The Battle for the Future of American Healthcare

Did the forecasted drug pricing storm come to pass following the 2016 US election? And what might the 2020 elections mean for pharma and the Affordable Healthcare Act?

Four years ago, The Medicine Maker made a bold prediction: regardless of who ended up in the White House, the pharma industry would have to weather change – with particular regard to drug pricing (1). Hillary Clinton had a long history of opposing rising drug prices, but Donald Trump was also making noises in favor of Medicare price negotiations and “repealing and replacing Obamacare”. In fact, one of Trump’s campaign promises was to allow American consumers to purchase drugs from abroad. Chris Dale, Director of Public Relations and Communications for Turchette, said that Medicare price negotiations and drug importation would become immediately politically untenable after a Clinton victory (due to the balance of power in the House of Representatives), and would only be possible if Trump won. Thus, we envisaged a strange situation whereby the USA would only see some of Clinton’s pharma-related policies if Trump became president. In the words of then Novartis CEO, Joe Jimenez, “We believe that, no matter which candidate wins, we will see a more difficult pricing environment in the US.” So did we?

Trump seemed anything but the “business as usual” candidate – an image he’s deliberately cultivated in interviews and on social media via more than 17,000 Tweets since he officially declared his presidential candidacy in July 2015 (see our sidebar: Talking the Talk). But, as far as pharma and drug pricing goes, we haven’t yet seen radical changes. “This is something I was clearly wrong about,” says Dean Baker, co-founder of the Center for Economic Policy and Research. “I expected Clinton to win, but even if she didn't, I thought Trump would feel some pressure to rein in the drug companies. As it turned out, spending on drugs rose more rapidly under Trump than during the Obama years.”

According to Baker, spending on prescription drugs rose by 6.3 percent annually under Trump compared to a 5.5 percent rate under Obama-Biden. “The general direction in the Trump years has been upward, with a peak of 9.7 percent in the first quarter of 2020, then a drop to 4.4 percent in the second quarter,” said Baker in a recent blog post (2). “This falloff is a direct result of the pandemic, as many people put off doctors’ visits, which meant that they would be prescribed fewer drugs. So, before the pandemic, drug spending was rising at a rapid and accelerating pace.”

In March 2018, Trump promised, “You’ll be seeing drug prices falling very substantially in the not-too-distant future, and it’s going to be beautiful.” Then in May, 2019, he said “Drug prices are coming down; first time in 51 years because of my administration.” But, according to the consumer price index, prescription drug prices in the USA rose during the Trump presidency by 5.9 percent from December 2016 to December 2019. Though this represents a moderate reduction in the rate of the increase, it is in line with the upward trend seen in the USA over the past couple of decades (3).

Why haven’t we seen the kind of radical shift in drug prices? President Trump decided in early 2017 – apparently following a meeting with pharmaceutical industry lobbyists and executives – that he would not seek to allow Medicare to negotiate directly with pharmaceutical companies. Since then, the President launched a number of policies aimed at reducing drug prices (see our sidebar: Trump’s Pricing Policies). But according to Monique Dabbous and her colleagues at Aix-Marseille Université, France, Trump’s primary focus has been on repealing the Affordable Care Act (ACA) (4).

On his first day in office, President Trump signed an executive order instructing administration officials “to waive, defer, grant exemptions from, or delay” implementing parts of the ACA. But, a few months down the line, Trump’s plan to repeal and replace “Obamacare” failed – largely due to the late Republican senator, John McCain, voting against the new plan. And though President Trump has been unable to repeal the ACA, he has been able to weaken it, mainly by dissolving the “individual mandate” penalty, which anyone without coverage had to pay. However, the result was a 32 percent increase in average premiums, according to the Kaiser Family Foundation (5) (although most received subsidies to offset those premium hikes) – likely because, without the financial penalty incentivising people to take out healthcare insurance, insurance firms anticipated lost revenues.

Further reforms made to the ACA include: i) allowing states to add “work requirements” to Medicaid, ii) ending payments made from the federal government to insurers to motivate them to stay in the ACA insurance exchanges, iii) expanding access to short-term “skinny” plans (allowing them to last for up to one year and be renewable for three years), and iv) slashing funds to facilitate HealthCare.gov sign-ups (5). Taken together, George Sillup, Associate Professor of Pharmaceutical & Healthcare Marketing at Saint Joseph’s University, USA, says that Trump’s efforts to dismantle the ACA has made it “more challenging for those who are underinsured (no drug coverage) to get affordable coverage”.

