Preparing for the Next Trump Presidency

What can we expect the US life sciences sector to look like over the course of the next four years as Donald Trump takes up his presidency?

| 6 min read | Interview

In 2020, as he approached the end of his first term as US President, Donald Trump signed an executive order to ensure Medicare didn’t pay more for prescription drugs than other developed countries. Considered an aggressive policy that could have shaved off around $10 billion per year from the industry, it was rescinded almost immediately by The Biden administration following a court order that stopped the program from going into effect. Can we expect a similar retaliation to Biden’s flagship Inflation Reduction Act (IRA) policy, or has Trump used his time out of office to reflect and reconsider his life sciences policies? We spoke with investment banking, strategy consulting, and leadership advisory firm Treehill Partners founder Ali Pashazadeh to get an idea.

How might the Trump administration impact regulatory policies in life sciences and what steps should companies take to prepare?

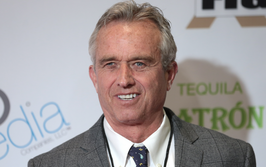

The news has certainly sparked more discussion than we typically see during an administration change. Traditionally, there’s a transition period with expectations of continuity, but this time feels different. Conversations about potential appointees, such as Robert F. Kennedy Jr., are already creating debate. His seemingly controversial stance on vaccines has for some time now drawn mixed reactions, with some fearing disruption, while others see potential for constructive analysis and efficiency in regulatory processes.

RFK Jr. often emphasizes the importance of following data and asking hard questions. As a clinician, I welcome inquiries into areas that often go unquestioned. For example, during my 30 year career, I’ve rarely encountered spontaneous subarachnoid hemorrhages. However over the past two years, I have witnessed a striking increase in previously healthy males with spontaneous subarachnoid hemorrhage cases. Interestingly, these seem to be since the COVID-19 pandemic – anomalies such as this warrant exploration without fear of labels like “anti-vaxxer.” This ability to question openly and pursue logical conclusions is crucial for patient safety and the continued evolution of medical care.

In terms of preparation, companies are in a holding pattern until key roles are filled and policies clarified. For now, the best course is to continue day-to-day operations while monitoring developments closely.

How might Trump’s "America First" policies affect international partnerships for US-based drug developers?

Policies under the Biden administration, such as the IRA, aimed to make medicines more affordable. While some outcomes have been positive for patients, they’ve also created challenges for companies, with certain drugs marketed programs being pulled from the market because of the financial penalties if they continue to sell them.

In terms of international partnerships, protectionist measures such as the Wuxi manufacturing situation may indicate the beginings of a broader trend. It’s likely that such policies will expand, making it harder for companies in regions such as Southeast Asia to form US partnerships. Our advice to foreign companies has been for some time to maintain minority stakes in US entities because this structure is increasingly seen as a safer model.

Although these shifts may complicate international collaboration, they are not entirely unpredictable. Companies that have proactively adjusted their strategies are better positioned to navigate this evolving landscape.

What potential changes to FDA processes might we see?

Drug development is a long process spanning 10 to 15 years, so any FDA policy changes may take some time to impact products currently in development. Companies with ongoing studies or approved protocols won’t have the ability to react immediately. Only those at the protocol-writing stage may have some flexibility to adapt.

Historically, the FDA has maintained consistency in its processes, with the exception of COVID-19, which required extraordinary measures. The agency, apolitical in its decision-making, has proven itself a steadfast advocate for patient safety. While changes may arise, they’re unlikely to deviate from a commitment to data and scientific-based decisions.

How might US healthcare reform influence drug pricing, and what should investors consider?

Drug pricing pressures have increased across the board, impacting both branded (RX) and generic products. While the US remains more lenient compared to Europe, it’s clear that pushing prices too low can deter companies from launching products in certain jurisdictions. For instance, in the UK, the cost regulator NICE often approves drugs for use but denies funding, dissuading developers from pursuing further launches in the country.

The US is acutely aware of this balance. Any pricing refinements will likely avoid extremes to ensure the market remains attractive to developers. Investors should stay attuned to pricing trends and consider the long-term implications of regulatory shifts on product viability.

Could tax policies under a second Trump administration shape life science investments?

Tax policy is a double-edged sword. While countries like Australia offer generous tax credits for R&D, these benefits often fail to reinvest in biotech growth, leaving many companies underfunded. In the US, tax incentives may favor domestic companies, but the impact on non-US entities will likely be limited.

Ultimately, tax policies may play a role in shaping the competitive landscape, but they’re unlikely to drive dramatic change. The administration’s approach to business has historically been pragmatic, with policy shifts proving less disruptive than anticipated once implemented.

What role might environmental regulations play for companies pursuing greener or more sustainable solutions?

Environmental policies will likely vary by industry. For pharmaceuticals, the impact might depend on company size rather than the industry itself. Larger firms may face stricter frameworks, but these measures would likely mirror broader corporate environmental standards rather than impose unique requirements on pharma. For now, pharma companies appear poised to self-regulate their environmental policies, focusing on sustainability without significant external pressures. While this may evolve, any immediate changes are expected to target other industries more directly.

How could a second Trump administration affect pandemic preparedness?

Unfortunately, preparedness remains a significant gap. The response to COVID-19 revealed a reactive rather than proactive approach to pandemics. Despite advancements during the pandemic, such as vaccine development, there’s little evidence of sustained momentum or readiness for future outbreaks.

Investors over the past two years have largely overlooked companies addressing COVID-19 or related conditions, reflecting an understandably short-term view given how the prior pandemic was handled. This lack of foresight as an industry hampers the creation of stockpiled solutions for future pandemics. When the next outbreak occurs, we risk being as unprepared as we were with COVID-19.

What is your expert prediction for the pharma landscape over the next four years?

The industry faces a critical inflection point. Over the past four years, we’ve seen financial stagnation, leaving many companies struggling to maintain viability. Without significant changes to business models, a large proportion of today’s biotechs may not survive.

Generics players are increasingly shifting toward specialty pharma, while biotechs face pressure to demonstrate differentiation and commercial relevance. By 2028, I predict only 10-15 percent of current biotechs will remain viable – defined by strong patent profiles, clear development pathways, and the ability to attract capital. For companies that fail to adapt, natural selection within the industry is inevitable.

Any final thoughts?

The life sciences sector must embrace innovation and adaptability to thrive. Waiting for market conditions to improve is not a strategy. Instead, companies need to focus on creating value through efficient drug development, robust business models, and an unwavering commitment to patient needs. I think we're going to go through quite a dynamic next four years where we're going to see the landscape materially shift, and each of the different stakeholders are going to need to evolve their business models to be viable at the end of that four years, compared to where they are today.