Revelations and Resolutions

It seems likely that 2016 will go down as one of the most eventful years in modern history, but what did the pharma industry make of it? Here, we quiz a number of past contributors to The Medicine Maker for their opinions on 2016 – and ask them what priorities and resolutions the industry should focus on for 2017.

Markus Thunecke

Founding Senior Partner at Catenion, Berlin, Germany.

Markus is a biochemist turned strategy consultant. In his early career, he developed transgenic rodent models for Alzheimer’s disease before turning his attention from mice to humans. After two stints at larger consulting firms, Markus focused on his passion for biopharmaceutical innovation by founding Catenion together with three like-minded partners in 2003. “I’ve often observed that within large organizations the most interesting breakthroughs happen in spite of rather than because of a particular strategy or organizational setup. This is a typical starting point for an R&D transformation effort.”

Featuring

Markus Thunecke

Founding Senior Partner at Catenion, Berlin, Germany.

Markus is a biochemist turned strategy consultant. In his early career, he developed transgenic rodent models for Alzheimer’s disease before turning his attention from mice to humans. After two stints at larger consulting firms, Markus focused on his passion for biopharmaceutical innovation by founding Catenion together with three like-minded partners in 2003. “I’ve often observed that within large organizations the most interesting breakthroughs happen in spite of rather than because of a particular strategy or organizational setup. This is a typical starting point for an R&D transformation effort.”

Christa Myers

Senior Pharmaceutical Engineering Specialist at CRB, USA.

Christa has an extensive background in the design of fill-finish facilities, chemical kilo labs, pilot plants, API research and manufacturing facilities, bulk pharmaceutical chemical facilities, highly hazardous compound containment and biotech process facilities. Her involvement starts with the strategic concept and continues through construction and startup of projects. “My role is to provide clients with insight as to how innovative technologies apply to process and facility designs.”

John Talley

Chief Scientific Officer, Euclises Pharmaceuticals, USA.

An organic chemist by training, John Talley is responsible for discovery and preclinical development of new chemical entities at Euclises Pharmaceuticals, Inc. His research examines the role of prostaglandins in immune suppression within the tumor microenvironment. “I am particularly interested in the utility of prostaglandin synthesis inhibitors to enhance the efficacy of checkpoint inhibitors by boosting immune control of tumors.”

Eva McLellan

Regional Disease Area Director, Oncology Pipeline at Hoffmann La Roche, Basel, Switzerland.

Eva McLellan (née Furczon) is responsible for the commercial strategy of Roche’s early oncology pipeline in Europe. Her industry experience spans operational and strategic responsibilities at the affiliate, regional, and global level and includes roles in field sales, medical affairs and marketing. “I am passionate about innovation. I love to integrate people, perspectives and creative approaches to help teams navigate complex and evolving environments.”

What were the highs of pharma’s 2016?

Markus Thunecke: For me, three things stand out. First is the continued success story of immuno-oncology – in particular, there was much new data revealed in the field of checkpoint inhibitors and cellular therapies. Secondly, gene therapy may finally deliver after decades of ups and down – promising real breakthroughs in the field of genetic diseases, such as retinal dystrophies, beta thalassemia or haemophilia B. Thirdly, though the number of FDA approvals was lower in 2016 compared with previous years, there are positive signs in company pipelines. The value of the top 30 pharma companies’ pipelines has increased considerably over the last 2-3 years (based on analyst consensus valuations). When one compares this value increase with R&D spending over a longer period, we get a genuine increase in R&D productivity. Some companies, including Gilead, Celgene or Biogen, have outperformed the rest, but I think that many other big pharma companies have learned important lessons on how to better recognize and capture innovation externally. As one example, although the checkpoint antibody revolution was initiated in academia and smaller companies, it’s Bristol Myers Squib and Merck, Sharp & Dohme who pushed it across the finishing line.

Christa Myers: The Zika virus was a large part of the overall world health story in 2016. Everyone worried about the health of their Olympic athletes in Brazil and the possibility of the spread of the virus. The silver lining was that it led to much more activity in the pharma industry to support this important neglected disease. And the research and development will not only address the concerns of this virus, but also drive knowledge for other insect-borne diseases, vaccine development, and testing capabilities. We also increased knowledge of our own immune responses during pregnancy for the mother and the developing fetus.

John Talley: I was really pleased to see a number of industry success stories in terms of anti-cancer efficacy, particularly with regards to checkpoint inhibitors. In the US, recent congressional approval of the “21st Century Cures Act” may have a favorable impact on early stage research into more ambitious disease targets, such as central nervous system diseases, infectious diseases and cancer. The bill is intended to streamline the grant application process, as well as the clinical and regulatory pathways.

