Biopharma's Brave New Biology

We live in exciting times for the biopharma industry. The 100-year-old promise of cancer immunotherapy turning cancer into a chronic (if not curable) disease seems within reach in selected indications. Complex cellular and gene therapies are starting to deliver significant benefits to patients; we now have a well-tolerated cure for Hepatitis C virus; and more broadly, new players like Google are bringing a fresh approach to biopharma innovation, with big data fueling R&D and clinical decision-making.

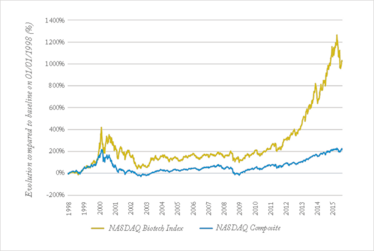

If we look at the market appreciation of the last three years (see Figure 1), it’s clear that biopharma has made a big comeback from a long period of relative depression. The industry climate has dramatically shifted; after years of dreary discussions concentrating on patent cliffs and poor R&D productivity, the focus today is more positive – leaning towards the technologies and drugs that can make a real difference to patients.

Figure 1. Compared relative evolution of the NASDAQ Composite and the NASDAQ Biotech Index. After the depression of the 2000s, market appreciation of biotech stocks has been climbing up to unprecedented heights since 2011, coinciding with promising scientific and medical advances on multiple fronts. The recent drop illustrates growing concerns regarding the sustainability of this trend, amidst an uncertain pricing and reimbursement climate (source: Yahoo Finance).

But at the same time there are concerns that this new trend will not live up to its promise – memories of the last bull market around the ‘genomics hype’ of 2000, which ended in a crash and a decade of depression and R&D productivity crisis for biopharma, come to mind. In addition, growing arguments around drug pricing and reimbursement have generated a general nervousness in the industry, especially when these concerns become a topic of political debate (biopharma share prices tumbled after Hillary Clinton tweeted a promise to tackle drug costs). With unprecedented clinical advances on one hand, and growing sustainability questions on the other, what is the outlook for biopharma? Can we believe that we will not once again fall into a ‘post-2000-style’ depression?

The path forward is certainly not clear. But unlike 2000, when immature science and the hype of genomics drove up valuations, today we are seeing new products and medicines that truly address unmet medical needs – in some cases, offering cures where there were previously none. Many of the developers of these products have turned into fully integrated biopharma powerhouses, such as Gilead, Celgene, Biogen and Regeneron, reaching a size and stability that was unthinkable back in 2000. Behind these products and companies lie exciting advances in applied science – which is becoming known as ‘The New Biology’. The following sections highlight a number of exciting advances.

Immuno-oncology keeping cancer in check

Immuno-oncology is starting to fulfill its promise of turning cancer into a chronic, if not curable condition. For instance, the arrival of treatments such as Bristol-Myers Squibb’s ipilimumab (Yervoy) in 2011, followed by nivolumab (Opdivo; also from BMS) and Merck’s pembrolizumab (Keytruda) in 2015, have dramatically improved the survival rate of certain subsets of patients with melanoma and non-small cell lung cancer, both of which are known for poor outcomes. The success of these immune checkpoint inhibitors is paving the way for an array of cancer therapies that harness similar mechanisms. Over 20 disease-relevant immune checkpoints have been identified and are currently being explored as therapeutic targets. Moving forward, combinations of different checkpoint therapeutics are expected to improve survival even more radically – and in a larger number of patients, as seen with the combination of ipilimumab and nivolumab in advanced melanoma.

However, the downside of harnessing the immune system is the risk of pushing it into overdrive, which can lead to serious autoimmune reactions. As a range of checkpoint therapeutics reach the clinic, combination regimens will have to be carefully designed and monitored to avoid excessive toxicities. But this revolution initiated by checkpoint inhibitors is now opening a window for a broader range of immunotherapies. Once an exciting field, cancer vaccines have been plagued by multiple failures in the clinic due to weak efficacy; in the near future, combinations with checkpoint inhibitors may be able to lift the brakes off the immune system and allow vaccines to finally deliver on their promise.

