A Tale of Irish Biopharma

Ireland can boast of many success stories when it comes to biopharma investment. Here, Barry Heavey from IDA takes us on a tour of recent investments and explains why talent and training are key.

Ireland’s pharma industry really got started in 1964 with some key investments in small molecule drug products (by Leo Laboratories) and drug substances (by Bristol Myers Squibb) manufacturing in Dublin. A lot has changed in the intervening decades, however. Exactly 50 years later, in 2014, BMS announced a US$900-million investment in a biologics drug substance manufacturing and process R&D facility for their immune-oncology portfolio – and I think these “bookend” investments give a good illustration of how the industry has evolved over time. The 1970s, 80s and 90s saw waves of investment in large-scale small molecule intermediate and drug substance facilities (particularly in Cork) from companies such as Pfizer, Novartis, GlaxoSmithKline, Merck Sharp & Dohme (MSD), Janssen and Lilly for blockbuster drugs such as Lipitor, Gleevec, Risperdal and Zyprexa. As time progressed, these facilities gained a strong reputation for handling complex and challenging chemistries, and were involved in both process re-engineering for existing drugs and the development and launch of pipeline products. An excellent example of this was an investment by Pfizer in the application of biocatalysis to lower the number of steps and costs associated with Lipitor production, which allowed the Irish site to retain responsibility for Lipitor manufacturing after loss of exclusivity, due to their very competitive cost of goods sold.

In the drug product space, the Irish company Elan invested heavily in formulation development in their Irish site in the 80s and 90s, and many companies followed including MSD (legacy Organon), Pfizer (legacy Wyeth), Teva (legacy Ivax) , GSK and Servier. Gilead has also established manufacturing operation for many of their antiviral drug products (including fixed dose combinations) and this activity has gone from strength to strength as they’ve moved from HIV to HCV treatments.

The first biotech investment came from Schering Plough (now MSD) in the Brinny facility in Cork in the early 1990s. This was a microbial biotech drug substance and sterile fill-finish facility – and proved to be very successful. MSD recently announced a new investment in the facility and a partnership with Fujifilm Diosynth Biotechnology. However, the biotech era really kicked off in the 2000s with the establishment of the first mammalian drug substance facility (Wyeth’s Grangecastle facility in Dublin). Since then, over €10 billion in capital has been committed to biotech manufacturing facilities in Ireland from companies such as J&J, Lilly, Regeneron, Sanofi, MSD, Alexion and BMS.

More generally, Irish manufacturing sites – whether small molecule, large molecule, drug substance or drug product – all have a mandate beyond manufacturing. For example, almost all sites have some involvement in process R&D, and many also have responsibility for supply chain management, overseeing a network of contract manufacturing organizations and other outsourced services.

Biopharma boom

As Ireland’s business development agency, IDA has long cultivated relationships with senior leaders in the pharma industry, which has provided us with insights into where these people saw their companies and their industry going. In the late 1980s, as products such as recombinant insulin, erythropoietin and the first monoclonal antibodies took off, it became clear that biopharma was growing fast and was here to stay.

But it was also clear that the industry faced challenges in commercializing biotech products because of a lack of suitable manufacturing capacity, underdeveloped manufacturing technology (resulting in, for example, low yields of proteins and high costs of goods sold), regulatory concerns, and skills deficits. IDA saw an opportunity to build national capability in biotech manufacturing in parallel with the industry – and we took guidance from key opinion leaders in the industry.

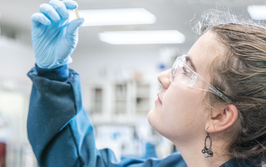

One key guide for our policy was Dr Mike Kamarck, who was head of biotech manufacturing in Wyeth at the time they invested in Ireland. He outlined the need for the industry and the government to invest in the development of workforce skills for biotech. He also coined a phrase “biology will trump stainless steel” – meaning that investing in research in the biology of producer cells (such as CHO), their cell culture media and the biochemistry of protein purification, would provide a much greater return on investment that investment in ever-larger stainless steel facilities to run low-yield processes. The Irish government heeded Mike’s advice and committed €60 million to a dedicated research and training center focused on biotech manufacturing: the National Institute for Bioprocessing Research and Training (NIBRT). Today NIBRT trains 4,000 people annually on industry standard equipment and we affectionately refer to it as Ireland’s “flight simulator for biotech manufacturing”. It is also increasingly serving as a research hub in areas such as process development, single use systems, process analytical technology and advanced protein characterization.