Eva McLellan: I also believe that advances and approvals regarding immune-oncology have been high points. 2016 saw several FDA approvals of checkpoint inhibitors PD-1 and PDL-1 for multiple indications, including lung cancer. These new therapies offer transformation potential rather than incremental improvement. In addition, I was excited to see CRISPR-Cas9 – the potentially industry-changing gene technology – enter human clinical testing. I also have an interest in biosimilars, so I was pleased to see biosimilar monoclonal antibodies, such as Inflectra, being approved by the FDA. Why is this a big deal? Well, because it means that patients have even more access to lifesaving drugs in both emerging and developed markets. It also means that we will have more competition in the marketplace, which will further push the boundaries of innovation. Though a status quo is fine in certain industries, innovation is extremely important in pharma and very good news for patients and society as a whole.

And the lows?

MT: Business models that solely exploit pricing inefficiencies of public and private healthcare systems for their own “enrichment” are a low point – such companies rely on profit maximization models without investing in innovation or adding anything meaningful to global healthcare. For a while, these “no internal innovation investment models” were very popular with investors (and consultants who sometimes became CEO), but it is my firm belief that our industry has an ethical obligation to invest in innovation as long as it benefits from the social contract through public healthcare funding.

CM: The fraudulent pricing practices of a few companies in 2016 has put undue pressure on the entire industry – and weakened public trust in pharma. I think companies need to better highlight the great work they are doing to help save patients money. For example, new equipment and processes being used in industry have been designed for higher throughput and lower manufacturing costs, which in the end should help bring the cost of medicines down.

JT: I think it is disappointing that the industry has failed to make any progress in terms of the pharmacological intervention in the treatment of Alzheimer’s disease. The industry must continue to explore new treatment modalities for Alzheimer’s and, at the same time, make a concerted effort to more fundamentally understand the underlying causes of this devastating disease.

EM: I think it is always disappointing when promising drugs do not meet their primary endpoints. The industry had a few of those in 2016. These are sobering reminders that it’s just how science works... In these cases, the industry should do what any good scientist would – get curious and analyze the results to look for insights, and then share them with the industry for the benefit of all. Such a gesture could help inform the many other ongoing trials and ultimately accelerate future success for patients.

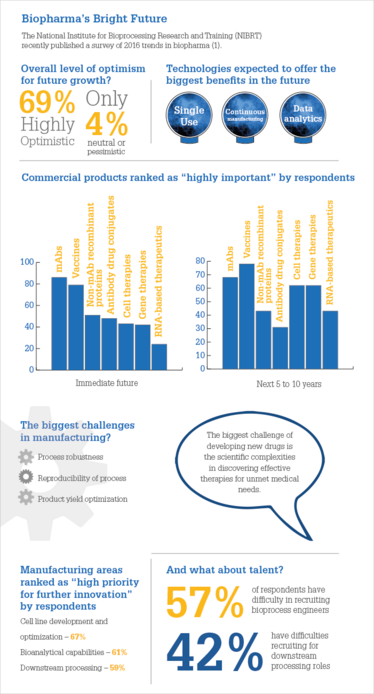

(1) NIBRT, “2016 Trends in Biopharma Survey Results” (2016). Available at: bit.ly/2jaDJkn. Last accessed January 12, 2017

Words of Wisdom for the New Year

Markus Thunecke:

“There are a number of companies in the race to test gene editing in clinical settings. If a therapeutic application showed real benefit with acceptable safety in a clinical setting, it could lead to an unprecedented wave of innovation – although it is hard to predict when this will happen, as safety and specificity are still concerns. Almost inevitably, most potential breakthrough innovations go through a long cycle of ups and downs before they finally deliver.”

Christa Myers:

“2016 was a year of Olympics, political change and celebrity deaths, but the true heroes in our world are not athletes, politicians or celebrities. The heroes in our world are the unsung technical people in hospitals, laboratories and manufacturing facilities who are striving to find new treatments and cures for people. If you ask the families of those people affected by medication or treatment how much impact you have had – they will tell you that the makers, inventors, developers, engineers, and so on, are worth all of the money in the world because you gave them hope for their loved one.”

