Towards Industry 4.0

The fourth industrial revolution – Industry 4.0 – represents a shift in manufacturing mentality and is driven by intelligent automation, big data, applied machine learning, advanced analytics, and even virtual reality. The digital technology is already here, but is biopharma ready? The third – and final – article in our Biopharma Trends series seeks the answers.

The German government first introduced the concept of a fourth industrial revolution – “Industry 4.0” – in 2011 with its strategy for the future of high-tech manufacturing. The idea was a simple one: new technologies will pave the way for greater automation, flexibility, connectivity and ease of use – improving manufacturing productivity and efficiency, while reducing costs. The term caught on, and the concept is central to China’s plans to occupy the highest parts of global production chains by 2050, as we discussed in July (1).

In the seven years since the German government coined Industry 4.0, many of the technologies required to make the concept reality – cloud computing, big data, smart technology, integrated systems – have come on in leaps and bounds, and are already used in several sectors.

But in biopharma, where companies tend to be more risk adverse and face regulatory, time-to-market, and other hurdles to new technology adoption, companies may be reluctant to embrace the changes needed to move towards Industry 4.0. Is it just another buzzword? What does it really mean? What practical applications will it have for my business today and in the next few years?

In this, the third and final in our series of articles based upon the Biopharma Trends report, we seek to answer these questions. Here, we present a roundtable made up of speakers from the upcoming Biopharma Trends 2018: Towards Industry 4.0 conference (www.biopharmatrends.com): Hal Baseman, Chief Operating Officer, ValSource LLC, and Per Liden, Product Strategy Manager, GE Healthcare Life Sciences; along with other experts from the field: Hans Heesakkers, ISPE; and Yvonne Duckworth, Lead Automation Engineer, CRB.

What does Industry 4.0 mean to you?

Hal Baseman: Industry 4.0 is the use of more modern techniques and methods for designing, operating and controlling processes. Examples include manufacturing intelligence systems, big data, applied artificial intelligence, and virtual reality that can help with modeling and planning processes, as well as the evaluation of the performance of processes.

Per Liden: It is a term that I believe very well summarizes the transformative impact of digital technology to industrial productivity. There is no doubt to me that we are on the verge of a quantum leap in productivity that will be of similar magnitude as the three previous revolutions and will have similarly transformative effects on the pharma industry – and society at large.

Hans Heesakkers: Per Liden is correct; we are talking about the fourth major change to industry operating models. It is driven by a leap in technological advancements. Like every revolution, this will only really arrive when it brings major benefits to the majority of mankind. The motor of industry 4.0 is the “ability to connect” many high tech developments that already exist and that are rolling out of development pipelines with increasing speed.

Yvonne Duckworth: I see Industry 4.0 as the trend towards the adoption of automation technology and data collection/exchange in the manufacturing industry, as well as the new technologies such as wearables (smart glasses, for example), new applications for virtual and augmented reality, and software applications using Industrial Internet of Things (IIOT) solutions.

Looking to the Future with Biopharma Trends

Here, we present the third set of findings from our Biopharma Trends survey (2), conducted in December last year, by The Medicine Maker and NIBRT, about current trends in the biopharma industry. The first article in the series looked at biopharma therapeutics and the most commercially important biotherapeutics now and in the future (3), while the second article focused on how to best equip the biopharma professionals of the future (4). Now, we look at growth opportunities and challenges.

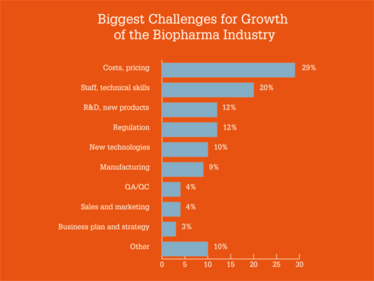

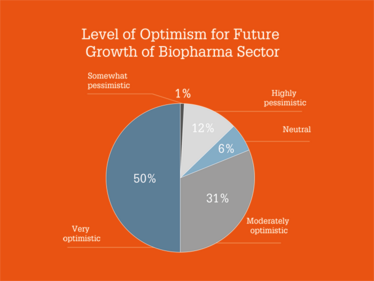

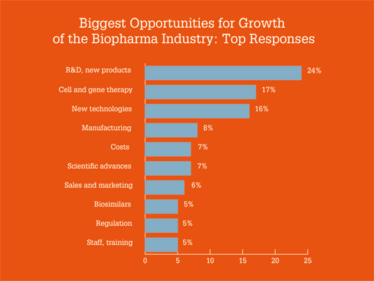

Overall, survey respondents painted a positive picture of the industry, with 50 percent saying they were “very optimistic” and 31 percent saying they were “moderately optimistic” for the future growth of the sector. Regarding opportunities and challenges, costs and pricing were the main concerns, while new products, plus cell and gene therapies, were seen as the biggest opportunities for growth.

