The Winning Strategy for Start-Ups

Business academics have been trying to uncover empirical evidence around how financing decisions are linked with technology. After all, the business of making biopharmaceuticals is expensive – so the more data you have to back up decisions, the better.

There is no doubt that biopharmaceutical corporations invest heavily in R&D. In 2011, the sector employed more than 810,000 people, supported nearly 3.4 million jobs, and contributed nearly $790 billion in economic output in the USA (1). In fact, the biopharma industry spends 13 times more on R&D expense per employee than other manufacturing industries – perhaps not surprising given that the average R&D cost of one drug is around 2.6 billion dollars (2). Such expensive R&D costs can make it difficult for biopharmaceutical corporations to finance their projects – a challenge that is especially salient in early stage start-ups, with their inherent lack of internal resources, and reliance on entrepreneurial financing sources: angel investors, independent venture capitalists (IVCs), and corporate investors.

These heterogeneous financing sources have their own investment motives and patterns, and usually offer a range of services for biopharmaceutical start-ups. Corporate investors, which are traditionally pharmaceutical incumbents, provide resources beyond the financial, including industrial expertise, marketing channels, and R&D facilities. However, these investors can bring with them a risk of misappropriation – in other words, using the start-up’s technological resources for their own gains. IVCs are financial institutions that invest in the private equity of start-ups to maximize capital gains through initial public offerings and acquisitions. IVCs, similar to corporate investors, provide managerial support, such as monitoring, professionalization, and certification effects, along with financial resources. Though the risk of misappropriation is minimal, these investors pursue investment opportunities characterized by high risk and high return. Contrary to institutional investors, angel investors are individuals who usually provide a smaller amount of financial capital, but are widely available to start-ups.

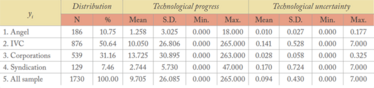

Table 1: Summary statistics.

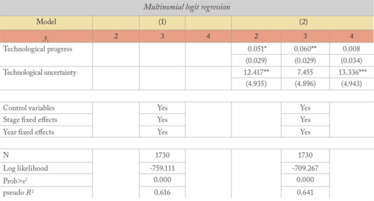

Table 2: Hypotheses test using multinomial logit (MNL) regressions. Robust and clustered standard errors are presented in parentheses. yi includes: y1= angel, y2= IVC, y3= Corporation, and y4= syndication. The base group is y1. ***, **, and * denote significance at 1%, 5%, and 10%, respectively.

Given the co-existence of heterogeneous investors in the entrepreneurial financing market, we were interested in how biopharmaceutical start-ups get matched up with certain types of investors. Considering that technology is often the most important resource for these start-ups, perhaps this question can be resolved by examining the connection between the characteristics of the start up’s technology and the financing sources. In other words, we need to explore how start-ups’ technological resources serve to determine their financing sources. Practitioners and scholars have tried to figure out this matching issue previously, but there is a lack of both theoretical guidance and data to fully examine this issue. By better matching start-ups (and their technological capability) to the most suitable type of investors, it may help optimize the whole funding process.

To generate more data on the topic, we performed our own study into the issue, and chose to focus on two dimensions of technology (see the Statistical Evidence section below for details): i) technological progress and ii) technological uncertainty, as these two characteristics can indicate the maturity of technologies pursued by start-ups. We came up with two hypotheses:

- Biopharmaceutical start-ups with strong technological progress were in a better position to attract investors and thus choose corporate investors or IVCs that would provide managerial and technological support, as well as financial capital.

- Start-ups that pursue highly uncertain projects create investment opportunities characterized by high risk and high return (3), which may be a better match with IVCs that can realize greater capital gains.

We were confident in our hypotheses, but we wanted statistical data to back them up (such is the drive of those in academia!).

Statistical evidence

Using a dataset on the fundraising activities of 529 biopharmaceutical start-ups (provided by the Deloitte Recap database), our study identified some interesting empirical evidence to validate our theories. The dataset corresponds to 186 angel investors, 364 IVCs, 305 corporate investors, and 129 syndicated investors between IVCs and corporate investors in the period 1985 and 2006. This period is characterized by a significant expansion in external fundraising activities in the biopharmaceutical sector (4). To build the two types of technological characteristics, we used patent data from the US Patent and Trademark Office (USPTO). Patents are particularly important to claim values from inventions in the biopharma sector and are, therefore, a good representation of a start-up’s technological characteristics. Technological progress was estimated by the stock of a start-up’s successful patent applications. Start-ups that have a greater stock of patents were assumed to have more advanced technologies. Technological uncertainty was also estimated using patenting information. Based on Lanjouw and Schankerman (5), our study first estimates technological maturity by using the stock of backward citations associated with a start-up’s patents at t (i.e., m). Second, m is divided by the stock of start-up’s successful patent applications (i.e., p) at t to normalize it. Finally, a reciprocal for the resulted estimation is calculated to measure technological uncertainty. A more matured technology has a lower technological uncertainty, and vice versa. Our control variables included the start-up’s age, experiences in external R&D activities and financing, funding amount in the round, investor’s reputation, and funding stage and year fixed effects.