Eva McLellan:

“Disruptive technologies and artificial intelligence (AI) are transforming business models in all industries. Companies like Uber and Airbnb own no vehicles or real estate but are the world’s biggest market places in their respectively industries. This is where I think the next wave of innovation in healthcare is eventually headed. Imagine the largest hospital network that owns no hospitals. Imagine a doctor and patient interaction revolutionized using AI and machine learning. IBM’s Watson technology is already being used to help healthcare practitioners make treatment decisions, diagnosis disease, and understand compliance. In 2017, we will just begin to scratch the surface of this type of personalize care, but it’s starting to happen and the potential impact is game changing.”

What other 2016 events will impact the industry’s future?

MT: President Trump – the exact nature of that impact remains to be seen...

CM: I agree – the overall change in the political environment across many countries will have an effect on the pharma industry, but perhaps it will be positive for patients. For example, the current patient-care system in the US is run by insurance companies and pharmacy benefit managers. The many lines of the Affordable Care Act took a great deal of power from the patient and doctor and gave it to insurance companies – but most patients didn’t find out about this until something overwhelming happened to their health. The contracts that go on between drug manufacturers, insurance companies and pharmacies are blocking costs savings. Any decentralization of the insurance system will affect the overall pricing of drug products and open up better and further competition.

JT: I’ve noted a dampened enthusiasm for investment in the biopharma sector. The emphasis on orphan and ultra-orphan indications, although understandable in the current funding and regulatory climate, has slowed progress on more ambitious disease targets, which could have a detrimental effect on the industry in the long run.

EM: Political events have certainly drawn much attention in the industry, but we shouldn’t let them overshadow other trends.Personally, I think it’s been very interesting to watch investments increasing in health technology companies; for example, new oncology software players that focus on advanced analytics tools to make sense of big data. Moving from insights to impact by collecting real-world data and integrating healthcare networks for patient benefit could have a big impact on the industry.

What are you predictions for 2017?

MT: Repatriation of US company profits will fuel deal making, especially M&As. I expect to see many acquisitions in hot areas, such as oncology. However, the unpredictable nature of global markets will continue to surprise us. More specifically, because the biopharma industry is heavily reliant on the US market (its biggest profit pool), any move by Donald Trump and his team will be closely watched – and could lead to strong share price reactions in both directions.

In terms of research, what I like to call “New Biology” (complex cell and gene therapies; immuno-oncology; biomarker-driven stratification of patients to focus on specific disease sub-settings; convergence of big data and drug discovery; and other technological advances) will continue to create lots of data – both positive and negative – which will ultimately have the potential to transform biopharma innovation.

CM: I think that 2017 will be a year of hope. There are many clinical trials going on right now – over ninety thousand in the US alone. At the moment, I have two friends experiencing the havoc of being treated for cancer. The treatments they are being offered are difficult, but the prognosis is good. Not very long ago, either of their diagnoses would have been nothing short of a death sentence. With so much time and money being invested in new clinical trials, new medicines certainly lie on the horizon.

JT: I’m hopeful that early stage research funding will improve, as well as funding for early-stage companies. There is a lot of exciting research out there at the moment. In 2017, CRISPR technology will likely be one of the most promising developments in disease control and treatment. I’m also positive about a potential medication that finally proves to be effective for the treatment of Alzheimer’s disease. On the cancer front, 2017 will see an expansion of checkpoint inhibitors into different clinical settings, as well as more research as to how cancer cells modify or alter their metabolism to promote growth.

EM: I think we may see approval of the first CAR-T – there are a number companies hoping for the nod from the FDA, including Kite Pharma and Novartis. Meanwhile, CRISPR launched preliminary human trials in China in 2016 and are hoping to start in the US in 2017. In the diagnostic arena, personalized healthcare will be taken to the next level for cancer patients with companies like Foundation Medicine, established to focus on analysis and diagnostics. Companies that develop and commercialize genomic analysis/diagnostics for a variety of cancers will start playing a bigger role in physician decision support and more personalized treatments.

Regulatory Review

With Siu Ping Lam, Director, Licensing Division, UK Medicines and Healthcare products Regulatory Agency (MHRA).

Personally, I think 2016 has been a very exciting and busy year. A great number of new medicinal products have been authorized and the pharmaceutical industry is predicting that more new active substances are coming to fruition in 2017 and beyond. MHRA saw an increase in the authorization of medicinal products via the UK National route in 2016 in addition to the larger number of applications submitted via the usual Decentralized (DC) and Mutual Recognition (MR) procedures, which is interesting because it may suggest that the UK pharmaceutical market is becoming more attractive.

In particular, 2016 was a significant year for enabling earlier patient access to innovative medicines in areas of high unmet medical need. Within MHRA, the UK Early Access to Medicines scheme (EAMS) has now designated 24 products as “Promising Innovative Medicines”. Within the EU, an initiative to enable accelerated approval and early access to medicines was introduced by the EMA in 2016 – the Priority Medicines (PRIME) scheme. The scheme is based on enhanced regulatory interaction and early dialogue with developers of promising medicines. MHRA contributed significantly to the development of PRIME.

