Solving the Capacity Conundrum

Given pharma’s new reality of niche products and diversified pipelines, flexibility is key – and modular technologies can go a long way to easing capacity dilemmas.

sponsored by GE Healthcare

Over the past 20 years, the industry has moved away from traditional small molecules and embraced biopharmaceuticals. Today, large molecules make up around a quarter of the entire drug industry – more than $200 billion in global sales – with the sector growing at nearly 10 percent per year. In addition, seven of the top 10 best-selling drugs currently on the market are large molecules. Some companies, however, have struggled to keep up with the demand for these complex medicines, with growth often exceeding planned manufacturing capacity. Outsourcing the required surplus capacity is one obvious solution, but the price of working with contract manufacturing organizations continues to rise as demand increases.

Making capacity decisions is a tricky business. Stainless steel plants typically cost around $300-600 million, and take two or three years to build. Once you have reached the end of phase III and been awarded your marketing authorization, do you really want to waste the next few years building a plant? On the other hand, if you begin construction during a phase I trial you need to bear in mind that there’s a 90 percent chance that the drug won’t make it to market – leaving you stuck with a plant you can’t use. Even assuming your drug does make it to market, you won’t know what your sales volumes will be, when, years before approval, you decide on what sized plant to build. Underestimate demand and you’ll have to use a contract manufacturer; overestimate and you’ll be forced to saddle the cost of an underused plant.

Building for biopharma

One way to reduce the risk of making an incorrect capacity decision is to shorten the lead time. Being able to decide whether or not to build your plant later in the clinical trials process would clearly increase the chances of making the right investment decisions around demand. The primary problem with stainless steel plants, however, is that everything must be built sequentially: the engineering must be done on site, then the utilities have to go in, followed by the stainless steel tanks, which also need to be tested on site.

There is now growing recognition in the industry of the benefits of flexible and modular approaches to facility construction. With a modular approach, it’s possible to carry out tasks in parallel. For example, with our KUBio factories (see box: The Russian Doll Approach), we build and test the single-use plant in another location whilst the company prepares the site. Then, we ship the portable modules over once ready. The ability to make the separate elements at the same time significantly reduces construction time, allowing companies to decide later in the clinical trials process when to add capacity, and how much capacity to add.

The flexible approach lends itself particularly well to the types of drugs currently in pharma pipelines. Over the past two decades, medicines – particularly large molecules – have become increasingly targeted to smaller patient populations. In the past, pharma companies would produce tons of their blockbuster drug to meet global demand, but today, many new molecules in development only require 500 kilos per year.

On top of the growth in large molecule drugs, we’re also seeing more cell and gene therapies edging closer to market, which have even smaller patient populations. Some companies are developing truly personalized approaches, where they take a patient’s blood to a production facility, separate the cells from the blood, modify, grow and purify them, before finally injecting them back into the patient. These kinds of therapies require individual production lines for each individual patient; in other words, many tiny batches run in parallel.

As the industry moves towards targeted biopharmaceuticals – including personalized cell and gene therapies – companies may need to consider moving away from stainless steel plants. Let’s say a company has 10 candidate large molecules in clinical trials, with expected demand of 500–1000 kg/year each. If the firm is set on stainless steel, they will have to consider whether to build four separate 20,000 liter plants, or one big plant. If three of the 10 drugs pass phase III, each at one ton/year, they’ll have to contend with huge changeover times. If six of the 10 are approved, the company would not have the capacity to produce the drugs. In short, it’s clear that stainless steel plants are geared towards making tons of drug substance per year rather than smaller volumes and target populations, which tend to require flexibility.

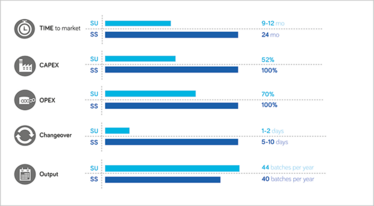

Figure 1. Single use versus stainless steel.

The Russian Doll Approach

FlexFactory

FlexFactory is a bioprocess platform using predominantly single-use technology – comprised of 100 to 200 individual pieces of hardware. FlexFactory is built into an existing process, with process control. The aim is to allow companies that want to add capacity to do so, provided they have cleanroom space available.

