The Next Stop for Pharma Outsourcing

Increasing consumption and steady innovation will be key trends in the small molecule drug market. But what does this mean in terms of contract manufacturing?

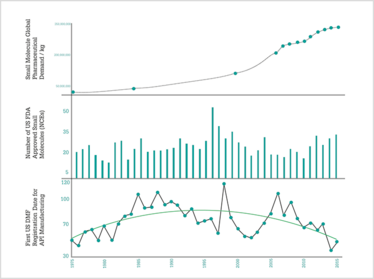

In the May issue of The Medicine Maker, I looked at how the field of contract manufacturing has evolved over the past 40 years (1). As a quick recap, my colleagues and I at Cambrex have been studying how contract manufacturing for small molecule drugs has changed since the 1970s (2). Our research showed that there have been four key phases to date: the early years (pre-1975 to 1980), the growth years (1980-1996), the competitive years (1996 to 2010), and the resurgent years (2010 to 2015). Our research was based not only on global API consumption data, the number of new drug approvals and the number of new entrants in the contract manufacturing organization (CMO) space, but also on expert views from leading figures working within the sector.

Reviewing the past is certainly very interesting, but the future is perhaps more important. What can we expect to happen in the lead up to 2020? Extrapolating from the research, I believe three key trends will shape the future of the CMO industry:

- Increasing consumption. It is well accepted in the industry that there is a tendency towards the manufacture of smaller volumes of API, but this will be offset by more people taking more medicines in the future. Growth in generics will also continue to drive consumption higher.

- Steady innovation. Despite the benefits of biopharmaceuticals, small molecules will remain the backbone of the pharmaceutical industry. Competing modalities will continue to surface, but approvals for small molecule drugs are expected to remain steady at 25-35 NCEs per year.

- Dynamic CMO space. As pharma companies continue to increase their small molecule outsourcing, the way CMOs do business will continue to evolve. There will be a further shake-out of under-performing CMOs, as well as sustained M&A activity as CMOs try to gain market share, move into early- and late-stage development, and gain access to new technologies.

Rickety tracks

All of the above trends appear to point towards a positive future for the CMO sector – and for pharma innovators who will be able to reap the benefits of strong contract manufacturing services. But the experts we spoke to warn that there could be risks for CMOs further along the tracks, as many pharma manufacturers may decide to move their outsourced operations back in house. Here are some intriguing comments from the experts we spoke to:

- “The first risk is that whilst western CMOs are enjoying a period of re-shoring and pharmaceutical companies have no obvious plans to explore eastern CMOs just yet, the discussion of building captive capacity, again, could become a real threat. As Cambrex research has shown, the typical volume requirement for a blockbuster product has migrated from the 100 metric ton (mt) range to the 1-10s range. Such a contemporary volume demand makes the prospect of building ‘mid-size’ internal capacity no longer a ridiculous or arcane idea.”

- “Another risk is that the lack of innovation undertaken in CMOs, largely at the request of large pharmaceutical customers who come with a well-developed tech package, has ultimately starved the CMO industry of some core differentiators. If pharmaceutical companies, with their new, ample in-house manufacturing, no longer look to CMOs solely as capacity-for-hire then there needs to be a compelling argument to continue to outsource.”

- “We have come full circle back to 1975, where a CMO existed only to offer a specialism based on a type of chemistry that the customer could not/would not want to do. By lacking that unique selling point, in this environment it will make the outsourcing argument in the customer’s decision-making process less and less compelling.”

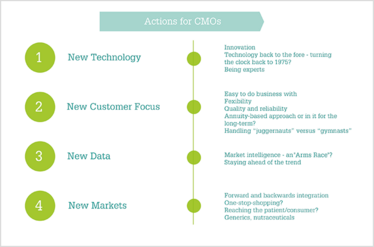

The CMO space is also changing; cost is no longer the historically critical factor that it once was. Instead, CMOs will need to decide if they are in the capacity game or the technology game – both of which have their merits. Capacity, for example, is often needed by pharma companies, but also has downsides. “If you are in the capacity game, the risk is that big pharma will use you as a ‘cheap date’, where they will use you when they need capacity – but drop you quickly as soon as they don’t,” said one industry expert. “To mitigate this, CMOs have started to ask for commitments up front. This is not seen as such a difficult thing for big pharma to honor, given that the cost of having idle capacity at the CMO (but for which you are paying a fee) is a lot less than the potential costs of not being able to supply the in-market demand.”

Being in the technology game can require significant investment and expertise, but can also help a CMO to differentiate itself, not only from its competitors, but also from big pharma internal manufacturing operations. “A CMO must continually strive to be working on the next technology, even in times when the order book is full and capacity utilization is high,” explained one expert. “The best CMOs are those that have adapted and moved with the industry – whether by adopting a specialty technology or moving into the next level of innovation, such as monoclonal antibodies, gene therapy, oligonucleotides, and so on.”

“Be an expert. There are a few CMOs who do all molecule/technology types, and then those who specialize in a single technology,” added another contact in the industry.