Overall, immuno-oncology is triggering an unprecedented seismic shift that is poised to far surpass the advances we have seen with the advent of targeted therapies. Reflecting this, analysts are forecasting the immune-oncology market to grow to over €20 billion by 2025.

The key to curing cancer: cell therapies

Another recent breakthrough in immuno-oncology is the advent of complex cell-based therapies, such as T-cells engineered with CARs (chimeric antigen receptors) and eTCRs (engineered T-Cell receptors) to selectively kill tumor cells. In early trials, treatment with CAR-Ts has produced previously unseen rates of clinical responses, including complete remissions (80-90 percent) in patients with acute lymphoblastic leukemia (ALL). And although outcomes in other hematological malignancies are less spectacular, they still remain extremely encouraging. We believe that the potential of CAR-Ts and eTCRs goes well beyond extending survival. In the not-too-distant future, they could perhaps provide a cure to a selection of patients with blood cancers. Solid tumors will be the next big field to tackle, although the limited clinical experience so far indicates that this will not be as straightforward as in leukemia, as the strong potency goes hand-in-hand with potentially harmful toxicities (the current mantra is “dose low, go slow”).

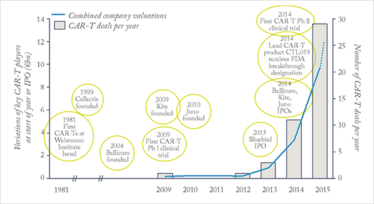

If successful, CAR-Ts and eTCRs would become, by far, the most radical innovation to hit the field of cancer therapy in decades. They are, however, less mature than checkpoint inhibitors – the most advanced products are only in Phase II, and we’re still far from having established CAR-T cures across multiple tumor types. But the field is moving extremely fast, and industry and investors alike have embraced it with great enthusiasm. This is reflected in the soaring number of CAR-T deals over the past few years, and the combined market capitalizations of the main biotechs focused on CAR-Ts, which are now reaching €12 billion (see figure 2).

Figure 2. Bars: number of deals (strategic alliances, licenses, or company acquisitions) involving CAR-Ts. The upward trend over the past three years reflects the soaring interest for the technology (source: Global Data). Line: combined market capitalizations of key companies focusing on CAR-Ts (Bellicum, Juno, Kite, Cellectis, Bluebird Bio) in € billion, at the start of each year or time of IPO. The dotted line represents these combined valuations, as of November 2015. (source: Yahoo Finance). Bubbles: key CAR-T events.

Gene therapy rising from the ashes

In the 1990s, gene therapy was touted as a breakthrough that would cure many hereditary diseases. Unfortunately, safety issues linked to immune reactions and vector integration into the genome, culminating in the death of a patient in 1999, led regulatory authorities and industry alike to reconsider the risk-benefit potential of gene therapy, and plunged the field into depression.

But there have been a number of encouraging success stories recently, with gene therapy correcting monogenic diseases in a handful of patients with blindness due to Leber’s congenital amaurosis (1), hemophilia B (2), X-linked severe combined immunodeficiency (X-SCID) (3), and other inherited immunodeficiencies (4). In parallel, the design of gene therapy products has improved in leaps and bounds, addressing many of the previous concerns with novel vectors that do not integrate into the host genome.

The improvements in design and clinical outcomes culminated in the (restricted) European approval of alipogene tiparvovec (Glybera) in November 2012, making it the first gene therapy to ever be approved for marketing in any of the major pharma markets. Despite the controversial clinical efficacy of Glybera and its restricted label, the approval sends a strong signal that the EMA is prepared to consider other gene therapy products for approval, despite a decade of extreme cautiousness.

Over a hundred clinical gene therapy candidates are moving through the pipeline, mostly for rare genetic diseases such as inherited retinal dystrophies or hemophilia. Although there is still much room for optimization of the technology (for example, to improve the durability of the therapeutic effect or to address questions of vector immunity), very promising early clinical data exists in several indications, and we are no doubt poised to see more gene therapy products in the spotlight over the coming decade.

