Unprecedented Growth – and Challenges

Gene therapy is a rapidly-growing area in healthcare but, now the promise has been shown, we must focus on improving the manufacturing process and bring down costs

Philip W. Wills | | Opinion

Since the first market approvals of gene therapy products in 2017, growth in the sector has accelerated. There is now an abundance of gene therapy-related activity, a clinical pipeline in a high growth phase, and an influx of venture capital funding for gene therapy companies. Frost & Sullivan recently reported that, “There are more than 400 cell and gene therapies in preclinical to phase 3 development” (1). In 2018, there was a 27 percent year-on-year increase in the number of clinical trials involving gene therapies, and the FDA’s Commissioner of Food and Drugs predicted that by 2020 the agency will be receiving more than 200 investigational new drug applications per year, and approving 10 to 20 cell and gene therapy products every year by 2025 (2). The regulatory landscape for gene therapy products is not all that different from standard biologics, with the exception that they mostly target rare, orphan diseases. The FDA has proven to be very collaborative for products with this focus, and often designates products for priority review and accelerated approval because of unmet needs.

The growth in the field has naturally led to a dramatic increase in demand for viral vector manufacturing. A number of companies have risen to meet this need, offering access to experts and assets for the development and manufacturing of products. Because of the relatively low volumes required to fulfil demand, outsourcing the manufacturing and downstream processing stages has become a common strategy for innovators rather than spending time and money building a dedicated in-house facility. As gene therapy is a new and relatively undefined means of treatment, compared with other therapeutic modalities, chemistry, manufacture and control activities are “gating factors.” There are challenges with dosing, undefined analytics, and unanswered questions about long-term traceability, which all contribute to the gene therapy regulatory landscape. Trying to build expertise to cover all these bases from scratch can prove very challenging.

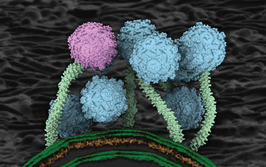

Of the viral vector types open to gene therapy innovators, adeno-associated virus (AAV) vectors have proven to be a safe vehicle for getting genetic material into cells. AAV genetic material does not incorporate into the host genome, and maintains long-term expression (10 – 30 years) due to its episomal nature. Though its manufacturing is rather complex and challenging (compared with traditional monoclonal antibodies) – scalability challenges and non-standard expression systems being just two of the complications – it is still simpler than many other viral vector types and produces higher yields. AAV manufacturing also allows for sterile filtration so a fully closed process is not required, which increases the safety profile and decreases manufacturing complexities. Additionally, AAV has multiple serotypes, and both wild type and engineered serotypes have been successfully used as vectors with a preference for the tissue type being targeted.

It looks as though AAV will continue to dominate the market, as other vectors, such as traditional adenovirus or lentivirus, have not shown as much promise. Critically, however, the field will need to evolve; reaching higher production yields is currently the major challenge associated with manufacturing. Consumables and raw materials used in manufacturing currently make up a high percentage of the cost of gene therapy production, so decreasing these is pivotal. When monoclonal antibodies were in their infancy, there was a point in the development at which yields suddenly increased logarithmically; with viral vectors, we are already seeing incremental improvements, but it feels like a similar step-change increase is some way off. Right now, even a 30 percent increase in yield is counter-balanced with 30 percent increase in demand.

Overall, the cost of gene therapies remains high for two main reasons: one, they are curative; and two, the cost must compensate companies for development and manufacturing costs. With such a high cost of goods, bringing down the price of the final treatment is a huge challenge facing the industry. But as processes and platforms are optimized with new disruptive technologies (including more stable producing cell lines over today’s plasmids), manufacturing costs will be reduced, which will allow the gene therapies of the future to be even more widely embraced.