What Trump’s Latest Moves Mean for the Industry

Audrey Greenberg’s latest insight on US-based manufacturing, Trump’s “Administration for A Healthy America”, and an ever-shifting regulatory environment.

| 6 min read | Interview

As executive orders, trade investigations, and leadership changes roll out across US healthcare policy, biopharma is once again at the center of a political transformation. We ask Audrey Greenberg, AG Capital Advisors CEO and a member of our 2025 Power List, what’s going on with manufacturing incentives and price controls, FDA leadership shifts, and more.

In your last two articles, you covered how Trump’s return could reshape biotech. What’s changed since then?

In part I, we looked at how the FDA might shift under a second Trump administration, including efforts to limit advisory committees and reduce regulatory friction. Part II focused on broader science and policy issues, potential NIH funding cuts, international trust challenges, and the push to withdraw from the WHO.

Since then, the policy landscape has moved quickly. Executive orders, agency restructuring, and leadership changes are beginning to reshape the operating environment for drug developers, manufacturers, and investors.

In May, the administration issued an executive order aimed at expanding domestic pharmaceutical manufacturing. It instructs the FDA to streamline facility approvals and calls on the Environmental Protection Agency (EPA) to fast-track construction permits for drug and API plants. There is also new attention on foreign manufacturers, including higher inspection requirements and the possibility of public noncompliance listings.

The intention is to bring more of the supply chain back to the US. This reflects a growing focus on biopharma as a strategic industry with national security implications.

Have there been any new policy rollouts since your last update?

Yes. In recent days, two significant updates have come from federal health leaders.

CBER Director Vinay Prasad and FDA Commissioner Marty Makary released a new framework for future COVID-19 vaccine approvals. The policy narrows eligibility to adults over 65 and high-risk individuals from six months to 64 years old. Manufacturers will be expected to conduct placebo-controlled trials in healthy adults aged 50 to 64, with a focus on symptomatic infection, hospitalization, and mortality as trial endpoints. This marks a shift toward more targeted use and stricter evidentiary standards.

The administration also published the list of benchmark countries for its “most favored nation” drug pricing policy. Prices will be indexed to nations with at least 60 percent of US per capita GDP, including Switzerland, Canada, Germany, and Australia. The Department of Health and Human Services (HHS) is urging voluntary compliance from manufacturers, though it has signaled it may pursue regulatory measures if pricing targets are not met.

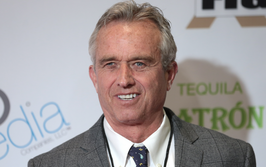

Separately, HHS Secretary Robert F. Kennedy Jr. defended planned research and staffing reductions during a Senate hearing. While more than 3,000 NIH grants and over 200 clinical trials have reportedly been paused or canceled, Kennedy framed the changes as a reallocation toward underfunded priorities. Lawmakers have continued to press for clarity on future funding levels and research criteria.

How does trade policy fit in?

Alongside these manufacturing changes, the administration launched a Section 232 investigation into pharmaceutical imports. That process, which has been used before for steel and aluminum, could lead to tariffs on APIs and finished drugs. A 10 percent global tariff has already been applied to many pharmaceutical inputs, including packaging and raw materials that were previously duty-free.

These changes are beginning to affect market behavior. Ireland, a major exporter of pharma products to the US, reported an 800 percent surge in shipments in anticipation of trade barriers.

What about drug pricing?

A second executive order, signed in mid-May, revives the administration’s proposal to align US drug prices with the lowest levels charged in other developed countries. The order gives the HHS 30 days to negotiate with manufacturers and allows for regulatory action if pricing targets are not met. It also supports pilot programs where patients can purchase medications at international benchmark prices.

This policy has generated mixed reactions. Some see it as a long-overdue attempt to reduce costs for patients. Others warn it could destabilize the economics of drug development, especially for smaller companies.

Are companies changing their strategies in response?

Some are. Sanofi recently announced plans to invest $20 billion in US manufacturing over the next five years. Other large companies, including Novartis and Eli Lilly, have also signaled expansions in domestic capacity.

At the same time, several biotech firms are considering shifting early-stage clinical trials outside the US, citing regulatory uncertainty and reduced agency staffing.

What’s happening at the FDA?

There have been major leadership changes. Vinay Prasad was appointed to lead the Center for Biologics Evaluation and Research, which oversees vaccines, cell and gene therapies, and other advanced biologics. He is a hematologist-oncologist with a strong academic background and a history of publicly questioning regulatory standards, particularly around COVID-19 vaccines.

Prasad has argued for new, age-specific trials before authorizing boosters and has criticized the inclusion of COVID-19 vaccines in routine immunization schedules. His appointment has generated debate, both for his views and for the tone of his public commentary. Supporters emphasize his focus on evidence standards and transparency. Critics worry that his rhetoric could undermine confidence in vaccines and other public health measures.

In parallel, the FDA is undergoing a broader reorganization as part of the HHS realignment. This includes proposed staffing reductions and the possible consolidation of agency functions under a new entity, the Administration for a Healthy America. The implications for regulatory capacity and timelines are not yet fully clear.

Are these changes reaching beyond biotech and pharma?

While the policies are aimed at drug pricing and manufacturing, the effects are being felt across healthcare. Hospitals are seeing increased costs from tariffs on materials and packaging. Diagnostic and device firms are facing delays and uncertainty as the FDA reorganizes and scales back staffing. Providers are also impacted when changes in pricing or supply chains make certain therapies harder to access or reimburse.

The broader health system is absorbing the ripple effects, especially in areas where supply chains, regulation, and care delivery intersect.

Are companies starting to adapt across those sector lines?

Yes. We’re seeing more movement toward integration between drug developers, diagnostics, and digital health platforms. Companies are looking for ways to deliver more complete solutions that connect treatments with data, outcomes, and measurement.

Some are forming partnerships with AI and tech platforms to support real-world data collection. Others are building internal capabilities for diagnostics and patient engagement. These moves help reduce dependency on shifting policy cycles and give companies more control over how their products perform once they reach patients.

This kind of convergence used to be a long-term vision. It’s increasingly becoming a short-term business requirement.

Your conclusion?

The regulatory and commercial environment is evolving quickly. Companies across life sciences will need to stay alert and flexible. These changes are not isolated. They affect every part of the value chain, from early development to commercialization and beyond.

The challenge now is to maintain focus on scientific progress and patient outcomes in a time of shifting rules and political uncertainty.