What Lies Ahead for Manufacturing?

What trends and new technologies await the pharma industry in 2018 and beyond? We seek the help of three gurus to map the way forward.

At the start of a new year, it is customary to review what has happened in the preceding months and to make resolutions for the future. It is fair to say that 2017 – and recent years in fact – have not been kind to the industry. Costs of manufacturing continue to rise, return on investment for R&D is low, and there is increasing rebellion from payers and pressure to lower drug prices. Slowly, the industry has accepted that the old, traditional ways of working aren’t good enough to get medicines to market faster – and with acceptable price tags. And so there have been many discussions about the best way forward – and what technologies could help. Despite the challenges, the many conversations between The Medicine Maker and experts across the industry throughout 2017 suggest a positive outlook; continuous processing, single-use technology and other innovations that could lead to lower cost and more flexible manufacturing are starting to gather pace. Change happens slowly in the industry, but we are certainly moving in the right direction.

We asked three gurus – one in academia, another from a contract development and manufacturing organization, and a third representing suppliers – for their views on the state of innovation in manufacturing operations.

The pharma industry is often described as being behind when it comes to manufacturing innovation. Do you agree?

Johannes Khinast: My answer is a resounding yes! The technology has not changed significantly in decades; today, a tablet is essentially made the same way as 50 years ago. Although designed much later, biopharmaceutical manufacturing processes, such as cell cultures, chromatographic separations and other steps, are also still far from their potential optimum state. In my view, the problem stems from the fact that 99 percent of processes have been designed based on trial and error (or “design of experiments”). To date, a predictive science framework has not been adopted widely by pharmaceutical engineers to design processes precisely, enabling peak efficiency and robustness. As a result, current approaches require extensive quality-assurance costs, wasted batches and lost material. Moreover, process development from small laboratory samples to large-scale manufacturing is often hampered by unexpected scale-up issues that can cause delays, supply shortages and enormous associated costs. A rational, science-based approach to manufacturing is pharmaceutical engineering, which combines material and process science to predict product and process performance based on fundamental science. The industry and its regulators seem to understand that change is necessary and progress is being now made.

Thomas Page: I actually believe that the industry is not so much behind because of a lack of technical competence, but simply because of the nature of the work in itself. With any highly regulated industry, the cost of change is innately high. Let us consider biologic drugs: the product is the process by nature, so making changes to adopt new technologies is not simple and is very costly. Until very recently, the industry has focused on “blockbuster” drugs, which typically call for high volume production in purpose-built facilities with traditional stainless steel technologies. Today, new technologies are emerging – and are being investigated for new products – but making changes to legacy products is particularly challenging.

To increase uptake of new technologies, I believe that we need to increase analytical power – in particular, the industry needs to focus on characterization. The concept of a well characterized biologic is not new but it must really take precedence, as it will help support the efficiency of new technologies and minimize the innate concerns related to process changes. Understanding how your molecule behaves from the very early stages will be key to minimizing risks introduced by technology/processing changes.

Daria Donati: It is true that the industry is slow to adopt innovation, but I agree with Thomas that it’s because it is highly regulated. The industry is, understandably, reluctant to disrupt everyday manufacturing operations, so the evaluation time for new innovations is long and diluted, leading to a less effective response to new technologies and solutions. I don’t think we can really say the industry is “behind” as such though because companies are certainly innovative in terms of exploring new proteins and molecules to treat formerly untreatable diseases – drugs are becoming more complex and advanced all the time.

The industry must be risk-adverse, given that the stakes are so high: changes in regulated manufacturing processes need to be documented and validated, and they might even demand re-filings to prove product quality, efficacy and patient safety. These activities are highly time consuming and costly. I think we need to create more robust processes to drive innovations forward – and we also need more collaboration. Collaborations between drug producers and technology providers can ensure that innovative technologies are designed to meet real-world needs, and I would also like to see more collaborations that give start-up companies and academia opportunities to test and verify their innovations in an authentic environment.

Johannes Khinast - Scientific Director and CEO of the Research Center Pharmaceutical Engineering, Austria

Thomas Page - Vice President of Engineering and Assets Evaluation, FujiFilm Diosynth Biotechnologies, USA

Daria Donati - Director for Innovation and Business Development at GE Healthcare Life Sciences, Sweden

What are the biggest trends driving innovation in manufacturing operations?

