Mapping Out MAM

Amgen has brought the Multi-Attribute Method (MAM) into the mainstream, but what’s next for this analytical workflow – and for biopharmaceutical QC?

sponsored by Thermo Fisher Scientific

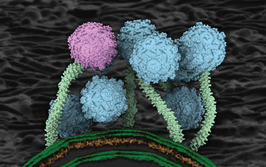

In the biologics industry, it sometimes seems like the only constant is change. Consider how the cumbersome, laborious mass spectrometers of the 1980s have evolved into sophisticated protein analysis tools. Today’s instruments, says Ting Song, a Senior Scientist at Amgen, can even analyze binding of a drug to its target. Amgen now has taken mass spectrometry into the cGMP environment – so what changes should we expect next?

The new normal

If you want a hint on what’s next for MAM, think about how quickly SDS-PAGE clipping assays were replaced by electrophoresis. “Electrophoresis will in turn be displaced by MAM – not just CE-SDS but also capillary IEF,” states Executive Director of Attribute Sciences Jette Wypych. “MAM is not intended to be complementary to existing assays – it is a replacement.” She lists QC techniques likely to be less prominent in the future: certain chromatographic methods for assessing amino acid modifications, glycan mapping techniques, ion exchange chromatography, hydrophobic interaction chromatography, and standalone peptide mapping methods with UV detection.

Similarly, antibody-based identification tools will become redundant, says Scientific Director Da Ren. “MAM confirms the amino acid sequence – and is far more specific than ELISA assays.” And while chromatographic methods may detect charge variants, only MAM elucidates the molecular basis of the variations. “It doesn’t just alert us to a peptide modification, it defines the precise site of the modification,” notes Ren. Consequently, MAM allows detailed assessment of the relevance of such events to drug safety and efficacy.

What should I look for when adopting MAM?

Instrumentation capable of providing data for attribute quantitation and new peak detection:

- high resolution (a measure for the width of a mass spectrometric peak – the higher the resolution, the narrower the peak and the higher the chances to distinguish ions that are very close in their detected mass to charge ratio [m/z] in a mass spectrum

- high mass accuracy (a measure of how close a detected mass to the theoretical mass of an ion is, provided as mass deviation in parts-per-million [ppm])

- reproducible isotope distribution (for peptide confirmation [requires reproducible measurements of ion intensities with high mass accuracy and high resolution])

- with highly reproducible chromatographic separation

Software that is:

- user-friendly (easy to use, automated data processing and reporting)

- allowing easy method transfer across instruments and sites

- robust and allows for reproducible result generation

- 21-CFR Part 11 compliance-ready

- capable of assuring data integrity and security (e.g., secure back-ups)

Systems that are:

accessible for contract labs and for countries that must repeat manufacturer’s release methodology (i.e., easy to use, affordable)

Vendors that:

- commit to long term support on instrument and software

- offer complete solutions pre-evaluated and optimized for user expertise level

- respond rapidly to service requests (minimize downtime)

- provide software training

- are open to collaborate on system/software optimization

Growing regulatory endorsement

Amgen’s quality focus inevitably led the team to concentrate on monitoring and control of critical quality attributes (CQAs) in biologics manufacture. “It’s all part of the quality by design (QbD) approach,” says Ren. “MAM allows us to fully understand the product and to control its quality attributes throughout the development and manufacturing process.” This, he says, is why MAM will have wide-ranging benefit to the pharmaceutical industry – and it also explains the increasing support for MAM from the regulators.

Wypych notes agencies’ enthusiasm as well, especially after some adopted and gained experience with the method for themselves. But this didn’t happen by chance – Amgen engaged major regulators early in the MAM development process. “At first, Amgen was a lone voice, but over the years we have slowly convinced the industry of the merit of MAM,” says Wypych. And in 2017, Amgen – along with Just Biotherapeutics, Merck, Pfizer, Biogen, and Genentech – published a paper establishing that MAM was ready for QC application (1). “That was hugely uplifting!”

