Small Molecules, Sizable Market Opportunities

The small molecule drug development pipeline is booming! And with shrinking clinical trial cohorts (especially in oncology and orphan indications), smaller and virtual companies are now able to take candidates further than ever before.

Stephan Haitz | | Longer Read

Often, it feels that statements such as, “Although small molecules remain the largest portion of the pharma industry, they are on the decline, with large molecules and advanced medicines set to dominate in the coming years” are the prevailing narrative in the industry. But does it stand up to scrutiny?

Looking at market data, the number of small molecules being developed as drug candidates has increased over the past five years (see Table 1). The growing number of preclinical candidates coming into existence has boosted pipelines, and there are more phase I trials taking place than ever before, with more than 7,500 launched or entering development over the past five years. In addition, 520 potential drug compounds advanced from one clinical development phase to the next in 2018, suggesting that the industry is continuing to invest in small molecule drugs – particularly in areas such as oncology and orphan diseases.

Table 1: Small molecule New Chemical Entities (NCEs) pipeline 2014-2019 (data from Cambrex/Citeline).

Big opportunities for small companies

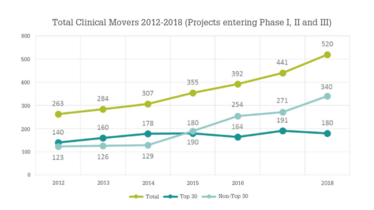

There is a growing trend for smaller and virtual companies to push projects further through the development pipeline than they typically would have in the past. For example, 65 percent of clinical pipeline projects are now sponsored by small companies (see Figure 1). Previously, the high costs of clinical trials meant that only the larger companies had the resources to support late-stage development, including final drug product approval. Now, with the clinical pipeline continuing to focus on smaller patient clinical trial cohorts requiring fewer resources, smaller and virtual companies have the resources to support late-phase trials. They may, in some cases, even be able to commercialize these assets.

Another positive sign of the health of the small molecule sector is the amount of venture capital funding available, which includes investment for the early-stage life science companies that are developing the majority of new chemical entities (NCEs). In fact, in 2018, experts estimated that more than $60 billion was raised in IPO funding, follow-on funding, private investment in public equity, as well as venture capital and funding from other sources. Of this, a record $20 billion was in the form of venture capital funding for start-ups and early-stage companies.

The large and growing small molecule API market (an estimated value of $25-35 billion in 2018) is also characterized by increased outsourcing, particularly by small and virtual pharmaceutical companies; despite the increased draw of biologics and cell-based therapies, the small molecule market remains an attractive business area for contract development and manufacturing organizations (CDMOs).

With the pharmaceutical industry currently focusing more on the quality of the drug product rather than on cost – as it had in the years since the turn of the century – drug companies are now returning to Western CDMOs for the manufacture of drug candidates and drug substances. These trends, as well as the industry’s growing and fast-moving clinical pipeline and the highest FDA approval rate since the 1990s, are the reasons for the considerable optimism now found throughout the drug development sector.

Figure 1: Total small molecule clinical movers 2012-2018 (data from Cambrex/Citeline).

Orphan drugs and the oncology scene

A total of 42 NCEs were approved in 2018, and 38 in 2019 – a considerable increase on the average of 25-35 NCE annual approvals seen in recent years. And looking at the broader commercial market (beyond approvals), consumption data for all small molecule prescription drugs in seven major markets (US, UK, France, Germany, Spain, Italy and Japan) shows a total volume of 3,500 metric tons with an annual growth of around 100-200 additional metric tons of API each year. This includes continued growth of the large, 100-ton-plus, high-prevalence-disease sector, as well as of the 10-20 ton range representing the more-targeted therapies, including orphan drugs.

Another recent trend is increasing investments by CDMOs in facilities for the manufacture of highly potent APIs (HPAPIs). The number of small molecule cancer treatments in development is a good indicator of the robustness of the HPAPI sector as a whole (most HPAPIs are being developed for the oncology sector). Overall, the small molecule oncology pipeline is growing well, now accounting for 38 percent of small molecule drug candidates in preclinical development, 35 percent of clinical-stage small molecules, and one third of recent FDA approvals. Revenue and volume data for the 252 oncology drugs on the market or in registration in 2019 shows a market value of almost $53 billion and a volume of 920 tons – significant compared with the typical commercial API volumes of around five tons per molecule.

CDMOs have reacted to these market trends by building in capacity on the assumption that all oncology drugs are highly potent with Operational Exposure Limits (OELs) in the 1-10 µg/m3 range. This is, therefore, an area of considerable interest for CDMOs given their expertise in handling such high-potency products and the current preference of the pharmaceutical industry for using Western suppliers.

In summary, small molecule drug development and manufacturing is not declining – on the contrary! We see more drugs at the clinical and preclinical stage than ever before, with record numbers of patients being prescribed small molecule drugs, for a wider range of conditions. Highly-potent products, especially in oncology and orphan indications, are particularly strong today. This is good news for the CDMO sector, which is benefiting from the demand for fully integrated services and experience with HPAPIs, and for small and virtual companies, which are able to take therapies further than ever before.