Rediscovering Innovation

If pharma is to retain its reputation as an innovator, companies must be brave enough to explore new areas, new targets and new technologies – and boldly go where no industry has gone before.

First question: is there an innovation drought in pharma? Well, it really depends on what you read and whom you believe.

In 2010, the Boston Consulting Group analyzed R&D productivity and found that the number of new molecular entities (NMEs), including biologics and small molecules, brought to market by per billion dollars of R&D expenditure had fallen by a factor of 100 in inflation-adjusted terms between 1950 and 2010 (1). Then in 2011, the Frankel Group published a white paper on the current state of R&D in the pharma industry and concluded “an innovation drought currently exists in the pharmaceutical industry that is significantly affecting the cash flow of the current business model”(2). Two eminent organizations, pretty much the same conclusion. Pharma R&D is in a mess...

I admit, these papers were written in 2010 and 2011, and here we are in 2014; things must have improved, surely? Perhaps they have. At the end of 2013, the European Medicines Agency (EMA) approved 38 NMEs, compared to 35 in 2012 (3). Between 2010 and 2012, NME output also rose at the FDA. At the end of 2012, the FDA had approved 39 NMEs, up from 30 in 2011. Aside from a dip in the number of NMEs approved by the FDA in 2013, to 27 (4), recent figures suggest the innovation drought is coming to an end. By mid-December 2014 the FDA had approved 35 NMEs (5), so it seems innovation is making a long-waited return to pharma. Or is it?

I’ve spoken to several experts on the topic who believe that much of what pharma companies are doing today is defensive and reactionary – responding to ever-decreasing returns on investment, shortening product lifecycles and limited long-term thinking. With incremental innovation and short-term profit being prioritized ahead of true innovation and longer-term benefits to society, many believe that things need to change (6).

Defining innovation

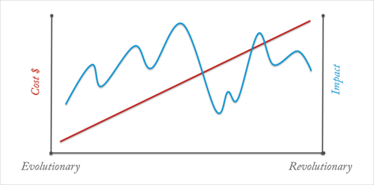

Innovation within today’s pharma industry exists across a continuum (Figure 1). At one end of the continuum innovation focuses on developing drugs about which relatively little is known at the time of their discovery. These are hailed as the game-changers; the products that have changed treatment paradigms and delivered significant improvements in human health (monoclonal antibodies are a good example). In many ways, they are hailed as ‘revolutionary’.

At the other end, innovation focuses on ‘tweaking’ and ‘tinkering’ with products that companies already know a lot about. Even minor changes to current products have the potential to deliver strong patient benefits and represent an ‘evolutionary’ approach to innovation (for example, child-friendly formulations).

The cost and impact of each type of innovation can vary hugely, and can be influenced by the class of product (small molecules or biologic), geography (developed or emerging markets), internal capabilities (vertically integrated or reliant on external partners), therapy area (chronic or acute), and specific indication (adult or pediatric forms of a disease). Suffice to say, making decisions about which type of innovation a company wants to invest in, whether it be evolutionary or revolutionary, or both, isn’t simply about flipping a coin.

Figure 1. Mapping innovation across a continuum. Costs rise as companies engage in revolutionary, rather than evolutionary, innovation but the impact is difficult to predict.

Driving innovation

There are many key drivers (and a number of resistors) of innovation within the pharma industry. These include internal company issues such as company size, level of R&D investment, therapy area focus and partnering strategy, and external market issues like the regulatory environment, government policy, levels of competition and unmet needs. Despite the complexity of variables, the experts I’ve spoken to keep coming back to the same three key areas time and time again – policy, partnerships and strategy.

Red tape or green light?