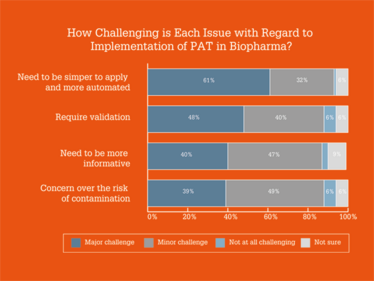

From a technology perspective, our results showed that process development of continuous manufacturing and lack of real-time monitoring technologies were major obstacles to the implementation of continuous bioprocessing – and that PAT needs to be simpler to apply and more automated. Here is a full breakdown on the results.

Which Industry 4.0 technologies are you most excited by?

HB: I’m most excited about using manufacturing intelligence and data to predict and model the performance of processes, as opposed to using (as we currently do) lagging indicators – this should help us decipher where we’re going and where we should be going. Also, being able to mine larger and larger fields of data – and then link that data from acquisition to process control is really big. That was actually the process analytical technology (PAT) dream of 10 or 12 years ago – and we can do it today.

PL: If I had to choose a single technology, it would be the commoditization and, therefore, democratization of computing power, storage, analytics and communication. The entry-level costs are simply getting lower, which opens up a massive potential for innovation.

HH: What excites me the most about Industry 4.0 is smart and adaptive development and production assets connected with distributed ledger technologies (such as blockchain) to all disciplines, from scientists to patients. In the end, our industry is all about preventing or curing diseases and improving human lives. Connecting all bright minds in our industry and focusing their efforts to improve patient outcomes could be accelerated by a smart, adaptive blockchain. Some tangible examples would be smart packs supporting treatment adherence, electronic batch records enabling quality and adaptivity in production, and blockchain integrating real world patient data with clinical trials.

YD: I am really impressed by smart glasses technology. There are a few pharmaceutical companies that have already adopted the use of smart glasses in the warehouse for automated retrieval. I have also seen examples of smart glasses providing “see what I see” technology; where smart glasses allow a person to communicate with someone who is off-site but is more knowledgeable and able to fix the problem remotely; it could help reduce the travel time required for specialists. Another great application for smart glasses is providing work instructions from SOPs, as well as training. All of these applications could potentially save time and money.

In addition, I have noticed a shift, at least with the companies I work with, in that five years ago, they were all using physical servers. Now, many companies either have virtual servers in place already, or are open to switching over and including virtual servers in their control system architecture that we are designing. It’s a big step forward in the automation world for pharma – virtual servers are far more cost effective and also scalable and flexible.

Industry 4.0 in Action

By Yvonne Duckworth

When discussing Industry 4.0, I hear a lot about new software solutions, including “Ignition”. Ignition is an integrated software platform based on a SQL database-centric architecture. We are using it as a SCADA (supervisory control and data acquisition) system, as well as an alarm notification system, in some of our projects. Some of the benefits of this software include unlimited tags, unlimited clients and unlimited displays. The software is built on MQTT, (Message Queuing Telemetry Transport), which is a proven data-transfer protocol that is quickly taking a lead in messaging protocols for the Industrial Internet of Things (IIOT). OPC-UA (Open Platforms Communications Unified Architecture – a machine to machine communication protocol) is built in to both the clients as well as the servers. This provides for a much more flexible and open architecture, and allows for ease of connecting many different types of control systems together on one platform.

For one project, we have multiple skids that have different control systems that must all communicate on the same network. Overall network communication can be tricky in cases like this. The more flexibility that we have with the software helps to make communication easier to configure. Clients can be launched from any computer, or even mobile devices, without having to install anything. The alarm notification configuration is highly flexible and provides many options for notifications. My client requires many different alarm notification configurations, so this software is a great fit for this project. In short, “Ignition” represents just one good example of the kinds of practical advantages that Industry 4.0 can deliver today.

What major challenges facing the biopharma industry could be addressed by digital technology?

HB: I like to open some of my talks by pointing out that I started in aseptic processing 40 years ago. And if I had been asked to predict what aseptic processing would look like 40 years in the future, I could never have imagined. This is because it is practically the same. Of course, there are isolators, faster and more reliable equipment, greater automation and so on, but the basic means by which we manufacture – large tanks, expansive clean rooms, limited production shifts, gowned operators, in-process monitoring and final product testing are essentially the same as they were 40 years ago! We have not embraced innovation and change as other technology-based industries have. But now we have the chance to make real changes to our manufacturing processes.

