Make Global Pharma Great Again!?

President Trump’s verbal assault on the industry is a manifestation of long-standing underlying structural issues that have been poorly addressed over time. It’s time for a change of direction for the industry.

Comments made by pharma CEOs at the recent 2017 World Economic Forum in Davos, Switzerland, about the effects of President Trump’s potential policy actions (1),(2). Comments suggest a future of risk and uncertainty for the industry, at a time when executives are already facing a myriad of difficult challenges. The quotes focus on pricing, innovation and intellectual property (IP) issues – with the latter two in particular being the life-blood of any pharma company. At the same time, pharma executives are weighing tremendous opportunities as R&D pipelines generate new pathways to treat unmet medical needs.

The industry’s failure

The industry used to focus on small-molecule drug formulations, catering mainly to primary care physicians, for large patient populations – where patient access and payer reimbursement were of lesser concern. Today, companies face stiff price competition from generic entry across many therapy classes, and increased payer influences on physician prescribing have further depressed business margins. In response, companies correctly leveraged new scientific developments to fill R&D pipelines and launched specialty medicines to address a plethora of previously unmet medical needs. The results are expensive, large-molecule medicines that cater to small or orphan-like patient populations, and that face far less competition from biosimilars.

It was assumed that these medicines would boost company margins and to an extent this is true. A 2016 study noted that biologics in the US comprised less than 1 percent of all prescriptions filled, but accounted for 28 percent of total drug spending (3). Growing company revenue mainly through price increases, however, is economically unsustainable in the long run – and this pricing approach has been met by growing patient access and affordability issues, as well as provider and payer cost-resistance. In short, the commercial model design of companies being used to develop and launch these new drugs has not adjusted to the current and future market dynamics.

The industry now finds itself facing President Trump and a form of populism driven by the socio-economic attributes of his supporters. Similar criticisms about the industry are coming from progressives in the Democratic Party. Both groups, despite their different political origins, are highly critical of industry pricing, as well as other pharma business practices. In short, the pharma industry as a whole has done a poor job of demonstrating the value of its new medicines (4).

Aside from industry leveraging an antiquated commercial model design not geared to today’s realities, there is also a more fundamental cause to the industry’s problems. Pharma companies mostly operate within a framework that is more focused on the business of pharmaceuticals (drug utilization, market share, financial return on investment and shareholder return), than the service of pharmaceuticals (addressing patient-access, affordability and key healthcare system outcomes). Of course, this is not to say that for-profit companies should ignore establishing, tracking, and meeting key market and financial targets. But by focusing on the service of pharmaceuticals, I believe that the former objectives will also likely be met, alongside additional benefits that are unlikely to be attained by simply looking at things from a business point of view.

CEOs Consider Cost

Remarks made by pharma CEOs in response to President Trump’s comments on the industry at the 2017 World Economic Forum (WEF) and during interviews in Davos, Switzerland (1),(2).

- “One way of lowering healthcare costs is to have more innovation and more competition.” Ian Read, Chairman and CEO of Pfizer

- “Industry has to price in an empathetic way. Just because you can demonstrate value doesn’t mean it is affordable.” Andrew Witty, CEO of GlaxoSmithKline

- The new administration has been pretty vocal about supporting innovation. They understand that when you spend money on research and you develop intellectual property there needs to be some level of return for that investment.” Joe Jimenez, CEO of Novartis

- “Pricing will remain a challenging issue for those of us who are in the research-based pharmaceutical industry, as well as a challenge for the overall healthcare system in terms of what it can afford.” Ken Frazier, Chairman and CEO of Merck

- “If you provide true medical differentiation coupled with a strong intellectual property position, I think the US will continue to reward this kind of innovation. If you don’t offer that then, frankly, I think it is the right thing that prices should come down.” Severin Schwan, CEO of Roche

- “It’s very difficult to understand what all those comments and tweets will end up being.” Olivier Brandicourt, CEO of Sanofi

Time for change

What changes must occur within pharma companies in order to address President Trump’s policy actions in the long term? My last article for The Medicine Maker discussed why a Trump presidency has targeted the biopharma industry and how the presidency could affect the industry through specific policy actions (https://themedicinemaker.com/issues/0217/make-us-pharma-great-again/). Here, I focus on what role analytics can play in mitigating the increased risk and uncertainty caused by these policy actions. In order to take advantage of the benefits offered by analytics, however, there must first be an underlying environmental change within pharma companies. I believe there are four elements needed to bring about a more aligned organization that is better placed to demonstrate the value of its products (5).