Government support of pro-innovation policy remains a critical driver. The Organization for Economic Co-operation and Development argued back in 2006 that there was “…an inability at the national level to address various issues that could promote innovation within the biopharma industry,” and recommended a focus on several key areas, including more effective public governance systems, the promotion of co-operation, and networking (7). Progress is being made, for example, orphan disease R&D policies in the US and Europe, and Europe’s Innovative Medicines Initiative. In terms of regulation, one could argue that a heightened sensitivity amongst regulatory agencies has contributed to a slowdown in innovation within the biopharma industry. Some high-profile product withdrawals have made the process of passing regulatory muster more and more difficult in recent years. An opposing view is that a rigorous regulatory system actually stimulates innovation. In a seminal analysis of regulation and innovation published in 1978, Grabowski et al. argued that “…more demanding regulatory apparatus, such as the US and UK, has fostered a more innovative and competitive pharmaceutical industry” (8).

Networks and partnerships

As the search for innovation becomes more expensive, time consuming and regulated, pharma companies have adopted strategies that leverage external expertise and collaborative approaches to meet the challenge. ‘Collaborative innovation’ is becoming the new norm in pharma R&D as companies seek to accelerate and refine the R&D process. Several partnerships have emerged in recent years between pharma and academic institutions (9), insurance companies (10), and non-profit research alliances (11). Perhaps the most high-profile example of pharma collaboration came in February 2014 when ten companies joined forces with the US National Institutes of Health to discover new medicines for diseases such as Alzheimer’s, type 2 diabetes, rheumatoid arthritis and lupus (12). More partnerships of this nature can be expected, but only if they deliver value to society.

Small is beautiful

In pharma R&D, surely bigger is better? More cash to invest in R&D, more pipeline assets, more chance of developing something truly innovative? Apparently not. An analysis of the NME output of large pharma companies has shown that being bigger does not guarantee success. In fact, the opposite seems to be true. Since the early 1980s, big pharma’s share of NMEs approved has been declining, whereas the small biopharma and biotech companies’ share has been increasing (13). Mergers and acquisitions (M&A) don’t seem to be solving the issue either. In fact, M&A in the pharma industry have been blamed for having a “negative impact on innovative performance” (14). A leading expert on the subject of innovation in pharma once told me that for large companies, M&A does not seem to create or destroy value, rather, the impact of M&A in the pharma industry on R&D can be viewed as 1+1=1. Regardless of the size and strategy of a company, innovation must be sustainable, allowing the company to thrive in the current market environment. There are several viable strategies:

- Focusing on one therapy area (Novo Nordisk).

- Selling products and services in addition to drugs (Bausch & Lomb).

- Becoming embedded in a specific country.

- Diversifying into certain adjacencies (for example, animal health, consumer health).

- Concentrating on generics.

For some companies, the best results may come from a blend of such strategies.

Delivering innovation

How can we reverse the innovation drought? Pharma companies must understand that they are part of a diverse, complex ‘innovation ecosystem’ that relies on symbiotic relationships to thrive. Notwithstanding this, pharma companies do have one of the more important roles – they spend money on R&D, shoulder most of the risk and must continue to move outside of their comfort zone, if real progress is to be made. However, without enlightened policy makers and contributions from physicians, payers, patients and other important groups, innovation will stall. Like a fine Swiss watch, each component of the innovation ecosystem is indispensable.

The innovation ‘audit’

Albert Einstein once said that insanity is defined as “doing the same thing over and over again and expecting different results.” Therefore, it is important that companies regularly audit themselves to assess and track their ‘innovation health’, very simply defined as how innovation is nurtured within the organization, including planning, investment, long-term strategy and making sure the organization learns from its mistakes and failures. If nothing else, it will prevent companies from making the same mistakes again and again, and curb wastage of precious time and resources. If you are charged with driving a company’s R&D strategy forward you must not shy away from asking difficult questions of management if the company’s strategy is not clear or well defined. Equally, those of you in management must ensure that all key stakeholders within the organization understand the strategy, provide open channels of communication to discuss and resolve issues quickly, and give employees the necessary tools and resources they need. Fundamentally, a company must be comfortable with the decisions it makes about what type of innovation to invest in (revolutionary versus evolutionary), and be prepared to change direction and focus if required.

An innovation-rich future?