JK: In my view, the biggest trend right now is the personalization of medicine; cancer therapies, for example, are slowly but surely becoming personalized, replacing decades of chemotherapy. In addition, the individual microbiome is being recognized as a major factor in disease progression and therapy outcome. Individual metabolism is another well-known factor in this whole puzzle – and there is still more to be discovered, such as a detailed understanding of the systems that control epigenetics.

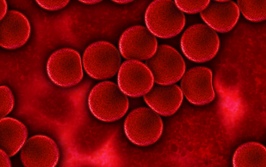

Right now, biopharmaceuticals, including human monoclonal antibodies, are currently among the most sophisticated drugs coming to the market. Their manufacturing is complex, as is their formulation. Enormous cost is associated with just 1g of drug substance, and therapeutic programs often start to exceed the ability and willingness of public health systems to fund costs. Significant advances have been made and lots of research has been dedicated to biotechnology and the related production. For many decades to come, large-protein drugs will be an important sector in the drug market, but I don’t believe these molecules are the final answer. Indeed, I expect that novel approaches will steadily become more relevant, including gene-based vaccines (with advanced vectors), small molecules that mimic the actions of proteins, gene-altering systems, and much more. Moreover, delivery forms will change, possibly leading to a reduction in parenteral forms and an increase in advanced oral applications, inhalable drugs, topical (also via micro-needles) and buccal delivery. Thus, we must prepare the formulation and manufacturing science for these challenges.

As for large-scale manufacturing, continuous manufacturing is becoming an important and irreversible trend of the future. In my view, the greatest advantage is that it is based on real-time analytics, making it possible to monitor a product’s quality. This requirement transforms old-fashioned manufacturing into a modern approach, which is long overdue.

TP: Secular trends are leading to big changes in how we manufacture drugs. In biopharma, for example, improvements in cell line development, a move towards process intensification and a paradigm shift in new products being developed, particularly in the gene therapy space, are driving a new era of manufacturing operations. Drug developers are moving towards treatments that provide cures rather than treatments, which means smaller to medium volumes that can be supported by a “scale out” approach. To achieve this, future manufacturing facilities must be more flexible and nimble.

DD: I agree that more flexible manufacture is a must to meet today’s drug development needs. Facilities are getting smaller, more flexible, less CAPEX-intense, all while still being able to produce several different drugs. In manufacturing, productivity and yields have increased significantly, partly because failures and contamination risks are now reduced.

The industry is also starting to see greater uptake of innovative technologies; for example, right now I see many companies seriously looking at closed and continuous bioprocessing. The use of single-use technologies, combined with more automated unit operations, finally provides the opportunity to run closed systems, which reduce contamination risk and time-to-market while increasing production efficiency. I also agree with Johannes in that continuous processing – an alternative to batch-based manufacturing, where raw materials are continuously fed into the process train, while finished product material is continuously removed from the other end – could be very beneficial for the industry in terms of improving product quality, reducing capital investment, and increasing scalability.

Flexibility and throughput are often cited as important factors in manufacturing, but what about energy-efficiency?

JK: Energy-efficient manufacturing is already a priority for other industries, and is now receiving greater attention in pharma. Most modern manufacturing approaches require extensive exhaust air and water treatment, which is energy- and cost-intensive. Though not considered a top priority in the pharma industry currently, energy efficiency is increasingly being taken into account, as it adds to the bottom line of a product.

TP: Energy savings are, of course, a goal that anyone running a facility would like to achieve, but as manufacturers our first and foremost responsibility is to keep the facilities running. Patients depend on us. As we look into energy conservation and efficiencies, we must ask ourselves, what does the process need? Can costs be offset without compromising quality standards and regulatory requirements? Single-use technology has already started a trend in energy conservation efforts by eliminating certain activities, such as steam and clean in place, and other technologies are engineered to conserve energy while not in production; mobile clean rooms, for example.

DD: Energy efficiency is one factor that can lead to a reduced carbon footprint – it’s a recurring topic that I find comes up whenever companies want to improve their production processes, or are evaluating the need for additional manufacturing capacity. We have a long way to go, but progress is starting to be made. As Thomas explained, single-use technologies are one way of reducing energy and water use in a facility – and uptake of single use is growing. It is estimated that single-use manufacturing technologies can help reduce capex costs by up to 50 percent (1), and water and energy use by up to 80 percent (2), compared to a traditional facility.