Culture

It is insufficient for pharma companies to see themselves as business enterprises; they need to be healthcare enterprises that benefit patients and the healthcare system. This means focusing on the science of medicine and delivering drug value (e.g., improvements in health outcomes, drug costs and treatment costs). Demonstrating drug value is not just the responsibility of one department – it should be a goal for everyone in the organization. A well-defined, known, practiced, and incented company culture is the glue that keeps a great company together – and it starts with strong leadership. If companies truly took a comprehensive view toward adopting a patient/healthcare system-centric approach to their practice, many commercial activities currently done would likely stop or be dramatically reformed. As a result, the reputation of the industry would improve, and people would better understand the value of the drugs they take.

Organizational design

Pharma companies are highly specialized, siloed organizations that also promote siloed thinking, inhibiting the interdisciplinary solutions needed to demonstrate and deliver value with specialty medicines. Compounding the problem, is the fact that company units can be scattered around the globe, which makes interactions difficult. What is needed is greater coordinated decentralization, and more cross-functional teams to better connect units, for example, scientific, clinical, operations, commercial, and health economics and outcomes research (HEOR). Further, just as a brand team in commercial may have a representative from sales or managed markets, this thinking must extend to other relevant parts of the organization instrumental in demonstrating and delivering drug value. Integrator roles could be set up to help instil cross-organizational thinking into identifying, solving, and executing solutions to common issues.

Talent

Companies must seek people with two traits. First, people should value, above all else, the service of pharmaceutical companies to patients and the healthcare system, as opposed to the business of pharmaceuticals. This means hiring people for who financial rewards are not their primary driver, and who are passionate about the good that pharma companies do for society. Second, companies must hire people who can think and operate on cross-functional and trans-organizational teams. They must be willing to adopt new thinking, especially from outside the industry. This also means hiring people who are prudent risk-takers, strive to innovate every day, and are able to engage a broad set of individuals with varying backgrounds. The increasing complexities of the pharma environment will demand the demonstration and delivery of drug value throughout the entire project/product lifecycle.

Process/system

Processes and systems can be used to bring groups together under a common goal to share ideas in solving key challenges – whether it be R&D project portfolio optimization, marketing mix optimization, business planning, lean analysis for production quality control, or public policy risk assessment. For example, a sales force optimization process should take into account not only traditional strategic and operational sales issues, but also views from areas such as marketing and pricing. In addition, the analytics underlying these areas allow for interdisciplinary thinking. Further, and critical for today’s pharma environment, data are needed to link commercial and clinical HEOR research to drive insights. This means adding to the current objective of driving physician prescriptions and market share, by also introducing metrics that will be indicators of improvements in future health/economic outcomes. The role of analytics is to connect sales and marketing activities to improvements in health/economic outcomes. This will involve infusing different analytical methods to make these connections.

The importance of analytics

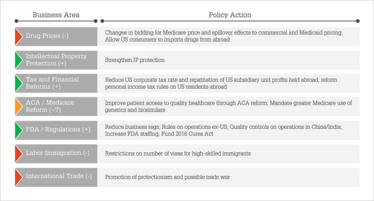

Figure 1 summarizes the potential policy actions of the Trump administration and the anticipated effects on overall pharma industry performance. The role of analytics is to understand both the intended and unintended effects of policy actions on a range of areas in the entire healthcare system. Pharma companies and industry trade groups, such as PhRMA, will need to develop and disseminate empirical evidence to show the expected consequences of policy actions. This is more than just analyzing proposed Trump policy actions – the increasingly complex pharma environment demands companies to become experts in leveraging analytics for key decision-making throughout their organizations if they are to achieve long-term success (6).

