Is the Tide Turning?

Mark Edwards, former Global Freight and Compliance Manager for Actavis and Managing Director of supply chain consultancy Modalis, argues that pharma companies should transport the majority of their products via sea.

I see the momentum in the pharma industry swinging towards sea freight, which is growing at around nine percent per year – far outstripping growth in airfreight. The main advantage is an increase in quality: airfreight has many “hand-offs” where the product is physically handled by different parties, not all of whom are trained in the handling of pharmaceuticals. With sea freight, once the container doors are shut (at the manufacturer’s own premises) that is usually the last time the product is touched by anyone until it reaches the customer. The second advantage is cost: sea freight is one-tenth the price of airfreight. Finally, when you transport a product via sea it is sealed and locked in a container with little opportunity for theft. Airfreight, on the other hand, is more open to unwanted intervention.

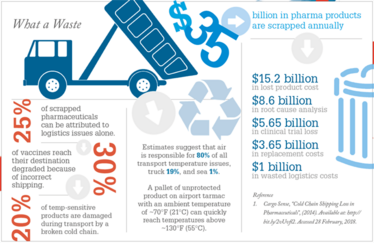

Despite these three advantages, there are some considerations one must make before deciding to ship via sea: timescale being a big one. The typical sea voyage between Europe and the US is seven to 10 days; from Europe to India and the Far East it’s 21 to 25 days; and to Australia it is six weeks. During these long trips, there are one or two risk points when the reefer (temperature controlled) container is unplugged, but this can be mitigated by using thermal blankets or passive protection. That said, the potential for temperature excursions is far greater when transporting via air – even the International Air Transport Association (IATA) has referred to the airport as a “black hole.” Temperature problems at sea do arise, but they are relatively easy to predict and protect against.

Sea Versus Air

Amy Shortman, Chief Executive Officer, ASC Associates, and Cathy Morrow Robertson, Founder and Head Analyst of Logistics Trends & Insights LLC, respectively, wade into the logistics debate.

Amy Shortman: The movement of pharmaceutical products via ocean has only begun to gain momentum. As health authorities have increased pressure to reduce prices, manufacturers have been forced to lower their own costs and turn to the relatively affordable option that sea freight offers. Some shipping lines have embraced this new opportunity and are slowly working towards good distribution compliance (GDP).

In fact, moving products via sea can be up to 80 percent cheaper than airfreight. It also provides a more robust method of transportation, especially when it comes to temperature management. The use of reefer containers to ship pharmaceuticals can maintain product temperatures for the duration of the transit, with limited risk of temperature excursions. When it comes to air shipping, there are many variables as the different stakeholders involved in airport infrastructure across the globe introduce the potential for temperature changes.

The biggest disadvantage to sea freight is that it takes significantly more time than air. Another disadvantage is that there are, as of yet, no global standards in place regarding how pharmaceutical products should be handled by the shipping lines and port operations. In comparison, the airfreight industry operates under a global standard: the IATA CEIV Pharma program.

With the sheer number of service providers in the sea freight chain – along with a lack of standardized protocols (each port has its own way of operating, complicating the process significantly) – it will be interesting to see how things develop over the next few years.

Cathy Morrow Robertson: I certainly see a shift towards sea freight and I believe that both the shipping lines and port authorities will embrace and adopt elements of the GDP guidelines and train their staff to an appropriate level for pharma. For pharma companies trying to work out whether they should be shipping via sea or air, clearly cost-to-ship and the time-in-transit are key considerations. Long transit times could affect the integrity of the product, but for those that do not require special handling, such as some generics, over-the-counter medicines and so on, ocean freight presents some clear advantages. Airfreight will continue to be used for higher value goods.

The cost implications of moving goods by air has driven the increased interest in using ocean freight – and several pharma companies have shifted more goods towards ocean freight. A persistent problem, however, is that some ports are not equipped with enough charging stations for containers to maintain required temperatures prior to being picked up by truck or rail. For that, qualified and trained staff is needed.

I’m still partial to airfreight because it is faster. But if I was responsible for pharma shipments, I would seriously consider testing ocean freight for some of my products.

Sea transport also presents some challenges because of the rules surrounding it, such as a limit on the value of the product that can be placed in a single container; however, these can be side-stepped with indemnities or special insurance products. Shipping lines have woken up to the fact that pharmaceutical companies present well-paying cargo that is consistent through the year and could be considered recession proof, which means they can make a good return if they have the right processes in place. Transport and logistics company Maersk has come up with the “Smart Reefer” concept that uses remote container management to alleviate some of the challenges. For example, if conditions inside the reefer change, on-shore teams will know about it.

Ultimately, most pharma manufacturers will need a combination of both sea and air, but there is no doubt that they should set up their supply chains to move the majority by sea, with air being used only where absolutely necessary.

Mark Edwards is former Global Freight and Compliance Manager for Actavis and Managing Director of supply chain consultancy Modalis.