The descriptive statistics are presented in Table 1. All samples include 1730 fundraising observations, including multiple fundraising activities by biopharmaceutical start-ups, and are categorized into four financing source groups. The columns report the distribution of the sample and the summary statistics of the independent variables, including technological progress and technological uncertainty. The first column reports the distribution of the sample: yi=1 (angel investor) is 186 observations and around 11 percent of the sample; yi=2 (IVCs) is 876 observations and 51 percent of the sample; yi=3 (corporate investors) is 539 observations and 31 percent of the sample; and yi=4 (syndicated investors) is 129 observations and 7 percent of the sample. These distributions indicate the unexpected smaller portion of angel financing – but we should also bear in mind that it is difficult to identify angel financing compared with IVCs and corporate investors financing, given that angel investors are individual people rather than typical professional investment firms. The proportion of corporate investor financing is, overall, consistent with statistics in prior surveys, which note that 37 percent of start-ups are financed from corporate investors in 63 industries (6).

The second column indicates a notable pattern: group 1 has considerably less technological progress compared with other investor groups, which provides evidence for hypothesis 1. It is also noteworthy that group 2 and 4 indicate significantly greater technological uncertainty than other investor groups, which supports hypothesis 2.

Of course, these statistics are simply univariate results and thus may be biased because of unobserved heterogeneity. To really back up our theories, we also delved into more elaborate empirical approaches using multinomial logit regressions. The general purpose of multiple regression is to learn more about the relationship between several independent or predictor variables and a dependent or criterion variable. This empirical technique helps identify the relationship between start-ups’ choices on funding and technological characteristics, while controlling for other factors that would impact the choices

of funding.

Using the specification of multinomial logit regressions, Model 1 includes only control variables and fixed effects. Model 2 presents our bench mark results. The data can be difficult to interpret for non-statisticians, but they indicate that technological progress has overall positive and significant regression coefficients for the probabilities of yi=2, and yi=3 (IVCs and corporate investors) with the conventional levels of significance. Since yi=1 serves as a base group to ensure model identification, these statistics suggest that technological progress is associated with a significant decrease in the probability of angel financing, offering yet more data to support hypothesis 1. Model 2 also shows that the regression coefficients of technological uncertainty of yi=2 and yi=4 are positive and greater than that of yi=3. These statistics are consistent with hypothesis 2. In a nutshell, MNL regressions show that i) increased technological progress is linked with a higher probability of IVC or corporate funding (further proof of hypothesis 1) and ii) increased technological uncertainty is associated with a higher probability of an IVC funding source (further proof of hypothesis 2).

It’s a numbers game

Combined together, we believe the results provide systematic evidence that biopharmaceutical start-ups select financing sources according to their technological characteristics. In some cases of couse, the funder may choose the startup (rather than the other way around) based on technological progress/uncertainty and in terms of safety versus competition/differentiation/risk, and there is much that biopharma startups can learn from this behavior to focus their own funding activities. The newness of our study, however, is that start ups can strategically use funding sources for their own purposes and choose the right one for them. Specifically, start-up projects tend to be financed by IVCs and corporate investors rather than angel investors when a sufficient level of technological progress has been reached, which is reflected by their attractiveness to a wider range of investors. Furthermore, when pursuing highly uncertain technology, where higher risk may be equated to a higher rate of return, start-ups projects tend to be financed by IVCs and syndicated investors – where the appetite for risk (and reward) is greater.

In short, the characteristics of the technology a biopharma start-up is pursuing has an impact on the resulting financing arrangements. Why? Along with the complexity and length of product development cycle, biopharmaceutical start-ups have a unique managerial and technological environment. Importantly, the earnings outlook for a biopharma company is often determined largely by the products they develop and market, rather than their overall performance in the industry. As a result, biopharma start-ups should fully consider the link between technological characteristics and financing sources to develop an optimized strategy for growth

– and survival.

Hyunsung D. Kang and Xin Geng are both based in the Campbell School of Business, Berry College, Georgia, US

- PhRMA, “The economic impact of the US biopharmaceutical industry,” (2013). Available at onphr.ma/2q8lXjW. Accessed December 2014.

- NDP analytics, “IP – intensive manufacturing industries: Driving US economic growth,” (2015). Available at bit.ly/2D1se9u. Accessed November 13, 2018.

- WF Sharpe, “Capital asset prices: A theory of market equilibrium under conditions of risk,” Journal of Finance, 19, 425-442 (1964).

- National Venture Capital Association, “VC investments 2010” (2010). Available at www.nvca.org. Accessed November 13, 2018.

- JO Lanjouw, M Schankerman, “Characteristics of patent litigation: A window on competition,” RAND Journal of Economics, 32, 129-151 (2001).

- B Guo, Y Lou, D Perez-Castrillo, “Investment, duration, and exit strategies for corporate and independent venture capital backed startups,” Journal of Economics & Management Strategy, 24, 415-455 (2015).

Hyunsung D. Kang and Xin Geng are both based in the Campbell School of Business, Berry College, Georgia, US.