Figure 1. Potential Trump policy actions and anticipated effects on overall industry business performance. Positive=green, negative=red, uncertain/mixed=orange.

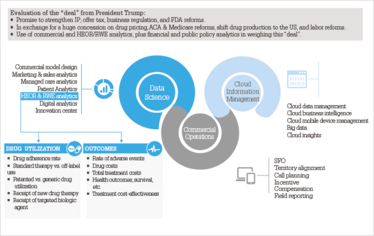

The “deal” President Trump is likely to offer pharma CEOs is a promise to strengthen IP protection, enact beneficial corporate tax and financial reforms, and make changes in business regulations and at the FDA to increase pipeline productivity and production efficiency. In exchange for these benefits, however, there is a huge concession on drug pricing, with further potentially negative effects from reforms of the Affordable Care Act and Medicare, international trade, and labor. My opinion is that huge (or as some like to say, “yuge”) concessions on drug pricing, coupled with other negative policy actions, will likely offset any offered policy benefits. A combination of commercial, HEOR, financial, and public policy analytics is needed to understand the magnitude of potential policy action effects and to weigh the overall effect of any “deal” proposed by President Trump. For example, large price concessions, even with benefits from “positive” policy actions, will likely mean lower margins, which in turn will reduce R&D investments. Forced lower drug prices will also mean slower diffusion of new technology. Lower prices, in the short-run however, would certainly help drug adherence, which has positive health/economic outcome effects. But in the long-run, a structure of lower drug prices will reduce financial incentives, lower new drug diffusion and innovation, and thus create adverse future health and economic outcomes.

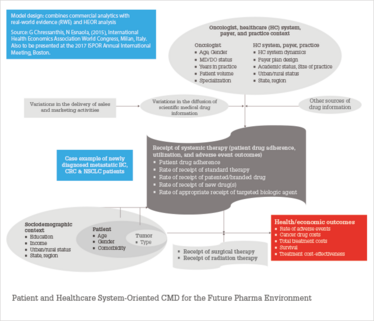

Analytics are needed to weigh the net effect of these countervailing forces. Figure 2 illustrates how these analytics need to be linked to execution, such as in commercial operations with the strategic and tactical allocation of field sales personnel. Similar links can be added to include, for example, other marketing channels, external medical affairs and public policy. In Figure 3 provides a detailed conceptual commercial model design for the future pharma environment. The case study example involves newly diagnosed metastatic breast cancer (BC), colorectal cancer (CRC), and non-small cell lung cancer (NSCLC) patients (7). A few key insights are outlined that can be applied across all specialty medicine therapy areas:

Figure 2. The role of Commercial, HEOR/RWE and other analytics in evaluating a Trump “deal”.

Figure 3. Proposed new commercial model design (CMD): a patient and healthcare system-oriented CMD.

1. Traditional sales and marketing are primarily vehicles that drive the diffusion of scientific medical drug information rather than the frequency of messaging, resulting in intermediate drug utilization outcomes. This is where typical commercial analytics ends. Recent academic marketing studies show the added effects of including the dissemination of drug scientific evidence in prescription sales response (8)(9)(10)(11).

2. Future outcomes needed to demonstrate drug value in a patient and healthcare system-oriented commercial model design are rate of adverse events, cancer drug costs, total treatment costs, survival, and treatment cost-effectiveness.

3. The model design shows how the oncologist, healthcare system, payer, practice context, sociodemographic, patient, and tumor information are all linked to achieve intermediate and final outcomes.

4. Underneath these relationships are commercial and HEOR/RWE statistical analytics to measure relationship effects.

5. Supporting these analytics is a robust and flexible data management process. Traditional commercial along with newer claims and EMR databases are need to be linked in ways not done before in order to demonstrate and deliver drug value to key healthcare system stakeholders.

6. The framework presupposes that a pharma organization is focused on patient and healthcare system outcomes. The interdisciplinary analysis is fostered by a culture, organizational design, talent, and process/system that facilitate the linkages.