What are the most exciting and positive advances in manufacturing technology or equipment in recent years?

JK: Without a doubt, the transition from bulk to continuous manufacturing has had a tremendous impact on manufacturing operations, in terms of quality, costs and reduction of production times.

TP: I am really excited by the uptake of single-use systems bioprocessing – and closed processing is one of the up-and-coming advances. Closed processing supports the flexible, multi-product ballroom facility that goes along with the concept of nimble and more efficient facilities. We must also consider the latest uptake of viral vectors.

DD: I am excited by the advances in biomanufacturing in general. Upstream processing has really come a long way and the efficiency with which cells produce antibodies has improved radically. But these gains have put pressure on downstream purification technologies, sometimes leading to increased processing times and larger chromatography columns to deal with the greater upstream output. Fortunately, purification is catching up, with new generations of high productivity chromatography resins contributing to reducing the cost, scale and time consumption of downstream operations. As Thomas says, single-use systems are also exciting because of their capability to boost production flexibility, help avoid quality issues, and reduce capital investment. The industry is aiming to reduce facility footprint, while increasing throughput – and single use can really help.

Another key advance affecting pharma and biopharma is the application of digital technology to manufacturing. Combining data analysis with predictive analytics can help reduce the failure rate of manufacturing, as well as predicting positive and improved outcomes from a quality and productivity standpoint. Moreover, better utilization of automation and network systems can create truly integrated manufacturing platforms that can be overseen and controlled remotely through smart interfaces. In addition, tighter connection of systems between drug manufacturers and suppliers can reduce risk and decrease the time from production to release of the product.

How do you think advances in 3D printing, robotics and other emerging technology will shape the near future?

JK: As the demand for new drugs and medicines grows, pharmaceutical companies are continuously looking for new ways to increase productivity and increasingly rely on automation. The use of robotics is ever on the rise in pharma, especially in sterile manufacturing. People are considered the major source of contamination in clean rooms, so automation and robotics are already becoming a prerequisite for the modern manufacturing of parenterals. I’d also welcome more automation for lyophilization, such as real-time analysis of defects.

As for 3D printing, I think its capability and potential to solve major problems is limited. Does a precisely shaped 3D object have a major advantage over a regular capsule that is filled with precise amount of powders? In a typical setting, the answer is no, and 3D printing is likely to remain a niche technology in pharma manufacturing.

However, I am interested in a very different type of “printing”. Integrated drug development approaches (including more effective clinical programs), novel delivery systems (targeted delivery to areas such as the brain and inner ear) and completely new manufacturing methods are a prerequisite for the next-generation of medicines. Standardized and robust methods to make drugs for individual patients, in real time, on demand should be available by 2030 – and drug printing could be an effective solution. Drug printing allows precise combinations of multiple APIs (including large molecules, DNA, RNA, vaccine vectors, and so on) to be printed into a single dose on a dissolvable strip, microneedle patch or other dosing devices. It makes individual delivery possible – and it’s something I am very excited about pursuing. Another field I am interested in is micro-fluidics of granular systems. Though a few microliters of a fluid can easily be dosed, it is very difficult to generate individual powder doses precisely in the mg range, but this is required for personalized medicine that involves solid components. The focus of my research is increasingly shifting to this field.

DD: Personally, I am very interested in 3D printing! True, the applications may be niche but I think it could be very useful for for manufacturing equipment and perhaps some consumables. In October 2017, GE Healthcare opened a 3D printing lab in Uppsala, Sweden, called the Innovative Design and Advanced Manufacturing Technology Center. The center will use 3D printing technologies to help speed up the launch of new products for the healthcare industry, especially within bioprocessing. We believe that we can improve the performance and shorten the lead time of bioprocessing equipment with additive manufactured parts. Reducing the number of parts will improve reliability and enable additional benefits, such as lighter products. Additive manufacturing can also improve product design, as it offers more freedom for engineers – and sometimes better economics for complex, low-volume components and products. The computer-oriented design process enables quick design iterations and improves the design process, meaning that better products reach the market quicker. It is also possible to collect data as parts are built. I think, for some applications, additive manufacturing will be a useful tool in the engineer’s toolbox that will coexist with traditional techniques.