Nevertheless, there’s still some way to go before agencies worldwide converge on MAM as a routine QC tool. What will it take to win over those regulators who still have questions? Wypych thinks the answer lies in providing full details of the MAM approach, operation and performance, including robustness, failure rates, and the standard criteria for “passing” a product with regard to CQAs. And she is confident of meeting the expectations of the regulatory bodies. “Eventually in the coming years, I expect MAM will be globally accepted as a replacement for conventional QC assays.”

Ren emphasizes that MAM already fits very well with current regulatory thinking. “It fits exactly within the QbD paradigm.” Furthermore, he emphasizes, MAM has satisfied all necessary ICH guidelines – for example, the current ICH Q2(R1) guidance – that pertains to analytical methods used in a cGMP environment. And that’s why he expects to see continued uptake of MAM in the industry, and increasing acceptance by regulators worldwide.

"We have ambitious goals,” says Wypych. “But look how far we’ve come in the last five years, and consider the growing momentum for MAM uptake – more and more companies are adopting MAM in their QC functions.” But a key requirement, she says, is to make MAM sufficiently robust and affordable for adoption by all, including contract testing labs and import testing labs. The latter point, she says, is important for countries that require import testing, for example Russia, South Korea, and China.

Upgraded technical capabilities

In an environment as dynamic as the biologics industry, should we also expect MAM to evolve? Certainly, the Amgen team is always thinking bigger and better, and continues to refine MAM for various applications. Ren points out the enormous potential of this young technology, and outlines two broad areas of interest that he and his colleagues are currently addressing.

The first is automated sample preparation – an area of interest to many companies besides Amgen. Ting Song notes that automation in both sample preparation and data analysis would support the evolution of MAM into a real-time release and stability testing tool, compressing the testing cycle and helping manufacturers get drugs to patients in shorter time-frames.

In support of this endeavor, says Ren, Amgen has made significant investments aimed at extending their capabilities in automated data analysis: “The idea is that operators will simply put a sample into one end of the system and collect processed data at the other end – the intervening steps of sample preparation, sample analysis, and data analysis will all be automated.”

According to Ren, advances in this area will likely need further close collaboration with instrumentation vendors. “We’ve already asked them to consider how we might collaborate to develop systems with higher levels of automation.” In addition, says Ren, aspects of data analysis require improvement. “The methods used for integration of peaks haven’t changed for decades – the time is ripe for application of artificial intelligence-powered data analysis; this could revolutionize the field and replace human analysts.”

The second area of interest for Amgen is miniaturization. “Manufacturers will have to develop small-footprint mass spectrometers that are sufficiently compact and mobile to be moved around the manufacturing floor as operators require,” says Ren. In addition, he believes that a range of software companies – not just the major vendors – will want to leverage the opportunities to develop solutions that support MAM in the QC environment. “This will result in growth in the currently limited number of vendors that can serve the compliance software field.”

A virtuous circle

If any company can upend the bioprocessing environment, it’s likely to be an archetypal biopharmaceutical pioneer such as Amgen. As Ren explains, Amgen’s science-based culture and embedded values of agility and adaptability – present since its genesis – have remained with the company as it has grown into a major industry player. “Our values, together with our strategic focus on quality, explain why we continually seek to develop better products and thereby better serve patients,” he says.

But there is another factor at play, according to Wypych: “To make a difference you have to be a risk-taker – while strongly committing to ensure compliance.”

Amgen’s desire to provide patients with the best possible options also informs the company’s proactive engagement with regulators. “That won’t change,” says Wypych. “We’ve already facilitated a big positive change in many regulators’ view of MAM, and we will continue to address any concerns as they are presented.” Amgen’s efforts have contributed to a sea-change in MAM uptake and enhanced the reputation as the developer of this novel technology. In other words, when quality is an intrinsic component of your core values, competitive advantage tends to follow.

- R Rogers et al, “A view on the importance of ‘multi-attribute method’ for measuring purity of biopharmaceuticals and improving overall control strategy”, AAAPS Journal, 20, 7 (2017). PMID: 29192343.