2016 success stories at the MHRA

- In 2016, the MHRA’s regulatory and scientific advice service provided a record number of 411 meetings, with our experts providing advice ranging from regulatory requirements to quality product development to non-clinical testing and clinical trial designs.

- The MHRA Innovation Office (IO) received 131 submissions. The IO was established to provide advice to help particular innovators, individual developers, academia and small and medium enterprises (SME) with regulatory processes and requirements for product development. Over 60 percent of queries were received from academic institutions and SMEs. A large number of queries related to innovative products or interesting concepts at the early development stage.

- The number of first-in-human clinical trials carried out in the UK is increasing. In 2016, MHRA assessed 58 first-in-human trials and 17 trials involving advanced therapy medicinal products (ATMPs). Our assessors have also taken a leading role in the update of the EMA ‘Guideline on strategies to identify and mitigate risks for first-in-human clinical trials with investigational medicinal products’ currently out for consultation.

2017 Resolutions

As a regulator, I see one of the priorities for MHRA in 2017 being to actively participate in process development and work collaboratively with stakeholders in the health system to implement the final government recommendations in response to the recently published report in the UK on Accelerated Access Review. Accelerated Access Review should enable patients to have earlier access to and benefit from innovative medicines, medical technologies, diagnostics and digital products for clinical need as the efficiency in the system – from product development to adoption – is further enhanced.

MHRA will continue to play a full and active role in European regulatory procedures in 2017. We will continue to contribute significantly in both the centralized and decentralized regulatory procedures, including new rapporteur and reference member state appointments, and to maintain the program for implementing the clinical trial regulation.

What should the industry prioritize in 2017?

MT: We need to continue to build truly collaborative models for R&D, enabling early partnering between large pharma, academia and biotech that bring out the best of each. We also need to develop better pricing models. Despite the sophistication of modern biopharma, pricing models sometimes still feel archaic. Finally, the industry needs to be better at explaining the value of innovation to prevent the public from viewing the industry as an enemy that only wants to maximize profits – in this regard, we need to remember that actions speak louder than words.

Siu Ping Lam’s Areas to Watch

- Growth in biosimilar products is expected as data exclusivity periods expire for big biologics.

- Immunotherapy is advancing rapidly. Of the 10 medicines in the MHRA’s Early Access to Medicines scheme, 9 were for cancer treatments in 2016.

- Significant research activities in dementia are gathering pace.

- Gene, cell and tissue therapies are maturing and gathering momentum. We should gradually see some of these therapies emerging from clinical trials to market.

- There is increasing clinical trial activity for the use of chimeric antigen receptor T cells (CAR-T) in oncology, which involves engineering T cells to recognize and attack tumors.

- Innovative medicines are being developed using gene editing techniques such as CRISPR and TALENS. One exciting development in this area is the development of a CAR-T cell therapy made from donor cells, offering the potential for future frozen, “off-the-shelf” T-cell based medicinal products.

- With more precision medicines being developed, we see companion diagnostics being a significant treatment tool. Recently authorized anticancer immunotherapies use companion diagnostics to detect specific genetic markers and thus select target patients for drug treatment for better outcome. In this regard, the imminent changes in the European Commission’s In Vitro Diagnostic Medical Devices Regulation will be very relevant in the future.

- New approaches to clinical trial designs are being adopted, particularly when cost, time and patient population are the limiting factors. We expect to see more clinical trial designs that make use of real world data, comparing the results of a cohort of patients taking the standard-of-care medicine as usual in a real world setting with those taking the drug on test.

CM: The industry needs to avoid the “status quo”. Pharma must tightly control the purity, quality and consistency of products of course, but sometimes the focus on this is so tight that innovation is stalled. Pharma and medical companies must take the time to innovate and adapt their products and services with emerging technologies. How can a new product be tied in with mobile technology? What can we do with drones? What can we do with robotics? What can we do with 3D printing? Can nanotechnology make an existing product more effective? What can we do to make cannabis-based active compounds available as an approved medical treatment? What dosing technologies can be used to make it easier for patients to comply with their treatment protocol?

JT: I agree with Markus – we need to better educate the public about the great benefit and overall value of medicines. For example, there have been plenty of news stories about the high price of Sovaldi for treating Hepatitis C, but what becomes lost in the discussion about price is the fact that Sovaldi has very high cure rates and a short dosing period for an otherwise intractable disease. I’d also like to see the industry renew some of its anti-bacterial research programs. I can imagine an industry-academic-government cooperative program to tackle the increasing issue of drug-resistant microorganisms.