As one example, there is increasing industry interest in moving to a continuous approach for biopharma manufacturing. This is something that we’ve primarily seen in the small molecule space, but there’s a lot of interest in biopharma as well around this technology. This will represent a shift towards smaller manufacturing space footprints and plants – which will rely more heavily on automation and data control, and the linkage of process monitoring, process control, and product attributes as we should see with analytical technology (PAT). The management of knowledge and data envisioned with Industry 4.0 can play a major role in the transition towards continuous manufacturing processes.

PL: Biopharma has many inefficiencies. To take one example, our industry is struggling with realizing continuous improvement in manufacturing performance. In the initial stages, I see the potential for industry 4.0 technology to help address that, simply by unlocking data and providing visibility to quick win types of improvements. In the longer run, and as Hal mentioned, I see the potential for Industry 4.0 technology to help address the shift to continuous manufacturing. A continuous approach to manufacturing should deliver better efficiencies.

HH: Our industry is laid out for mass production (Industry 2.0) and working with these principles is in our genes. But mass production thinking consists of large organizations, silos, repeatability and products with little variance for a large population. Demographic changes are forcing the industry to consider smaller facilities and increase collaboration to develop a greater variety of medicinal treatments for smaller patient populations. Biopharma is not yet used to this new way of working. It requires a new set of “industry genes” or, as we like to say in ISPE, a new, digitalized operating model: Pharma 4.0.

YD: Facility design – the area I specialize in – is always a challenge for biopharma companies. Even with planning tools it is incredibly difficult to really visualize how a facility will look until it’s built – and by then it’s too late to change anything you suddenly notice that needs changing! Virtual reality is now starting to be used for build modeling. You can build a model using a software program that includes all of the components of a facility including walls, floors, process equipment (tanks, pumps, transfer panels, etc.), conduit, ductwork and piping. It’s really useful (and really cool!) to be able to put a headset on and do a “virtual walk-through” of a facility being designed to see how it will look. And to take this one step further, through the use of laser scanning, we are able to scan an existing construction area and pull this information in and use it as the background for 3D modeling for all of the new process equipment to be added. We can synchronize to an origin point and perform all of the new modeling using the scan as the background. This is a great example of augmented reality (providing spatially registered digital content overlaid onto views of the real world), which is another exciting component of Industry 4.0.

However, Industry 4.0 also poses challenges to facility design, or perhaps we should say that current facilities pose a challenge to implementing Industry 4.0… implementing a wireless infrastructure in a biopharma manufacturing facility is actually a huge challenge because of the amount of stainless steel used. With interest growing in single-use facilities, it is becoming easier to implement wireless infrastructures. I also think that my biopharma clients are realizing the benefits of investing in a more robust infrastructure when they are having new facilities built or renovating existing ones.

Biopharma Trends 2018: Towards Industry 4.0

By Killian O’Driscoll

In essence, Industry 4.0 means improving the efficiency of manufacturing via the implementation of digital technologies. From the perspective of NIBRT – Ireland’s National Institute for Bioprocessing Research and Training – we are very interested in the potential of immersive reality (IR) technologies to provide competency development programs. For example, could staff be trained – on an ongoing basis and to an optimum level – using “digital twins” of advanced manufacturing facilities?

As biopharma operations become increasingly globalized, complex and more highly regulated, businesses must become more effective and cost efficient at delivering what patients need and want. Industry 4.0 technologies have the potential to optimize the manufacturing process, reduce cost-of-goods, and ultimately help improve access to high-value biologics by bringing drug costs down. Like all technologies, there is probably a bit of hype and hope associated with Industry 4.0 , but as the industry focuses on the topic we’ll soon begin to find out what is possible and what the reality is. I will be interested to hear more opinions and case studies on the topic of Industry 4.0 at the Biopharma Trends conference being held November 13-14, 2018, in Cork, Ireland.

The Biopharma Trends conference was developed in collaboration with The Medicine Maker, with the aim of exploring the future of biopharma manufacturing. Why focus on Industry 4.0 for the inaugural conference? Because interest in this area is high, as highlighted in the recent survey we conducted. A number of survey respondents indicated that continuous manufacturing, process characterization, real-time process control, data dissemination, and IT and data integrity were high-priority areas for innovation in the industry.

Registrations for the conference are now open at www.biopharmatrends.com

What are the hurdles to embracing and implementing Industry 4.0?

HB: I do not believe biopharmaceutical processes are more complicated than what many other industries are doing. This industry should be able to implement much of Industry 4.0 into biopharma manufacturing. However, there is a big question over whether biopharma is ready to accept or embrace these types of technologies.

There are three significant challenges we must overcome to make Industry 4.0 a reality in biopharma. The first is overcoming a reluctance to try new approaches. We need a system where manufacturers feel comfortable going to regulators with new ideas and where regulators are open to the acceptance of new technologies and approaches. We also need suppliers to listen to users and help create systems that will reduce the time and effort required to implement new technologies. We need to find ways of forming effective partnerships between manufactures, suppliers and regulators.