Another key technology for me is robots. Robots are already seeing increased use in the industry. We deploy collaborative robots (also known as “cobots”), which allow us to better allocate resources. Cobots do not replace employees, but rather take on mechanical, repetitive tasks within a factory, allowing employees to concentrate on more meaningful work. That said, given the huge variety in products and production processes, and the fact that even robots need to be “trained” or programmed by humans, it seems highly unlikely that human workers could ever be completely replaced by robots in the foreseeable future.

TP: As Johannes and Daria say, robotics are seeing increased use – and I believe they will substantially reduce risk to patients over time. The next step will be driven by the FDA’s desire to move more processes into isolators without human intervention. Eliminating risk to patients from direct and indirect contamination from operators will require use of robotic manipulation in place of glove ports. Down the road, transitioning to continuous operations, which are by their nature highly automated and controlled, will reduce the front line manufacturing labor, but increase the need for highly trained robotics technicians, software engineers and savvy validation and quality assurance management. For manufacturers, 3D printing may find a place in quickly providing replacements for broken parts; thereby maintaining manufacturing schedules.

Where do you think the industry’s priorities need to lie in 2018 and beyond?

JK: Continuous manufacturing is in the process of being widely recognized as an important improvement. Early adopters have registered products and created certified plants (for example, Vertex, J&J and GSK). Others are following closely, and some companies will wait until the trend is inevitable. My first workshop on continuous pharmaceutical manufacturing was held at Rutgers University around 1998 – and we are still only in a start-up phase, which shows how slowly new technologies can be adopted across the industry.

I think we also need to pay more attention to researching advanced manufacturing solutions for personalized and patient-centric healthcare; it will become one of the main issues in the decades to come and engineers have to be ready to provide solutions. As the individual consumer may become the pharmaceutical company’s most strategic partner, the focus has to shift from the product to the patient.

Ultimately, I think we need to move to future facilities that use continuous manufacturing to produce personalized medicines in a highly energy-efficient way – making them affordable for everybody.

TP: The Holy Grail for all drug developers is not just to treat diseases, but to bring actual cures to market. This will have a profound effect on how we, as an industry, approach manufacturing operations. Companies will have to change their current models, moving from the large volume blockbuster drug production to lesser volume products. But I think we are in a great place to develop effective facilities of the future. Biologics are likely to dominate the industry for the time being so facilities will need to focus on these drugs. The BioPhorum Operations Group is doing a lot of great work in this area through their Technology Roadmap initiative – a collaborative effort with a number of industry leading organizations to define future needs, challenges and potential solutions. In my view, the facility of the future will be nimble, flexible, designed to decrease manufacturing costs and, most importantly, will ultimately help increase patient access to life saving medicines all over the world.

DD: Flexibility will definitely be crucial for the facilities of the future. Already, there is a trend towards smaller, less CAPEX-intense facilities that can produce several different drugs. There is also a trend towards more manufacturing delocalization, with local production gaining more importance. To make this possible, the integration of new digital technologies is key. Smaller modular facilities with manufacturing processes that are standardized, integrated and automated on the same platform will allow the “copy and paste model”, where facilities can be replicated in different regions, while adapting to local manufacturing requirements. We have a lot to learn from other industry sectors when it comes to digitalization, and not making the most out of this opportunity would be unacceptable. Using predictive digital solutions, automation control and automation integration, we can bring significant operational and financial benefits for manufacturing that should eventually help increase access to new drugs.

- GE Healthcare, “Biologic manufacturing capacity expansion with single-use technologies. Key variables to consider”, (2016). Available at: bit.ly/2Dznfu7.

- EDB Singapore, “Amgen unveils next-generation biomanufacturing facility in Singapore”, (2014). Available at: bit.ly/2DdxO9v.

Making great scientific magazines isn’t just about delivering knowledge and high quality content; it’s also about packaging these in the right words to ensure that someone is truly inspired by a topic. My passion is ensuring that our authors’ expertise is presented as a seamless and enjoyable reading experience, whether in print, in digital or on social media. I’ve spent fourteen years writing and editing features for scientific and manufacturing publications, and in making this content engaging and accessible without sacrificing its scientific integrity. There is nothing better than a magazine with great content that feels great to read.