business (1). This merger follows a similar action taken by the Justice Department to approve the Cigna-Express Scripts merger, and partnering activities by Amazon, Berkshire Hathaway, and J.P. Morgan to get into the healthcare industry. These events taken together suggest what some have characterized as “the era of retail medicine is fast approaching” (2). These changes also imply a looming battle between big pharma, large retail, big health insurance companies, and large pharmacies with their influential PBM programs. Clearly, change is coming to the historically insular pharma industry; not from within, but from the outside – especially from business change-agents like Amazon and tech-giants.

Not everyone is happy about such developments. Some in the pharma and healthcare industries may see consolidation as threats. This quote from Barbara McAneny, President of the American Medical Association (AMA), is fascinating: “The AMA worked tirelessly to oppose this merger and presented a wealth of expert empirical evidence to convince regulators that the merger would harm patients.” Why do physicians feel so threatened by this deal? Why do they feel patients will be harmed? It could be they see this merger as another big step in reducing their influence, caught between the mega-health systems and the mega-retail-insurance conglomerates. The creation of monopolies or a small set of stronger oligopolies means cutting costs and higher profits by limiting access to patient care. While “better outcomes,” “higher value,” “improved prevention,” and so on, are all admirable goals that this and other similar mergers aspire to produce, in reality, CVS-Aetna will play hardball to exert their newly-created economic power in deals with pharma and healthcare systems. There is a delicate balance between managing costs versus maintaining or increasing quality of care and outcomes. Mergers like CVS-Aetna will likely shift the balance to the former at the expense of the latter. Both pharma and healthcare systems need to adapt to these changing dynamics.

There is no question that significant cost cutting is warranted. The healthcare sector has significant cost-structure imbalances (approximately 20 percent of US GDP is spent on healthcare) relative to outcomes generated, causing people to question the status quo. External change-agents are finding these conditions ripe for opportunities. CVS/Aetna can be seen less as change-agents and more as two healthcare industry insiders trying to adapt and position themselves in a changing landscape to protect their respective businesses.

Is the pharma industry prepared for such developments? Unlikely. These mergers and collaborative efforts bring together companies that better understand how to serve the customer, know how to leverage large amounts of data to improve outcomes, and have experience with transformative technologies such as artificial intelligence (AI) and machine learning (ML) to build better predictive models to diagnose and treat patients more effectively. Pharma companies would be well-advised to take notice and adopt the preceding areas of expertise to develop better customer insights and demonstration of value.

Mergers like the CVS-Aetna deal also place individual pharma companies at a disadvantage when it comes to negotiations over drug prices, formulary placement, and demonstration of value when entering into performance-based contracts (which will accelerate given these mergers). This is a big threat to pharma, as mergers like CVS-Aetna will likely focus more on negotiating lower prices and limiting access to branded drug therapies than on the “do-good” activities for patients, as touted by the CVS CEO: “Our focus will be at the local and community level […] to intervene with consumers to help predict and prevent potential health problems before they occur.”

How should pharma companies respond?

The pharma sector is already undergoing rapid and evolving environmental changes, and the CVS-Aetna merger is an additional change that pharma companies need to evaluate. The important question is what should pharma companies do in response to this and similar events?

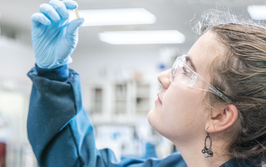

First, pharma companies must recognize that they can’t be experts in all things, especially in those areas mastered by change-agent companies (2). Pharma companies have a “comparative advantage” of developing the basic science to produce novel drugs that address unmet medical needs – and they should stick to what they do best (2). But pharma companies need these capabilities mastered by change-agents to compete effectively, they need them now, and they cannot hope or wait to build these capabilities internally – the process will either take too long or will not be done right. Instead, we recommend that pharma companies partner with organizations that have deep and broad-base analytics, large database management, AI/ML, and pharma commercial operations expertise. This will allow them to leverage predicted outcomes from their drugs while also aligning with the objectives of patients, providers, payers (public and private), and pharmacies.