The second major challenge is the regulatory burden of post approval changes. Once a manufacturer has received approval to manufacture a product a certain way, it can be quite burdensome to then improve the technology. The manufacturer must go through an approval process once again. This is not a matter of just seeking approval from the FDA or the EMA. Any country that the company wishes to distribute product to may require similar approvals. Significant manufacturing technology changes cannot be made until all of these global health authority approvals have been granted, often at multiple sites across the world. Here, the principles of Industry 4.0 can help accumulate and analyze data and generate the evidence needed to show that improved processes remain under control and that the changes are acceptable.

The third challenge is overcoming the risk of compromising speed to market. New technologies can take longer to develop and gain approval than existing approaches. As a response to the perception of additional business risk, companies may decide to use older, and perhaps less effective, manufacturing methods to get their products to market as quickly as possible. To overcome this challenge, we need to recognize the benefit of long term manufacturing efficiency against the risk and make the transition to new technologies as seamless as possible. If we decide to go to market with existing manufacturing approaches, we must plan for the introduction of better technology in the future. Companies should not be forced to live with old technologies forever, because of early product introduction needs.

All three of these challenges boil down to this important question: how can we remove barriers and burden to the implementation of new manufacturing technologies and prove to ourselves and others that these new methods are more effective?

YD: Regulatory hurdles are a big challenge for the adoption of any new technologies in the pharma industry, and that also applies to automation. Data collection is a big issue with pharmaceutical companies and the restrictions put forward by the FDA can make it difficult for pharma companies to use the cloud for data storage, which is an integral part of Industry 4.0 and IIOT. But I am hopeful this will change in the future as more security measures are introduced and put in place. I think that the emerging use of blockchain technology can add some potentially exciting features to data collection in the pharma world.

Industry 4.0: is it hope or hype?

HB: Recently, I attended a conference where a point was made that before we jump completely into some of the possibilities of Industry 4.0, such as artificial intelligence, machine learning and so on, maybe we should take a step back and use some of the things we already have available to us (but we are not using), such as big data acquisition, system integration, and predictive modeling and maintenance. The hype comes in when we say, “Let’s just move from where we are today to new, grandiose plans where everything is robotic and only a few human workers are required.” A staged approach will deliver practical, and more acceptable benefit to today’s biopharma manufacturing operations and prepare our industry for acceptance of improved innovative approaches in the future.

PL: Neither – even though some of the concepts seem like science fiction – especially for an industry that arguably is one of the last to work through the third industrial revolution. Industry 4.0 is real. Even though I expect that full implementation will take longer for biopharma than other industries, I see signs that our industry is already starting to implement some of its concepts, such as augmenting human decision making. We have come a long way, but we still have a lot more to accomplish.

HH: I agree, it’s a false dichotomy – Industry 4.0 is fact! I am very optimistic about the future. Pharma 4.0 might come slower or faster, but it is reality. The smaller, connected organizations that give their bright scientists, engineers and other staff the freedom to innovate will unleash a treasure of potential. But we need to ensure that these wonderful new technologies are properly implemented in the biopharma industry so that, ultimately, patients can benefit.

YD: There are some components of Industry 4.0 that are already being used in the biopharma windustry. In addition, there are also some exciting new concepts of Industry 4.0 that have the potential to significantly improve automation technology in the biopharma industry, so I think that gives us hope that it isn’t just hype. I would say that this is a pretty exciting time right now for automation technology in the pharmaceutical industry, and I look forward to seeing where these new trends will go in the next few years.

- J Strachan, “Make china great again”, The Medicine Maker, 43, 18–25 (2018). Available at: bit.ly/2oTDfkj.

- NIBRT & The Medicine Maker, “Biopharma Trends: Trends in Biopharma Manufacturing Survey Report” (2017). Available at: bit.ly/2lDuHwl.

- R McGuigan, S Sutton, “All Eyes on Biopharma Trends”, The Medicine Maker (2018). Available at: bit.ly/2vi5jRZ.

- J Strachan, “Just can’t Get the Staff!”, The Medicine Maker (2018). Available at: bit.ly/2PwEnpe.

Over the course of my Biomedical Sciences degree it dawned on me that my goal of becoming a scientist didn’t quite mesh with my lack of affinity for lab work. Thinking on my decision to pursue biology rather than English at age 15 – despite an aptitude for the latter – I realized that science writing was a way to combine what I loved with what I was good at.

From there I set out to gather as much freelancing experience as I could, spending 2 years developing scientific content for International Innovation, before completing an MSc in Science Communication. After gaining invaluable experience in supporting the communications efforts of CERN and IN-PART, I joined Texere – where I am focused on producing consistently engaging, cutting-edge and innovative content for our specialist audiences around the world.