KUBio

KUBio is a cGMP-compliant facility that includes a FlexFactory bioprocess platform for the production of monoclonal antibodies. Whilst the company is adding the groundwork, foundations, pipes and so on for a new facility, we build the KUBio plant in parallel, in another location. We assemble and test the whole factory, with all the air handling, and then we disassemble and ship it in modular containers to the site. In a third location, we also build the FlexFactory, which arrives at the same time as the KUBio – when the site is ready.

BioPark

Although a KUBio is a production plant, it still requires some support services, such as a quality control lab, offices, a warehouse, a water supply and so on. Customers often have to build these things next to the KUBio. In 2016, we announced that we would be setting up a BioPark in Cork, Ireland. The aim is to allow different KUBio customers in nearby locations to share certain services. We are building a site in Cork on which four KUBios can be supported. The customer will buy their own KUBio, with their process, people, IT systems, security, and so on, but the support buildings are shared facilities run by GE – for which customers pay a fee. Working with the IDA and Cork County Council, we’ve announced 150 million euros of investment and are currently towards the end of the planning approval stages.

Another key challenge for biopharma companies is the management of Net Present Value (NPV). With the long timelines associated with stainless steel, companies need to be patient as they wait for sales to come in. But if sales aren’t as good as hoped, or if drugs fail before approval, NPV can turn negative – a massive turnoff for investors. Modular, single use technology reduces the investment costs and decreases the time from investment to launch, thereby reducing the risk of a negative NPV. Investments can be repurposed depending on whether or not drugs pass or fail, and it’s relatively easy to build another plant, in parallel, if a drug happens to take off.

Some companies have been quicker than others at “dipping their toes” into flexible manufacturing, but it is only during the past 10 years or so that the productivity of processes has sufficiently improved to make single use viable. In the past, titer would be around half a gram per liter, but today they are closer to 5 grams per liter – reducing the size of the bioreactors by a factor of 10. Smaller bioreactors have made single-use bags more viable, which in turn has sped up the cleaning process. Today, there are 100 stainless steel production facilities in the world and around 80 single use production facilities. Of course, the single use facilities tend to be smaller, but there is a clearly established footprint.

Moving to modular

For companies thinking of using flexible manufacturing technology, there are a number of factors to consider. Two key aspects are the range of drug substance volume and the complexity of the pipeline; if a company has multiple drugs at early stages, at uncertain volumes, then a more modular, single use approach is sensible. Again, if a company has a cell line expressing more than five grams per liter, they should consider single use. Single use systems can generate the same protein mass with a smaller production footprint, enhancing process economics. GE Healthcare differentiates itself by being able to design the whole production process. Rather than buying different bits of hardware – the bioreactor, column, filtration unit, and so on – we take over the process and deliver a standard design. We manage the production line as well as the automation. Overall, it’s a less engineering-resource heavy approach, and also faster because we have a standard configurable production line, which we call a FlexFactory (see sidebar: The Russian Doll Approach). If a company buys multiple FlexFactories, they can use the same production line in multiple locations. Firms also have the same IT control systems, the same physical process, and the same contact surfaces, making it easier to move drugs between sites or to add a second site to manufacture the same drug. And that introduces another advantage to single use technology – two drugs can be put down the same line because changeover between drugs can be done with a single use bag. If a company runs two drugs simultaneously, and if one takes off, then it’s easy to dedicate a second line to that same drug because the line and control technology is identical.

A flexible future?

Although there’s a vast number of large molecules in the pipeline with forecast demand at <500 kilos, blockbuster molecules in the pipeline, small molecules are not going away – there still remains an underlying base of blockbusters, and for these drugs, stainless steel will continue to be the way forward for the foreseeable future. For drugs with demand of one-plus tons of substance per year – even with new single-use processes and higher process yields – stainless steel is still the lower cost option.

But as for the future of flexible manufacturing? The indications we see at GE Healthcare are very strong. Today, around 70 to 80 percent of large molecules are used by patients in the West, which translates to a huge unmet need in countries, such as India, China and other developing markets. Investment into local production in those markets is rapidly increasing, with biosimilars, as well as a strong pipeline of new molecules. All of this suggests that the demand for capacity will continue to grow. Flexible manufacturing can help companies build this capacity more quickly and with lower risk when compared with a stainless steel approach.

Jan Makela is General Manager, Bioprocess, at GE Healthcare Life Sciences.