Curing Hepatitis C

The past five years have seen radical advances in the field of Hepatitis C (HCV); for instance, the arrival in 2011 of the new antivirals boceprevir (Victrelis; Merck) and telaprevir (Incivek; Vertex Pharmaceuticals) resulted in impressive cure rates of 70 percent in combination with interferon-based standard of care. Three years later, Gilead introduced the once-daily oral treatments sofosbuvir (Sovaldi) and the combination sofosbuvir-ledipasvir (Harvoni), which removed the need for an interferon backbone. Harvoni has pushed the efficacy bar even higher to achieve sustained virological response in over 90 percent of patients with genotype 1 HCV after only 12 weeks of treatment, with a favorable side-effect profile. In other genotypes, Sovaldi and Harvoni have also greatly increased cure rates, in combination with the standard backbone of ribavirin and/or interferon.

This latest generation of therapies has effectively turned HCV from a chronic condition into a curable disease for the large majority of patients. On Gilead’s side, the HCV franchise is hugely successful, with sales forecasted to reach over €12 billion by 2020 – in part thanks to the high price tags for these therapies, which is another burning issue that we’ll address later in this article…

Moving beyond HCV, HIV now appears to be the next frontier in curing infectious disease, and two recent experimental approaches may bring us closer to this goal than ever. The first one is the “shock and kill” strategy, a drug regimen that uses a “shock agent” to reactivate latent HIV-infected CD4 T-cells, which are then recognized and eliminated by a “kill agent”, effectively suppressing latent HIV reservoirs. The second approach stems from the observation that people who are homozygous for a loss of function mutation in CCR5 (a cellular viral receptor) are resistant to HIV infection. Incidentally, in 2008, an HIV patient was cured after receiving a bone marrow transplant from a donor harboring such a mutation (the so-called “Berlin patient”) (5). In a recent study that used a gene editing technique, the CD4+ T-cells of HIV patients were edited ex vivo to render the CCR5 gene non-functional, and then transplanted back. Promising early results have been published, with several patients achieving long-term viral control without the need for antiviral therapy (6).

The power of gene editing

The ability to make precise, targeted modifications to the genome of in-vitro and in-vivo models in a reliable and efficient manner has long been a goal in biomedical research. Gene-editing techniques, such as zinc finger nucleases (ZFNs), have been successfully used to target genes in mammalian cells since the mid-2000s. However, in 2012, a new method came to the front stage and sparked a flurry of interest from the industry: the CRISPR-Cas9 system. CRISPR enables targeted genome manipulation in a highly efficient and versatile way. Unlike prior methods that relied on proteins to guide gene editing, CRISPR employs a short sequence of RNA. For any given gene, the process of generating the guiding RNA sequence, and editing the gene, resulting in a ready-to-use assay, can be completed in just two days.

Beyond bench research, gene editing also opens up the way to novel therapeutic approaches. Leading this wave is the ongoing HIV trial we mentioned earlier – in which ZFN editing is employed to knock-out the CCR5 gene in patients’ CD4+ T-cells ex vivo. Beyond ex vivo knock-outs, the long-term goal is to correct genes or insert new ones in vivo (that is to say, without prior extraction of the patient’s cells), which would open the door to cures for a much broader range of diseases than current ex vivo strategies allow. Of course, we are at least a decade away from seeing such approaches being broadly and reliably applied into patients, but the advent of novel, efficient technologies such as CRISPR is certainly broadening the field of possibilities.

Tapping into precision medicine

For a long time following the genomics hype, precision medicine (also known as personalized medicine), which data, was very much an unfulfilled promise. But today, that promise is coming to fruition as precision medicine is beginning to deliver real value to patients. In oncology, the genetic makeup of tumors is playing an increasingly important part in determining which treatment a patient will receive; patients with lung, breast, colorectal, skin and blood cancers routinely undergo molecular testing. Pushing it a step further, institutions like the Memorial Sloan Kettering Cancer Center (MSKCC; funded by Roche) and the US National Cancer Institute are running trials that match patients with drugs based on the mutations in their tumors, regardless of histology (so-called “basket studies”).