A change of priorities?

In 2016, the affordability of prescription drugs was one of the most important issues in American politics. According to a poll conducted the week following the last US election, healthcare was rated as the third most important factor in peoples’ vote for president – above foreign policy, terrorism, immigration and either candidate’s personal characteristics (6). And when thinking about healthcare priorities, dealing with the high price of prescription drugs topped the public’s list (7).

Today, in the midst of an international pandemic, and following protests and riots against racism and police violence, drug pricing may be lower on the public’s priority list this time round. Fiona M. Scott Morton, Theodore Nierenberg Professor of Economics at the Yale University School of Management, agrees: “We have such important issues of democracy, corruption, and racial injustice to worry about.”

Baker thinks the Democrats are focusing on the pandemic and Trump’s lack of respect for norms – most recently his alleged disrespect for people in the military. On the other hand, Trump is focusing more on painting a picture of the Democrats as dangerous radicals. “In neither case is there much room for talking about healthcare,” he says. “That may change, and my expectation is that a shift to healthcare would benefit the Democrats more than the Republicans (coverage has fallen and costs have risen sharply under Trump), but I know better than to try to predict the course of this campaign...”

Sillup also hasn’t seen healthcare discussed much in the media, but that might be about to change. “A recent ad by Biden addressed the issue and I anticipate that will increase as we ramp up for the presidential election,” he says.

In fact, the COVID-19 pandemic may have led to an improvement in the reputation of pharma companies. Researchers from The Harris Poll found that 81 percent of Americans polled recalled seeing or hearing something about the industry during the pandemic, with 40 percent believing that pharma’s reputation had improved since the beginning of the COVID-19 outbreak. Rob Jekielek, managing director at Harris, said the industry was at its highest ever point in terms of its reputation and relevance (8).

Interestingly, before the last election Baker advocated expanding the role of public open research as a means of reducing drug prices. This has, in a way, taken place during the development of drugs and vaccines related to the coronavirus. But the government has not taken ownership of the research – potentially feeding into the good press surrounding the pharma industry at present. “Moderna, which is generally thought to be the leading US contender to develop a vaccine, had pretty much all its research costs paid by the government,” says Baker. “Nonetheless, it will get a patent monopoly on the vaccine and will be able to charge what it wants.”

In any case, Baker believes that this could provide an example of where direct funding to develop a vaccine leads to a useful outcome. “It should be possible to point to this example as a reason to have more direct funding in the future, but with the patents going into the public domain so that a new drug/vaccine can be produced as a generic from the day it is approved,” he says.

The new landscape

What then, given the new landscape, should pharma companies expect following the outcome of the 2020 US presidential elections? In July, President Trump announced four executive orders to reduce drug prices (see Trump’s Pricing Policies for more detail):

So far, only the policy to ensure the USA pays the lowest price for Medicare Part B drugs compared with other economically similar countries has been officially signed as an executive order – and actually goes further by also including Part D drugs. The move represents a deviation from the International Pricing Index model and instead anchors to the lowest price for a product sold across OECD member countries, with a comparable per-capita GDP, after adjusting for volume and differences in GDP.

Pharma wasn’t best pleased with the proposal. “This reckless scheme will eliminate hope for vulnerable seniors and other patients waiting for new treatments by drastically reducing investment in cutting-edge scientific research and development,” said Michelle McMurry-Heath, CEO of the Biotechnology Innovation Organization (9). “That is why we will use every tool available – including legal action if necessary– to fight this risky foreign price control scheme.”

PhRMA CEO Stephen Ubl agreed, arguing that the administration “has doubled down on a reckless attack on the very companies working around the clock to beat COVID-19,” and that the order is an “irresponsible and unworkable policy that will give foreign governments a say in how America provides access to treatments and cures for seniors and people struggling with devastating diseases” (10).

Scott Morton argues that the result of the policy would be high US prices exported to its allies. “This is particularly egregious and poorly thought out,” she says. “Instead of procuring drugs in a cost-effective and rational manner, we will be forcing our bad system on to others.”