Rebuilding pharma

The Trump administration poses new opportunities, but also risks, uncertainties, and challenges for US and global pharma. Regarding opportunities, at the printing of this article, President Trump intends to nominate Dr. Scott Gottlieb to lead the FDA. As a former deputy commissioner of the FDA, physician, and conservative health policy advocate, Dr. Gottlieb will look for ways to reduce industry regulatory burdens and speed up the approval process of new drugs. One way would be to leverage the allowance of observational data, such as HEOR and RWE analysis, for new drug applications, as allowed under the 21st Century Cures Act, to quicken approval times and thus reduce costs. Industry critics, however, are suspicious of this move and will demand caution.

Regarding challenges, the populism fueling Trump’s rise and his targeting of the pharma industry highlights the need for the industry to rethink its current commercial model design, internal company orientation, and use of analytics. Trump’s proposal for the government to directly negotiate Medicare drug prices may have external global pricing effects. Trump’s policy will not only lower Medicare prices, but also commercial and Medicaid pricing as well. The result will be a lower US pricing structure, meaning governments elsewhere, such as in Europe and Canada, will face greater tension with pharma companies to use a even lower structure of US prices to cross-subsidize their policies to extract lower prices. Most European countries use government-imposed external price referencing schemes to lower the structure of drug prices. As noted in a December 2015 European Commission report (12), the result is that pharma companies launch in the highest price country, resulting in drug shortages and/or slowing the diffusion of new drug technology in lower priced markets. As prior academic research has shown, slower access to new drug technology adversely affects patient health outcomes and can increase the cost of healthcare if new drug treatments bring greater cost-effectiveness. Thus, a lower structure of US drug prices caused by President Trump will place greater pricing pressures on European markets if they desire to continue receiving the benefits of the latest new drug technologies.

In short, Trump could end up being the kind of change-agent the industry needs to make necessary internal reforms. I often emphasize that there is a growing gap between the cost/risk to bring innovative medicines to the market, and individual/societal willingness and ability to pay for these medicines. Demonstrating and executing drug value is critical for an individual company’s success, as well as the success of the whole industry. The current pharma business model is broken, still focusing on drug utilization as the primary goal, and relying mainly on price increases to sustain revenue and margins. This is not economically sustainable in the long run (13),(14). Dramatic changes are needed. Whether you voted for and/or like Trump or not, he is forcing the industry to reshape itself for long-run success. Market forces were already affecting this need for dramatic change. Trump has just accelerated the process.

George A Chressanthis is Principal Scientist at Axtria. This article has been co-published with Axtria: https://insights.axtria.com/whitepaper-global-pharma-pricing-and-market-effect-of-president-trump-proposed-policies

Calling for Change in the UK

George Chressanthis is not the only one calling for the pharma industry to change. Karim Meeran, professor of endocrinology at Imperial College Healthcare NHS Trust, Charing Cross Hospital, London, also believes that things cannot continue on. His main area of concern is generic drug pricing.

In a letter to the BMJ, Meeran, and his co authors, Sirazum M Choudhury and John Wass, discuss the scandal of generic drug pricing and suggest a radical shake up – developing an arm’s length NHS organization to manufacture essential, generic drugs (1). “This would enable the NHS itself to set the market price for generic drugs. Such a company could be run as a non-profit making NHS Trust with the aim of making generic drugs at cost prices, setting prices to ensure solvency, and ploughing profits back to getting approval for other generics,” the authors write.

We caught up with Meeran to learn more.

What prompted you to write the letter?

I have been shocked by the huge increase in the price of hydrocortisone (used to treat adrenal insufficiency) over the last 8 years. The pharma industry has an important role to develop new drugs, and there is indeed risk taken on when embarking on new developments. The degree to which innovation and research is undertaken, however, varies – and some companies have no intention of innovating at all and are simply price gouging. The price of hydrocortisone in the UK today is now 12000 percent higher than in 2008 – interestingly, this isn’t the case in the rest of Europe, where the drug remains cheap. Drug development should continue to be rewarded with patents, but generic drugs, by their very nature of being generic, should be sold cheaply.