Taken together, these initiatives are slowly leading the way to a world in which, one day, each patient could receive an individualized, dose-tailored cocktail of drugs. However, we have only just begun to tap into the potential of precision medicine to improve patient care. Actors in and outside the healthcare industry have recognized this huge potential too, as we have seen with the rise of companies like the sequencing giant Illumina, as well as with strategic alliances between Foundation Medicine and pharma companies like Roche, Novartis and Johnson & Johnson, or the multiple investments of Google in healthcare to back big data companies like Foundation Medicine, Flatiron, DNAnexus, and Predilytics. Lastly, in January 2015, Barack Obama announced the Precision Medicine Initiative, with a $215-million initial investment, and a short-term focus on cancer, and a long-term goal of developing knowledge on a broad range of conditions.

Putting a price on innovation

Although the above advances of new biology show that we are well beyond the immature science that spurred the genomics hype of 2000, danger still lurks on biopharma’s horizon. The willingness and ability of healthcare systems to fund these novel therapies is a growing concern, particularly as the prices of newly approved drugs seem to reach record heights year after year; for example, the gene therapy Glybera was initially priced at €1.1 million, and Gilead’s HCV Harvoni treatment reached over €66,000 per treatment course in Germany, and $85,000 in the US.

In oncology, the progressive shift of treatment standards to novel-novel combinations or cell-based therapies will push prices to unprecedented levels – the newly approved combination of ipilimumab and nivolumab in metastatic melanoma is expected to cost over $250,000 for a year of treatment in the US (without accounting for rebates and patient access schemes), for an additional 4.2 months of progression-free survival over ipilimumab alone. As a result, the public is increasingly reluctant to accept new drug prices. The outcry over the price of Gilead’s HCV medicines, and the recent scandal over Turing Pharmaceuticals hiking the price of a toxoplasmosis drug by over 5000 percent, are perfect examples. And in the medical community, 118 oncologists recently expressed their concerns in Mayo Clinic’s medical journal and called for new pricing regulations (7).

The fact that the pushback against pricing comes at a time when real advances in new biology are being made represents a real crossroads for the biopharma industry. And many questions must be answered as we try to decide the best path forward. What are a few additional months of survival worth to cancer patients? What is a cure worth in a disease in which only a minority of patients will develop serious, expensive complications (as is the case of HCV)? How should gene therapy be priced, if it could potentially offer a cure after only one application? And importantly, can we find a balance where drug prices allow sustainable healthcare systems, but still support R&D and innovation?

In an ideal world, new drugs would generate cost savings (for instance, by reducing the number of hospitalizations), which would lead to a sustainable, balanced system of healthcare and innovation. Although companies sometimes claim such benefits, the savings have often been unrealistic or difficult to assess in practice.

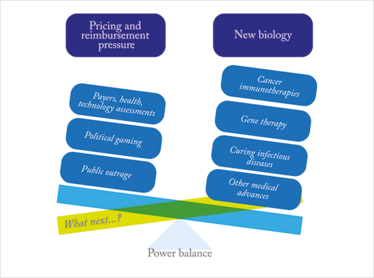

At the moment, the balance of power largely lies with the industry in that new therapeutics are brought to the market at prices that are set by drug makers (see Figure 3). This has long been the status quo, and rebates and other restrictions put in place by European and American payers have not managed to significantly counterbalance this trend. How will this evolve in the future? A likely scenario is that a pro-industry political climate and the lack of a strong, unified “payer power” will allow the status quo to remain (with prices largely unregulated) particularly in the US. In the medium term, this would be beneficial to the biopharma industry, which would stand to reap substantial benefits from the advances of new biology.

Figure 3. The power balance is tipping in favor of the biopharma industry, while payers and other actors in favor of tight pricing regulations have a limited impact.