Scott Morton would rather see the next president tackle barriers to entry: “Getting generics into the market by eliminating pay for delay, REMS abuse, restriction of samples, and price fixing to name a few,” she says. “Also, biosimilars must have the same scientific name as the innovator, not face undue approval hurdles at the FDA or loyalty rebates and other contracts that act as a barrier to entry. Finally, government purchasing (Medicare, Medicaid, and so on) should incentivize a physician (in Part B, or on the medical side of commercial plans) to buy a lower cost drug.”

Sue Peschin, President and CEO of the Alliance for Aging Research, concurred in an article for Stat News. She pointed out that an Avalere study found that fewer than one percent of older adults in Medicare Part B would see a reduction in out-of-pocket costs as a result of the international pricing index model (11) – though it is not clear how the inclusion of Part D might affect the analysis. She also criticized the policy for endorsing the cost-effectiveness standards often used by other governments, such as the UK, which she described as “discriminatory.”

According to a more recent Avalere analysis, any potential savings will depend on how the system identifies the range of per-capita GDPs considered “comparable,” what drugs volumes are used for adjustment, and what pricing sources are used for calculating MFN (12).

Either way, as Rachel Sachs, a law professor at Washington University in St. Louis and an expert on drug policy, pointed out on Twitter (13), it seems unlikely that the Trump administration would be able to finalize the necessary regulations before the November election. “In the best case scenario, it would still take quite some time to implement the model,” she says.

Interestingly, the Democratic-controlled House also passed a bill in December of 2019 that would have allowed the US Department of Health and Human Services to negotiate prescription drug prices using other countries’ prices in a similar way to Trump’s proposal (Republicans opposed the bill and Trump threatened to veto it). We may, therefore, see some sort of proposal implemented regardless of which candidate wins the election – though we’ve made similar predictions before...

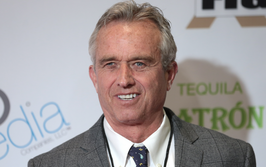

Obamacare in the balance

Thus far, we’ve paid very little attention to the man who is, at the time of writing, leading the national presidential polls: former Vice President Joe Biden. He too has promised to put a stop to “runaway drug prices” and the “profiteering of the drug industry.” In fact, Biden advocates two policies that Trump touted four years ago: allowing people to buy prescription drugs from other countries and repealing laws that prevent Medicare from negotiating lower drug prices with drug companies. “These are both good measures to lower prices,” says Baker. “If he gets in, the extent to which he follows through will depend on the political pressure from both sides.”

The major differences between the two candidates may, therefore, be found not in their approach to reducing the cost of prescription drugs, but rather in their views on healthcare – specifically the Affordable Care Act. “If Biden wins, the ACA will be the foundational building block of an improved healthcare delivery system – one that retains cover for pre-existing conditions,” says Sillup. “If it’s Trump, then he'll try to dismantle it. But, as with his first term, he’ll need an alternative before he does that.”

Baker agrees: “The Trump administration has done everything it could to sabotage the ACA. That would surely continue if he were re-elected.” Baker points to Biden’s promise to make the subsidies more generous, which he expects him to follow through with. But he’s most excited about his proposal to lower the Medicare age to 60. “That would be huge, as the older pre-Medicare age population has the greatest need for health care,” he says. “I don't know if he will be able to do five years at once, but even one or two years would be a huge foot in the door towards a universal Medicare program.

The Affordable Care Act also faces another existential threat. Following the recent death of Supreme Court Judge Ruth Bader Ginsburg, President Trump has appointed (with the approval of the Republican-controlled senate) Judge Amy Coney Barrett. This might give the Supreme Court enough conservative votes to declare the Affordable Care Act unconstitutional – causing 20 million Americans to immediately lose health coverage. Nicholas Bagley, a law professor at the University of Michigan who specializes in health issues, tweeted, “Among other things, the Affordable Care Act now dangles from a thread” (14).

Lawyers have argued that the Republican-backed tax-cut law of December 2017 rendered the ACA unconstitutional by reducing the ACA’s penalty for not having insurance to zero. This means if Biden were to win the election, he – along with a Democratic Congress – could in theory make the entire issue go away by reinstating the penalty for failure to have insurance (14).

For now, all we can say is that both candidates are advocating policies that would create a new pricing environment for pharma companies. And with regards to healthcare, the outcome of the election may be a crucial turning point: will America build upon the foundations of the ACA? And if not, then what?