Second, pharma companies need to better understand and leverage the claims/electronic health record data space for commercial advantage. Roche’s acquisition of Flatiron Health earlier this year for $2 billion was designed to get more involved with and increase access to real world evidence (RWE). RWE will be critical to show the benefit of personalized but expensive drug treatments, which are increasingly being seen in diseases such as cancer. The 21st Century Cures Act passed by Congress and avidly supported by FDA Commissioner Scott Gottlieb places a greater role for RWE in new drug applications for the demonstration of value-based evidence.

Third, pharma companies need to leverage AI/ML technologies for patient-centered predictive analytics. If healthcare is moving to a more retail-oriented and patient-centered industry, then applying AI/ML for real-time analytics will be crucial to ensure that contracted performance-based outcomes are on track to be achieved.

Fourth, pharma companies need to partner with medical device companies to help with patient data collection and monitoring treatment progress. The use of medical apps is on the increase, and the data collected by smartphones and wearable devices will become increasingly important in quantifying “performance” in performance-based contracts.

Fifth, pharma companies need to find allies in the healthcare sector to counterbalance the growing influence from mergers. Consolidation is occurring in the healthcare sector between organizations like health insurance companies and pharmacies. We also see new competitors enter the fray that have no history or traditional mission within healthcare (e.g., Amazon, tech giants, large financial service companies, etc.). Therefore a key question is, who is a natural partner with pharma that can speak for patient care, access to the best medicines, and delivery of outcomes?

The quote from the AMA president suggests a fear of reduced access to quality healthcare, lower competition driving up prices, profits shifted to consolidated agents at the expense of other actors in healthcare, and healthcare decisions based more on cost containment than on delivery of outcome. Thus, a natural collaboration between pharma and healthcare systems (along with their providers) would be not only in their own mutual interests but also, and more importantly, to those of patients. These two groups are closely aligned, and together can ensure the identification of the best treatment options for patients and delivery of health and economic outcomes. This means pharma companies have to change their commercial focus and embrace what they are truly selling – not new prescriptions or boxes of product, but superior healthcare outcomes as a result of patients taking new medicines. This represents a formidable collaboration that can act to counterbalance the economic forces and concerns noted by the AMA president.

Collaborate to adapt

Is the CVS-Aetna merger a transformative event or more a response by inside-actors repositioning themselves in the shifting healthcare and pharma sectors? Strong arguments can be made for either case. However, it is clear that dramatic and structural changes are already occurring in the pharma industry. Significant economic forces will force change, whether pharma companies are ready or not. These significant changes are not favorable to pharma, which means pharma companies must manage both the disruption coming from outside the industry and restructuring happening within the industry as a result of these changes. These changes will increase the need for pharma to be very shrewd and calculated in pricing and contract negotiations. We believe the answer lies in the applications of analytics, the use of AI/ML to drive real-time insights and improve decision-making, better ways to commercialize RWE analysis, and demonstrating value. The good news for drug companies is that there are organizations already working within the pharmaceutical analytics area that can help them to navigate these challenges. Companies that adapt successfully to the changing times can use these environmental shifts as a source of significant competitive advantage relative to those that lag behind and fail to adjust. However, the time for pharma companies to act is now – delay is not an option.

This article has been co-published with Axtria: https://insights.axtria.com/whitepaper-cvs-aetna-merger-a-pharma-industry-transformative-event

- The Washington Post, “CVS’s $69 billion merger with Aetna is approved in deal that could transform health-care industry”, (2018). Available at: wapo.st/2T6sTLc. Accessed January 21, 2019.

- Forbes, “Aetna, CVS, Walgreens and Amazon may finally let pharma do what it does best” (2018). Available at: bit.ly/2U42rC8. Accessed January 21, 2019.

George Chressanthis brings almost 25 years of pharmaceutical industry knowledge and experience gained through working within companies advising senior executive teams, functioning as an outside consultant, and conducting research as an academic. He also holds a Ph.D. in economics from Purdue University and earned a full professorship in economics with tenure and graduate faculty status at Mississippi State University prior to his pharmaceutical career.

Randy Risser is Principal at Axtria.