Despite concerns over declining output and R&D effectiveness, several experts and key industry stakeholders believe that the pharma industry is about to enter a golden era of innovation. The mistakes of the past, they hope, have been learned and a new generation of pharma industry leaders is now developing new models of innovation in an attempt to deliver growth, shareholder value, and something meaningful for society. The industry must not become complacent, however. Companies must be brave by exploring new areas, new targets and new technologies. Companies must also seek to strike the optimal balance between collaboration and competition; while innovation is driven by competition, even a big pharma company can’t do everything internally. And perhaps most critically, companies need visionary leadership (see “Innovation: Make It So”). As a leader you must trust your workforce, empowering them to make bold decisions about the future of your business, and giving them sufficient time and resources to take longer-term risks on what could be the next medical revolution.

Innovation: Make It So

As a leader in the life sciences industry, how can you make sure you are encouraging innovation?

- Be clear what innovation means to you as a business, what value you can deliver, and go for it!

- Know where your organization sits on the innovation spectrum; if you’re not happy where you are, make changes to move!

- Make sure everyone in the business understands what’s needed to drive innovation; if people don’t understand, provide information that clearly establishes the company’s innovation strategy and what people can do to support it.

- Do not be scared of asking the hard questions of senior management to make sure you’re in good “innovation health.”

- Be clear on the critical success factors that your organization must focus on in order to maximize your chances of success.

- Boston Consulting Group, “Life Sciences R&D: Changing the Innovation Equation in India”, www.bcg.com (September 2010).

- B. Frankel et al., “The Current State of Pharmaceutical Industry Research and Development”, www.frankelgroup.com (December 2011).

- EMA Press Release, “EMA Recommends 81 Medicines for Marketing Authorisation in 2013”, www.ema.europa.org (January 2014).

- B. Munos, “The FDA Approvals of 2013: a Watershed?”, Forbes, www.forbes.com (3 January 2014).

- A. Ward, „Signs of a Revival in Drug Development“, Financial Times, www.ft.com (10 December 2014). FT,www.ft.com (10 December 2014).

- TCP Innovations, “Drug Prices are (Unnecessarily) High Because R&D is (Unnecessarily) Inefficient”, www.tcpinnovations.com (April 2014).

- OECD, “Innovation in Pharmaceutical Biotechnology; a Comparison of National Systems”, www.oecd-ilibrary.org (March 2006).

- H. Grabowski et al., “Estimating the Effects of Regulation on Innovation: An International Comparative Analysis of the Pharmaceutical Industry”, J. Law Econ. 21(1), 133–163 (1978).

- AstraZeneca Press Release, “Alzheimer’s, Cancer and Rare Disease Research to Benefit from Landmark MRC-Astrazeneca Compound Collaboration”, www.astrazeneca.com (October 2012).

- Pfizer Press Release, “Humana and Pfizer Form Research Partnership to Improve Health Care Delivery for Seniors”, press.pfizer.com (October 2011).

- TB Alliance Press Release, “Novartis Provides Drug Candidate Compounds to TB Alliance”, www.tballiance.org (August 2014).

- M. Langley and J. D. Rockoff, “Drug Companies Join NIH in Study of Alzheimer‘s, Diabetes, Rheumatoid Arthritis, Lupus”, Wall Street Journal, online.wsj.com (3 February 2014).

- B. Munos, “Lessons From 60 Years of Pharmaceutical Innovation”, Nat. Rev. Drug Disc. 8, 959–968 (2009).

- C. Ornagh, “Mergers and Innovation in Big Pharma”, Int. J. Ind. Organ. 27(1), 70–79 (2009).

Duncan Emerton has experience across a broad range of pharma disciplines including R&D, sales, marketing, medical affairs, competitive intelligence, management consulting and business analysis. Duncan currently heads up FirstWord’s syndicated reports business, where he’s responsible for delivering future-focused research and analysis across a wide range of topics. “My current passion is biosimilars,” says Duncan. “I’m a regular presenter and chair at biosimilar-focused conferences, and I’ve contributed several articles and book chapters on the subject.” In his spare time he plays golf and runs The Biosimilarz Blog.