Many countries’ funding agencies are seeking to develop their biotech sector and often focus heavily on basic biomedical research. I myself undertook research in Austria, the UK and the US on basic research in immunology, genetics and stem cell biology, and I am a fervent supporter of this kind of basic research. Both industry and society are reaping the benefits too breakthrough treatments emerging in areas such as hepatitis C, melanoma and orphan diseases in recent years. However there is a risk that this investment in exciting areas of basic biomedical research can “crowd out” investment in areas such as manufacturing research, which may appear, superficially, to be less exciting. Ireland made a very deliberate decision to balance investment in basic biomedical research with investment in manufacturing research. I think NIBRT is emblematic of that so although my background is in basic biomedical research, I am passionate about ensuring that Ireland continues to invest in manufacturing research. I represent IDA on the board of NIBRT. Other board members include senior leaders from across the industry, including companies such as Alexion, Sanofi, J&J and Biomarin. With the success of NIBRT and the biotech cluster in Ireland, we also needed to support the ongoing development of the small molecule sector and the government has also invested significantly in a similar research centre (Synthesis and Solid State Pharmaceutics Cluster (www.sspc.ie), led by the University of Limerick, to support manufacturing research in the small molecule space.

Small but strong

It’s challenging for a small country like Ireland to compete with larger countries and countries with a long and storied history in the chemical and pharma industries (such as Germany, the UK and the US). Ireland also faced increased challenges between 2008 and 2014 when a property bubble, crash and bank guarantee fuelled a fiscal crisis for the government and necessitated a bail-out. This severely limited the government options in attracting new investment. However, I think the government won respect from the industry in maintaining a pro-business stance throughout this crisis, and in particular it maintained a strong focus on biopharma and other key sectors.

Ireland’s lack of scale forces us to focus and we have certainly placed a lot of focus on the pharma industry in the last 50 years. Where IDA have had early wins, we have sought to maximize the learnings from those wins and to influence the wider Irish ecosystem (e.g., in education/training policy) to maximize the chances of winning additional investment. This is another area where being small can be an advantage in that the degrees of separation between government departments and universities can be quite small. I think there is a real agility to react quickly to industry trends and requirements.

Over the past 50 years, Ireland has developed a really strong track record of project execution and long term compliance that is difficult to replicate. As biopharmaceuticals become more complex and more targeted, and as more individual drugs gain fast track status, this track record becomes increasingly valuable to companies. Ireland’s competitive corporation tax rate also has a role to play in attracting investment in the pharma industry, but this is a policy that is relatively easy to replicate by competitor locations, so we’ve focused on developing more intangible assets, such as of talent and track record, which are more likely to be the key differentiators in competing for mobile foreign direct investment.

An area we are focusing on for the future is to stimulate increased business-to-business collaboration in the life sciences sector and beyond. This could involve leveraging the very strong medical device sector in Ireland to collaborate with biopharma on drug delivery devices, or leveraging our strong base of engineering and technology companies to collaborate with biopharma companies on areas such as the factory of the future.

Planning for the future

IDA recently approved additional grant funding for NIBRT to expand its R&D activities to match its strong training program. The first manifestation of this has been the recruitment of Professor Mike Butler, who will join NIBRT as Chief Scientific Officer in Q3 of 2016. NIBRT are also looking to recruit additional principle investigators in the coming year and key areas of focus will include downstream processing, engineering and manufacturing technology for next generation therapeutic platforms. NIBRT also recently announced that BMS are placing a team of bioprocess researchers in residence in NIBRT to drive their manufacturing science and technology agenda ahead of the completion of the BMS manufacturing facility in Dublin. We see this as a great example of how NIBRT can interact with industry. In addition, given that NIBRT has strong links with a number of “vendor” companies developing technology for the biotech manufacturing industry (from analytical systems to single use systems), we see the institute also having a role to play in catalyzing (pun intended!) business-to-business collaboration on next generation manufacturing technology. I think there are some really exciting times ahead for NIBRT’s research program.

Another initiative we are working on is to develop a research and training centre with similarities to NIBRT, but focused on discrete manufacturing, which is vital given Ireland’s vibrant medical devices manufacturing sector. We hope that investment in this space will support companies in validating new technology in automation, factory 4.0, advanced metrology, surface and materials science, robotics, additive manufacturing and more. Greater innovation in the medical device sector will also benefit the biopharma sector, which is increasingly looking to devices to diagnose disease, deliver drugs and monitor responses.

Barry Heavey is Head of Life Sciences, Engineering & Industrial Tech at IDA Ireland.