How would the manufacture of generic drugs in-house at the NHS work in practice?

There are several possibilities. One is for the Department of Health, or NHS England, to invest in building a plant in the UK. There is a World Health Organization list of essential drugs that should be available to any person in any healthcare system. Any drug on the list that is overpriced, such as hydrocortison, should be made in the proposed plant. An alternative is for the pharma industry itself to do this. They already have the infrastructure, and if they make all the drugs on the list at cost price for the NHS, and other healthcare systems, it would be a sensible way forward. I think this is a real chance for industry and a conglomerate of industry (such as the British Generic Manufacturers Association or the Association of the British Pharmaceutical Industry) to join the NHS for the greater good.

Creating a specialist body – as what happened with the UK’s cost watchdog, the National Institute for Health and Care Excellence (NICE) – that had the authority to review prices and set the drug tariff in an open way could be another way forward.

What would be the main challenges?

The biggest problem is that the Department of Health is too busy trying to run the NHS to actually spend time sorting out this problem… Turning these ideas into action requires will, capital, time to get the MHRA to agree to license the drugs made in the UK, someone to set the drug tariff, and all with the authority of a government, that frankly has bigger worries right now.

Read more at

Reference

K Meeran, SM Choudhury, J Wass, “The scandal of generic drug pricing: drug regulation policies need review,” BMJ, 356 (2017).

- J Nash, CNBC, “Pfizer CEO: this is what Trump doesn’t understand about the pharma industry”, (2017). Available at: cnb.cx/2iyMzJv. Last accessed March 17, 2017.

- B Hirschler, Reuters, “Pharma CEOs in Davos put brave face on Trump presidency”, (2017). Available at: reut.rs/2jGArp8. Last accessed March 17, 2017.

- F Scott Morton, A Stern, S Stern, Harvard Business School, “The impact of the entry of biosimilars: evidence from Europe”, (2016). Available at: hbs.me/2n6iOAP. Last accessed March 17, 2017.

- J Singh, R Jayanti, “Closing the marketing strategy-tactics gap: an institutional theory analysis of pharmaceutical value chain”, Innovation and marketing in the pharmaceutical industry: emerging practices, research, and policies, 710-735, Springer (2014).

- A Zoltners, P Sinha, S Lorimer, “Building a winning sales force: powerful strategies for driving high performance”,1st Edition, Amacom (2009).

- T Davenport, J Harris, “Competing on analytics: the new science of winning”, 1st Edition, Harvard Business School Press (2007).

- G Chressanthis, N Esnaola, “Health outcome implications from restricting the flow of FDA-regulated medical information from pharmaceutical companies to physicians” presented at the 2015 International Health Economics Association World Congress; July 14, 2015; Milan, Italy.

- M Rod, S Saunders, “The informative and persuasive components of pharmaceutical promotion”, International Journal of Advertising, 28, 313-349 (2009).

- P Azoulay, “Do pharmaceutical sales respond to scientific evidence?”, Journal of Economics & Management Strategy, 11, 551-594 (2002).

- A Sood, E Kappe and S Stremersch, “The commercial contribution of clinical studies for pharmaceutical drugs”, International Journal of Research in Marketing, 13, 65-77 (2014).

- E Kappe, S Stremersch, “Drug detailing and doctors’ prescription decisions: the role of information content in the face of competitive entry”, Marketing Science, 35, 915-933 (2016).

- S Vogler et al., European Commission, “Study on enhanced cross-country coordination in the area of pharmaceutical product pricing”, (2015). Available at: bit.ly/2mDq0Bx. Last accessed March 17, 2017.

- J Rockoff, “Pricey drugs are hurdle for new biotech CEO,” Wall Street Journal, June 7, B1-B2 (2016).

- J Walker, “Drug makers raise prices despite protests,” Wall Street Journal, July 15, B1-B2 (2016).

George A Chressanthis is Principal Scientist at Axtria.