Breaking the bubble

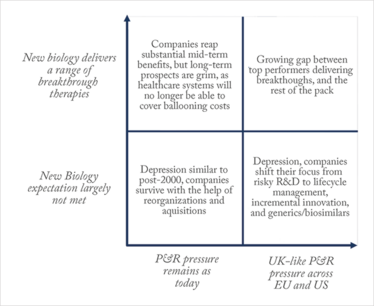

While the above may sound advantageous for the biopharma industry, in the long-term, the prospects are grim. What will happen to patients once healthcare systems can no longer afford the ballooning costs of new treatments? In a different scenario, under a more challenging political climate for the industry, both the US and EU would implement a tighter price regulating system – perhaps one comparable to the QALY (Quality-adjusted life year) framework used by the UK’s cost watchdog NICE. This system is designed to reward meaningful clinical benefits. Although the growth rate of the overall industry may be negatively impacted, there would still be ample room for success for the drug makers that can leverage new biology to bring real advances to patients.

We have put forward several arguments to show that we believe that the era of new biology is not a repeat of the 2000 genomics bubble, but there is the possibility that it will fail to deliver on its promises. Should this be the case, the growth rate of the industry will evidently suffer as companies scramble to pick up the pieces and move forward on to a new wave of innovation; but here again, the pricing environment will affect the extent to which they will be hit. If the status quo remains in place, most biopharma companies will likely manage to survive through the storm with a few new product launches and the help of reorganizations and acquisitions, akin to what happened during the depression of the 2000s.

But should the disappointment of new biology be accompanied by the implementation of tighter pricing systems in both the US and EU, many companies could find themselves in serious danger. We may end up in a situation where drug makers will shift their focus from risky, costly R&D to cheaper, more stable generics/biosimilar businesses, lifecycle management, and incremental innovation – which all comes at a great cost for innovation and, ultimately, patients’ health (see Figure 4).

Figure 4. Possible future scenarios for the biopharma industry based on pricing & reimbursement (P&R) environment and success of New Biology.

Forging a future path

In the light of these scenarios, where do biopharma companies – especially pharma giants – stand today with respect to these two drivers – new biology on the one hand, and pricing and reimbursement pressures on the other? On the pricing and reimbursement topic, companies have for a few years now been trying to integrate the needs of payers into clinical development, mainly by incorporating endpoints to measure the pharmaco-economic benefits of their drugs in order to make a more compelling case for reimbursement. For a handful of drugs, attempts to implement outcome-based pricing have also been made. Overall though, these efforts have encountered limited success, and the difficulty is made even greater by the heterogeneity of payers and their demands.

On the new biology side, we believe that the outlook is brighter. Big pharma companies have finally realized that size is the enemy of creativity and breakthrough innovation, and have built sophisticated externalization models to source the innovation brought about by new biology from those who do it best.

Ultimately, one thing is clear: companies will perform better and face much reduced pricing hurdles, if they are able to develop truly differentiated therapies that bring significant, meaningful improvements over existing drugs. Those that master these skills will find the right path ahead of the pack, whatever the future scenario may be.

Markus Thunecke is a founding Senior Partner of Catenion, a strategy-consulting firm focused on biopharma. Pauline Ceccato is an Associate at Catenion.

- J.W.B. Bainbridge et al., “Long-Term Effect of Gene Therapy on Leber’s Congenital Amaurosis,” N. Engl. J. Med., 372, 1887-1897 (2015).

- A.C. Nathwani et al., “Long-Term Safety and Efficacy of Factor IX Gene Therapy in Hemophilia B,” N. Engl. J. Med., 371, 1994-2004 (2014).

- S. Hacein-Bey Abina et al., “Efficacy of gene therapy for X-linked severe combined immunodeficiency,” N. Engl. J. Med., 363(4), 355-64 (2010).

- S. Hacein-Bey Abina et al., “An Emerging Era of Clinical Benefit From Gene Therapy,” JAMA, 313(15), 1550-1563 (2015).

- G. Hütter et al., “Long-Term Control of HIV by CCR5 Delta32/Delta32 Stem-Cell Transplantation,” N. Engl. J. Med., 360, 692-698 (2009).

- P. Tebas et al., “Gene Editing of CCR5 in Autologous CD4 T Cells of Persons Infected with HIV,” N. Engl. J. Med., 370:901-910 (2014).

- A. Tefferi et al., “In support of a patient-driven initiative and petition to lower the high price of cancer drugs,” Mayo Clin. Proc., 90, 996-1000 (2015).