Relationship issues and data

For CMOs that want to be well prepared for the future market, relationships and data will be key. A CMO’s relationship with its customers has been important since the early days of contract manufacturing – and this will continue to be important in the future, but will become more challenging. A CMO needs to be of sufficient size to be able to offer a wide enough range of services, technologies and manufacturing capacities to satisfy customer demand, but not be so big that bureaucracy, inertia and inflexibility make it difficult to work with. Experts said:

- “Offering transparency and an open approach to the partnership builds trust. Also thinking about the whole journey rather than a particular half-year or quarterly period is important. For example, it is easy for a CMO to force a customer to adhere to a particular contract – but this is myopic if the relationship is based on a long-term approach – and an example of such is occurring in the biologics CMO industry. Customers have long memories in this industry.”

- “CMOs will have to become more flexible in their approach to making deals with customers. Whilst big pharma is traditionally very conservative and operates in the classical fee-for-service, with some shared accountability, other pharmaceutical companies are less rigid and require different business models from their CMOs. As a general rule, across the industry it is a perception that CMOs need to become more flexible and easier to work with – an example of which might be adopting a greater risk/reward profile.”

- “CMOs have to get used to working with both ‘juggernauts’ and ‘gymnasts’. Big Pharma applies this juggernaut approach and expects or demands preferential pricing models. Gymnasts (or specialty pharma) adopt a more partnership mentality, based on mutual sustainability and success.”

Experts spoken to as part of this research:

- Simon Edwards, VP, Global Sales & Marketing, Cambrex

- Kent Kent, Senior Director, Chemical Manufacturing, Gilead

- Paolo Russolo, President, Cambrex Milan

- Peter Lyford, Commodity Director, GlaxoSmithKline

- Carl Johansson, Global Director, Proprietary Products, Cambrex

- Dix Weaver, Consultant, Weavchem LLC

- Jan Ramakers, Consultant, FCCG

- Rob Miotke, Consultant, Advantage Pharma Solutions LLC

- Jim Miller, President, PharmSource

- Steven Cray, Director, Supplier Relationship Management, Shire

As for data, right now there is an “arms race” among CMOs to use market data and analysis – and with good reason, as being able to anticipate market trends is an effective way to react to the rapidly changing market. “The pace of change in today’s business environment – such as new markets and new technologies – is frantic. Things change so much more quickly nowadays than they did back in the 1980s!” said one expert.

Another added, “It is important to invest in market intelligence to ‘take a few bets’ on the next blockbuster products that are still at the early stage. Sitting and waiting for the next large-scale Phase III product is not a viable business model, and making a few early stage bets on pipeline molecules is hugely important – using the appropriate data.”

Figure 1. Trends in API consumption, New Chemical Entity approvals, and CMO entrants.

Figure 2. CMO actions to prepare for the coming years.

Further down the tracks

For CMOs looking to grow in the coming years, the most important strategic decision will be developing an approach to secure new markets. One obvious way to do this is to back-integrate further upstream into the production of intermediates, or to forward-integrate into making drug product – or even both.

“As more and more steps in a chemical synthesis come under the scrutiny of the regulatory authorities, there has been a trend to push back the regulated starting material to earlier in the process,” said one expert. “This has led to the need for more GMP manufacturing of intermediates.”

“By back-integrating into the value chain, the CMO will ensure it can not only fill capacity, but the large number of chemical steps performed in the same facility will also allow greater process improvement opportunities,”said another.

Similarly, by moving into the final product, the peaks and troughs of CMO capacity utilization can be smoothed out to some extent through the absorption of excess capacity for own product manufacturing. But tempting as it might be to adopt a one-stop-shop strategy, some experts suggested that this may not be the best solution because by trying to be everything to everybody, you run the risk of failing, which isn’t good for a CMO, its customers, or patients. Experts told us:

- “Though there is pressure for CMOs to acquire more competencies and move to formulation activity and vice versa, the preferred approach is to hold your hand up and say ‘we’re not specialists in everything, but what we focus on, we are experts in.’”

- “The one-stop-shop approach from API to formulation is not essential either. We do not attribute more value in the API and drug product being under the same roof.”

- “If there is someone who can do everything, then great – but no one has managed this yet.”

In summary, to take advantage of the favorable industry scenario of rising consumption, steady innovation and a dynamic outsourcing sector, CMOs will need to offer a technological edge, while at the same time remaining flexible. They must study trends to be in a position to adapt and move with the industry, and be big enough to stand out from the crowd, but not so big that they become difficult to work with. The next five years will present both risks and benefits, but it may well be that fortune really does favor the bold.

Matthew Moorcroft is Vice President at Cambrex, New Jersey, USA.

- M Moorcroft, “The Runaway Outsourcing Train,” The Medicine Maker, 30 (2017). Available at: bit.ly/2r4XERX.

- Cambrex, “A History of the API & Intermediates Contract Manufacturing Industry (1975 – 2015),” (2016). Available at: bit.ly/2qjjQe1. Last accessed May 15, 2017.

Matthew Moorcroft is Vice President at Cambrex, New Jersey, US.