EM: We need to push “patient centricity” beyond just being a buzzword – we need to turn it into an authentic reality. It begins by truly understanding patients’ needs, fears, wishes for themselves and their families, and the hurdles that complicate their journey. Patients are our most important stakeholder, and the companies that succeed in truly engaging their diverse and increasingly influential voices will succeed both ethically and commercially. The effort cannot be a project, initiative or priority du jour – we need to rethink who we are as an industry and truly put ourselves in the service of patients as opposed to regulators and payers. It won’t happen with “business as usual”; it will take relentless commitment, unprecedented partnership and sacrifice by all stakeholders. But if we begin 2017 with a genuine priority on patients, then transformation awaits.

Top Articles of 2016

What was hot on The Medicine Maker website during 2016?

These were the most-read articles on www.themedicinemaker.com:

The Beginning of the End of Quality by Design

By Jasmine (May 2016)

Where did Quality by Design come from? Where will it lead to in pharma? And will there be a day when its principles are so firmly entrenched that the concept no longer exists?

https://themedicinemaker.com/issues/0516/the-beginning-of-the-end-of-quality-by-design/

Bluff or Serious Biosimilar Bet

By Eva McLellan and Martyn Smith (October 2016)

To understand who is most likely to command the biosimilars game, McLellan and Smith examine the companies at the table, peak at their cards and imagine how they might play.

https://themedicinemaker.com/issues/0916/bluff-or-serious-biosimilar-bet/

The Great British Debate

By James Strachan (May 2016)

Before the surprise outcome of the UK’s referendum on its EU membership in June, The Medicine Maker’s Associate Editor asked what Brexit might mean for the global pharma industry.

https://themedicinemaker.com/issues/0516/the-great-british-debate/

A Tale of Irish Biopharma

By Barry Heavey (June 2016)

Biopharma in Ireland is booming today, but what are the origins of this success? And what further investment is IDA Ireland planning for the future?

https://themedicinemaker.com/issues/0616/a-tale-of-irish-biopharma/

The Bright Star of Open Innovation

By Niclas Nilsson (March 2016)

LEO Pharma tells the story behind its Open Innovation platform, which launched in 2015. This platform was also the winner of The Medicine Maker 2015 Innovation Awards.

https://themedicinemaker.com/issues/0316/the-bright-star-of-open-innovation/

Building a QbD Masterpiece with Six Sigma

By Jasmine (August 2016)

Many people struggle with Quality by Design and a common obstacle is getting stuck at Five Sigma. For some, Five Sigma is good enough, but there are a number of ways to finally reach Six Sigma.

https://themedicinemaker.com/issues/0716/building-a-qbd-masterpiece-with-six-sigma/

Beyond Keeping Up Appearances

By Charlotte Miller (April 2016)

The perfect drug and the right packaging to protect it – all is well until the medication reaches the patient, who then stores the tablets inappropriately. Can film coatings help better protect medicines?

https://themedicinemaker.com/issues/0416/beyond-keeping-up-appearances/

The Great American Debate

By James Strachan (September 2016)

Once again our Associate Editor delved into politics – this time looking at what the potential outcome of the US presidential elections might mean for the pharma industry.

https://themedicinemaker.com/issues/0816/the-great-american-debate/

The Cautious Comeback of Oral Peptides

By David J Brayden (September 2016)

After the clinical failure of oral peptide formulations in the 1990s, pharma took a step back, but today select oral peptides are yielding positive data in advanced clinical trials.

https://themedicinemaker.com/issues/0815/the-cautious-comeback-of-oral-peptides/

Pharma Manufacturing? There’s an App for That

By George Mashini (June 2016)

Mobile technology and apps have become a staple of the pharma industry in terms of disseminating information to patients, but much less is known about their impact on manufacturing.

https://themedicinemaker.com/issues/0616/pharma-manufacturing-theres-an-app-for-that/

Making great scientific magazines isn’t just about delivering knowledge and high quality content; it’s also about packaging these in the right words to ensure that someone is truly inspired by a topic. My passion is ensuring that our authors’ expertise is presented as a seamless and enjoyable reading experience, whether in print, in digital or on social media. I’ve spent fourteen years writing and editing features for scientific and manufacturing publications, and in making this content engaging and accessible without sacrificing its scientific integrity. There is nothing better than a magazine with great content that feels great to read.