Trump’s Pricing Policies

May, 2018

American Patients First

Trump’s American Patients First blueprint to lower drug prices and reduce out-of-pocket costs covered focusing reforms on the opaque world of pharma rebates and discounts.

June, 2018

President Trump jawboned pharmaceutical CEOs to limit and/or delay their company price increases with Pfizer reporting pricing pressures, from many sources, including those from the administration.

July 2018

The Biosimilar Action Plan was rolled out to lower drug prices by promoting greater competition through increased availability of biosimilars in the US.

October 2018

President Trump signed two bills that passed virtually unanimously by Congress to ban “gag orders” in contracts between pharmacies and insurance companies/pharmacy benefit managers (PBMs) to tell consumers that they could get drugs at a cheaper price by paying cash rather than the negotiated contract price on their drug plan.

President Trump also announced a five-year experiment to lower Medicare Part B drug prices. Administered by the Centers for Medicare & Medicaid Services (CMS), US prices will be linked to what countries with similar economic conditions pay for drugs by creating an International Price Index (IPI) Model (10).

July 2020

President Trump announced four executive orders to reduce drug prices: passing discounts obtained by health centers from drug companies on epinephrine and insulin to people with low incomes, allowing for safe importation of certain drugs by states, prohibiting deals between pharmacy benefit managers and drug manufacturers, and ensuring the US pays the lowest price for Medicare Part B drugs compared with other developed nations.

September 2020

President Trump signed an executive order to expand the drugs covered by the proposed "most favored nations" pricing scheme to include both Medicare parts B and D so that Medicare would refuse to pay more for drugs than the lower prices paid by other developed nations.

For sources and further elaboration, see: https://themedicinemaker.com/business-regulation/pharma-in-the-firing-line

- James Strachan, “The Great American Debate” (2016). Available at: https://bit.ly/3mMJcMp

- CEPR, “Spending on Prescription Drugs: Lies My President Told Me #3,475,652” (2020). Available at: https://bit.ly/2RR8aMF

- Statista, “Consumer price index for prescription and nonprescription drugs in the U.S. from 1960 to 2019” (2020). Available at: https://bit.ly/2HISHwi

- M Dabbous et al., “President Trump’s prescription to reduce drug prices: from the campaign trail to American Patients First” (2019). Available at: https://bit.ly/3cq5rDc

- NPR, “Trump Is Trying Hard To Thwart Obamacare. How’s That Going?” (2019). Available at: https://n.pr/3i0ji4r

- KFF, “Kaiser Health Tracking Poll: November 2016” (2016). Available at: https://bit.ly/3hUvlQx

- KFF, “Kaiser Health Tracking Poll: October 2016” (2016). Available: https://bit.ly/32XQfu1

- MMM, “Everybody loves pharma? Unexpected reputational gains since COVID-19 crisis” (2020). Available at: https://bit.ly/301W1bW

- BIO, “New Drug Pricing Executive Order is “Reckless” And “Dumbfounding” (2020). Available at: https://bit.ly/3hYhGrT

- PhRMA, “PhRMA Statement on Most Favored Nation Executive Order” (2020). Available at: https://onphr.ma/306jbxZ

- Stat News, “Trump’s ‘most favored nation’ executive order on drug prices is a scam for seniors” (2020). Available at: https://bit.ly/3kKnGpO

- Avalere, “Most Favored Nation” EO Creates New Questions on International Prices” (2020). Available at: https://bit.ly/2RSA36K

- Rachel Sachs (2020). Available at: https://bit.ly/303hlOt

- Nicholas Bagley (2020). Available at: https://bit.ly/3jcCjSJ

- NPR, “The Future Of The Affordable Care Act In A Supreme Court Without Ginsburg” (2020). Available at: https://n.pr/2ZZpdAz

Over the course of my Biomedical Sciences degree it dawned on me that my goal of becoming a scientist didn’t quite mesh with my lack of affinity for lab work. Thinking on my decision to pursue biology rather than English at age 15 – despite an aptitude for the latter – I realized that science writing was a way to combine what I loved with what I was good at.

From there I set out to gather as much freelancing experience as I could, spending 2 years developing scientific content for International Innovation, before completing an MSc in Science Communication. After gaining invaluable experience in supporting the communications efforts of CERN and IN-PART, I joined Texere – where I am focused on producing consistently engaging, cutting-edge and innovative content for our specialist audiences around the world.